What is a W-4 Form? How to Fill it Out & 2024 Changes

Do you need to complete a new W-4? Learn what updates have been made to the form and how to navigate the new design.

February 2nd, 2024

Are you aware of the latest updates to the W-4 Form? This blog post breaks down everything you need to know about the most recent W-4: what it is, what changes were made in 2024, when it’s used, and how to fill out each line. We'll also review all essential regulations surrounding this critical document and identify best practices regarding its use in your workplace.

Read our full HR Compliance Guide to learn more.

What is a W-4 Form?

Form W-4, also known as the Employee's Withholding Allowance Certificate or Employee's Withholding Certificate, calculates federal tax withholdings from an employee's paycheck. This calculation is based on the employee's data, such as filing status and family size. Due to the variable nature of this data, the withholding total can vary from year to year. Therefore, employees are encouraged to update their forms annually.

The Wage and Tax Statement, or W-2, is combined with the W-4. Calculations provided by the W-4 are placed alongside the employee's annual earnings to generate the W-2.

Download The Ultimate New Hire Paperwork Checklist

Who is required to complete a W-4 form?

The list of employees required to complete a W-4 form is relatively simple. It includes:

New Hires

All new hires must submit a W-4 when they start working to help you determine how much tax to withhold from their paychecks. If an employee doesn't submit a W-4 form, you must withhold taxes based on their status as a single person claiming zero dependents, which will likely result in a higher tax withholding than their actual liability. Employees should complete and update their forms annually to avoid this 'default' scenario.

Employees who experienced significant life changes

Existing employees who experience significant life changes need to fill out a new W-4, as well. These changes include

Getting married

Getting divorced

Having a child

Changing jobs

When an employee reports one of these changes, you should ask them to fill out a new W-4 form, so you can update their tax withholding appropriately.

Employees who want to adjust tax withholdings

Some employees may adjust their tax withholding. This could be because:

They're earning more than expected from non-wage income.

They received a large tax refund or had to pay more than expected.

They plan on making a major purchase, like a new home.

These employees can change their withholding by submitting a new W-4 that reflects their current situation.

It's worth taking the time to ensure that your staff understands what the W-4 form is and why it's essential to fill it out correctly. Many people may not know that their tax withholding affects their take-home pay or that they need to update their W-4 when their circumstances change. Educating employees can help you eliminate errors in the W-4 process, which can save you time and potentially avoid compliance issues.

How to fill out a W-4 form for 2024

The 2024 W-4 tax form consists of five employee sections. Employees only need to complete sections one and five. Section 6 must be filled out by the employer.

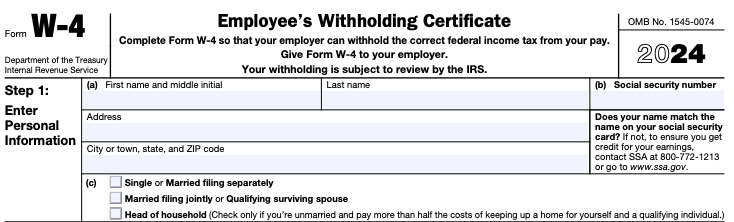

Step 1: Enter Personal Information

Employees must enter all required personal data, such as name, address, and filing status.

Step 2: Multiple Jobs or Spouse Works

Employees must enter information about additional jobs relevant to their taxes. The new form gives employees three methods of entering this data.

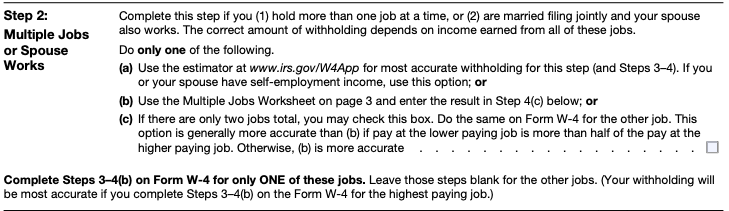

Step 3: Claim Dependent and Other Credits

Employees must earn less than $200,000 ($400,000 if filing jointly) to claim a dependent. Each eligible child is recorded at $2,000, and non-child dependents are recorded at $500.

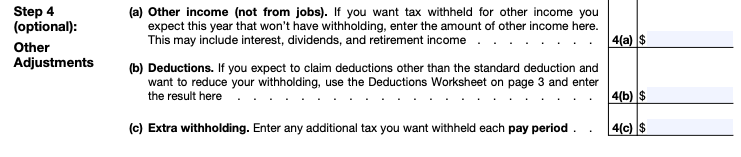

Step 4: Other Adjustments (optional)

Self-employment income, other standard deductions, and extra withholdings for each pay period can be entered in section 4, if applicable. If an employee claims exemption from withholding, they must write 'exempt' in this section.

