Complete 2024 HR Compliance Calendar and Important Deadlines [+Download]

Key dates and deadlines for HR compliance, from payroll to benefits and beyond

November 6th, 2023

2024 is here – and for HR, this means a new year of challenges like employee retention, hybrid engagement, and upskilling the workforce. On top of all this, HR must juggle ever-changing employment, payroll, document retention, and benefits compliance requirements.

Download the 2024 HR Compliance Calendar

One of the most important things on your to-do list should be ensuring that your HR department is up-to-date on all the latest compliance regulations. To help you out, we’ve put together the only compliance calendar you’ll need in 2024 so you can tackle HR compliance reporting with ease. This calendar includes all of the important deadlines you need to be aware of, as well as a few helpful tips to make sure your HR department is always compliant. Check out our compliance guide to learn about more HR compliance issues.

January 2024 HR Compliance Deadlines

January 31st - Distribute W-2s and 1099-MISC (Paper & E-File)

W-2 (Wage and Tax Statements) Forms: Must be distributed to each employee in order to report employees’ annual wages and the amount of taxes withheld from their paychecks.

Form 1099-MISC: Indicates the amount of taxes withheld from paychecks for freelancers and contractors (non-payroll workers).

January 31st - Quarterly Forms 941 & 720 due

IRS Form 941: Reports income taxes, Social Security taxes, and Medicare taxes withheld from employee paychecks.

IRS Form 720: If you own a business in goods and services that are subject to excise tax, you must prepare this form.

January 31st - Distribute 1095-B & 1095-C Forms to employees

IRS Form 1095-B: Reports the type of health insurance coverage employees have, dependents that are covered by the policy, and the period of coverage for the prior year -- used to verify that employees and dependents have minimum qualifying coverage.

IRS Form 1095-C: The Affordable Care Act requires some employers to offer health insurance coverage to full-time employees and dependents. This form serves as an annual statement employers should send to employees eligible for coverage and describe the insurance available.

January 31st - Annual Form 940 due (If quarterly FUTA taxes were not paid when due)

IRS Form 940: Report annual FUTA (Federal Unemployment Tax Act) tax.

January 31st - Form 1099-NEC to both the IRS and to recipients

IRS Form 1099-NEC: Report non-employee compensation on Form 1099-NEC instead of Form 1099-MISC (beginning with the 2020 tax year).

January 31st - Due Date for Form 1099-MISC with only boxes 8 & 10 to be sent to the recipient

February 2024 HR Compliance Deadlines

February 1st - Post OSHA Form 300A

OSHA Form 300A: Employer record of all reportable injuries and illnesses that occur in the workplace, the location and time in which they occurred, and additional details. OSHA requires most employers with 10 or more full-time employees to keep an annual log.

February 10th - Annual Form 940 Due (If quarterly FUTA taxes were paid when due)

February 28th - Deadline to file ACA Forms 1094-C, 1095-C, 1099-MISC without NEC to IRS (If paper filing)

February 28th - Form 8809 Paper Filing Deadline

IRS Form 8809: Request an extension of the due date to file federal tax forms, including the W-2, W-2G, 1042-S, and 1094-C.

February 29th - Creditable Coverage Disclosure to CMS (for calendar year plans)

Entities that provide prescription drug coverage for self-administered drugs to Medicare Part D eligible individuals must report to CMS whether the coverage is “creditable prescription drug coverage.” The disclosure is required regardless of whether the entity’s coverage is primary or secondary to Medicare.

March 2024 HR Compliance Deadlines

March 1st - HIPAA Breach Employee Notification

The HIPAA Breach Notification rule requires HIPAA-covered entities and their business associates to provide notification after a breach of unsecured protected health information. Notifications must be submitted to the Secretary.

March 1st - Form M-1 Filing Deadline

Form M-1: Report information regarding a multiple employer welfare arrangement (MEWA) and any entity claiming exception (ECE).

March 2nd - Electronically submit OSHA Form 300A

March 15th - Form 8809 E-filing deadline

March 15th - S Corp (Form 1120-S) and Partnership (Form 1065) Tax Returns due

Form 1120-S: U.S. Income Tax Return for an S Corporation, used to report the income, losses, and dividends of S corp shareholders.

Form 1065: U.S. Return of Partnership Income, used to declare profits, losses, deductions, and credits of a business partnership.

March 15th - Form 2553 due

Form 2553: Must be filed for a company to qualify as an S corporation.

March 31st - Form 1099-MISC due if reporting NEC in box 7

March 31st - Deadline to file Form 1099s electronically

April 2024 HR Compliance Deadlines

April 1st - Deadline to file Form 1094-C & 1095-C & 1099-MISC without NEC to IRS electronically

April 15th - Tax Day (filing deadline for personal tax returns & C corporations)

Tax Day: Day on which income tax returns are due to be submitted to the federal government.

April 15th - Forms 7004 and 8928 Filing Deadline

IRS Form 7004: Request an automatic six-month extension of time to file certain business income tax, information, and other returns.

IRS Form 8928: Employer self-report COBRA administration compliance failures.

April 28th - Summary Plan Description (SPD)

SPD: Documentation employers must give employees in retirement plans or health benefit plans covered by the Employee Retirement Income Security Act of 1974 (ERISA).

April 30th - Quarterly Form 941 & 720 due

May 2024 HR Compliance Deadlines

May 15th - Non-Profit Tax Returns due, including Form 990

IRS Form 990: Report activities annually for organizations exempt from income tax.

June 2024 HR Compliance Deadlines

No key compliance dates

July 2024 HR Compliance Deadlines

July 31st - Quarterly Form 941 & 720 due

July 31st - Forms 5500 and 5558 Filing Deadline (for calendar year plans)

IRS Form 5500: Report information about a 401(k) plan’s financial condition, investments and operation to ensure compliance with government regulations.

IRS Form 5558: Request for extension of 2 ½ months for additional time to file employee plan returns.

July 31st - Compliance check

This is time to review benefits notices, or issued as required.

August 2024 HR Compliance Deadlines

No key compliance dates

September 2024 HR Compliance Deadlines

September 29th - SAR Furnish to covered participants for calendar year plans deadline

Summary Annual Report (SAR): Summarize for employees information that appears in an ERISA plan’s Form 5500. Admin must furnish SARs within nine months after the end of the plan year.

October 2024 HR Compliance Deadlines

October 3rd - QSEHRA Notice Deadline (for QSEHRAs that begin January 1, 2024)

Qualified Small Employer Health Reimbursement Arrangement (QSEHRA): health cost reimbursement plan that can be offered by SMB employers.

For QSEHRAs that do not begin on January 1, businesses must send the notice at least 90 days before the start of each calendar year in which they’ll offer the benefit.

October 3rd - RDS Application Due to CMS (for plan years beginning in January 1, 2024)

Retiree Drug Subsidy (RDS): One of several options available under Medicare that helps employers continue to assist Medicare-eligible retirees in obtaining more generous drug coverage.

For plans that do not begin on January 1, businesses must send the notice at least 90 days before the start of each calendar year in which they’ll offer the benefit.

October 15th - Medicare Part D Notice of Creditable Coverage