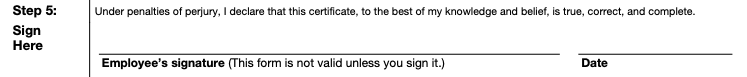

Step 5: Sign and Date

The employee must sign and date the form. Hey, that wasn't so tough, was it?

Step 6: Employer Information

You, the employer, are responsible for adding your organization's name and employer identification number (EIN) to the Employers Only section of the document.

Recent W-4 updates

2024 W-4 updates

2024 saw these minor updates to the W-4 form:

The form references a new tax withholding estimator for individuals (and their spouses) who have self-employment income.

The IRS updated the amounts for the 2024 Deductions Worksheet.

You can find the most updated version of the W-4 on the IRS website.

Previous W-4 changes

The IRS made minor changes to the 2023 W-4 form:

The form removed references to the tax withholding estimator.

The IRS provided additional information to clarify who should use the checkbox for multiple jobs.

The 2023 Deductions Worksheet was updated.

There are fewer lines to complete on the form, and there is no option to lower withholding by using personal allowances.

Current employees with a valid W-4 on file are not required to complete a new form simply due to the redesign, but employers should make their teams aware of the changes. The data on the existing W-4 can be used to calculate withholdings if the employee doesn't need to update their filing status or adjustments.

The employee must complete the most recent version if a new form is required. You should also know document retention requirements for W-4s and other essential forms.

2020 W-4 changes

The Content

The 2017 Tax Cuts and Jobs Act reshaped W-4 calculations, which led to a huge update to the 2020 version of the W-4 that removed withholding allowances. Changes to child credits, deduction limits, and income brackets can impact how much an employer can withhold and the type of adjustments an employee can claim.

No personal exemption – One of the most significant changes affecting the W-4 is eliminating the personal and dependency exemption. The IRS removed this option from the form completely.

Updated child tax credit – The maximum child tax credit and the threshold to claim the credit were increased. For example, a single filer can claim the tax credit if they earn less than $200,000 instead of the $71,201 required in 2019.

New dependent tax credit – Employees can now claim $500 for each eligible dependent that is not a child.

The Design

In addition to the changes in content, the new Form W-4 underwent a complete redesign. The form is now composed of five sections. Each section consists of straightforward questions regarding the employee's income, deductions, adjustments, and credits.

Instead of entering numbered withholding allowances, employees must enter dollar amounts for each adjustment. For example, in the 2019 form, eligible employees had to enter four to claim a tax credit for one child. But, in the 2020 form, eligible employees must enter $2,000 for each child. All entries on the new form about adjustments must be entered in dollar amounts.

What are some common Form W-4 mistakes?

A W-4 form is invalid if it includes unauthorized changes or false data. You can avoid the following mistakes by reading all available instructions and entering the most up-to-date information.

Completing another applicant's form – It is illegal for employers to complete a W-4 on behalf of the employee.

Completing unnecessary sections of the form – Only sections one (personal information) and five (employee signature) are required. Only employees claiming dependents, secondary jobs, or additional adjustments must complete sections two to four.

Accepting an invalid form – Employers must ensure that the document received was not illegally modified. If an employee has edited the language or structure of the form, an employer has the right to reject it.

Not reminding employees when a new form is required – Employers must remind employees to update their W-4s before December 1 of each year.

Giving unsolicited advice to employees – Employers cannot advise or tell employees to enter specific information. Instead, they can direct employees to the instructions on the form, IRS troubleshooting tools, and available worksheets.

What variations exist in states' withholding requirements?

Employees are typically required to pay both state and federal income tax. As a result, two W-4 forms may be necessary to calculate accurate withholdings. In some cases, states use the federal W-4 form as a guide for their system. Therefore, recent changes to the 2020 form may impact state documents.

For example, states that use the federal form to calculate state taxes may need to update their processes to accommodate law changes. Colorado, Delaware, Idaho, Nebraska, New Mexico, North Dakota, Oregon, South Carolina, Utah, and Wisconsin have announced that they have or will be rolling out new state-specific W-4 forms to reflect the updated tax laws and federal design.

It's worth noting that Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming don't levy a state income tax. Therefore, the updates made to the federal form will not affect state-specific W-4 requirements.

What are the repercussions of incorrect filing?

Incorrect W-4 calculations can result in tax discrepancies. If an employee underestimates federal tax withholdings, they may face surprise bills when filing tax returns. These discrepancies not only deliver severe financial setbacks but can also come with steep penalties. The following two actions can result in fines or prison time.

Underreporting Estimates – Employees may face a penalty of $500 if they underestimate their federal tax withholdings when filing tax returns. The fine is waived if the employee owes less than $1,000 in federal taxes after all current withholdings have been assessed.

Entering False Data – A criminal penalty may apply if an employee willfully enters false information or fails to submit details that would increase withholdings. Employees can face a $1,000 fine or up to one year in prison if convicted.

Employers are only required to calculate withholdings based on the data supplied by the employee and are not required to verify the information.

2024 Form W-4 FAQs

-

Form W-4 is an Employee's Withholding Certificate that calculates federal tax withholdings from an employee's paycheck. It is based on the employee's data such as filing status and family size, which can vary from year to year. It is combined with the Wage and Tax Statement, or W-2, to generate the employee's annual earnings.

-

The W-4 form is only applicable to employed individuals who earn a wage or salary. A new form is typically required when a new employee is hired, an employee experiences a relevant life event, or an employee applies for an exemption.

-

The current W-4 form consists of five sections. Employees only need to complete sections one and five and all other sections that apply to them. The employee must provide personal details, information about multiple jobs and spousal income, dependents' information, other adjustments, and sign and date the form. The employer must add the organization's name and employer identification number (EIN) to the Employers Only section of the document.

-

The IRS has made minor changes to the 2024 W-4 form, including adding a new tax withholding estimator and updating the 2024 Deductions Worksheet.

-

In 2020, the Form W-4 underwent significant content and design revisions due to the 2017 Tax Cuts and Jobs Act, which reshaped W-4 calculations. The personal exemption was eliminated, and the child tax credit and threshold to claim the credit were increased. The new form consists of five sections, and employees must enter dollar amounts for each adjustment rather than numbered withholding allowances.

-

Employees should update their W-4 form annually or when they experience a relevant life event such as getting married or having children. Failure to update the form may result in the employee being treated as a single filer with no adjustments, increasing their withholdings.

-

If a new W-4 form is required but not completed, the employee must be treated as a single filer with no adjustments. This often increases an employee's withholdings to ensure enough federal tax is collected throughout the year.

-

Employers are responsible for providing the W-4 form to employees and ensuring accurate withholdings. Employers must also add their organization's name and employer identification number (EIN) to the Employers Only section of the W-4 document.

-

If the IRS believes that an employee has underestimated his or her withholdings, they will send a lock-in-letter to the employer. Once received, the employer must follow the instructions outlined in the letter and withhold the amount based on the updated calculations. Employers must disregard previous W-4 forms and honor the calculations provided by the IRS.

-

An employer can reject a form if the employee has revealed to them that the data is false. If the form contains information that the employer believes to be false, he or she cannot reject it. But, if the form has been illegally altered, the employer can request a new copy.

-

No. The employee must complete their own W-4.

-

Although the form W-4 doesn't compute self-employment tax, it does consider secondary jobs that don't withhold federal income tax. Information from the second job is used with the employee's main job to calculate appropriate withholding.

-

An individual may claim exemption from withhholding if they paid no federal income tax in the previous year and exepct to have no income tax liability in the current year due to their income being below the filing threshold.

-

Some of the most common life events that result in a change in the amount of taxes a person pays include buying a home, marriage or divorce, the birth or adoption of a child, getting a second job, a spouse getting a new or second job, or being unemployed for part of the year. If any of these events happen, an individual should revisit their W-4.

Updated 2/2/2024

Subscribe to Beyond The Desk to get insights, important dates, and a healthy dose of HR fun straight to your inbox.

Subscribe hereRecommended Posts

2024 Employee Onboarding Checklist [3 Easy Phases]

Blog Articles

The State of Health & Safety In HR Report

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![2024 Employee Onboarding Checklist [3 Easy Phases]](/img/containers/assets/goco/featured_images/posts/new-hire-checklist.png/6fc8dd34ae3228988b533b18c7cbc95c.png)

![How To Build a Business Case For HR Software [Free Calculator]](/img/containers/assets/goco/featured_images/posts/build-business-case-for-hr-software.png/523e57aedee519da6f963895c12ba0e0.png)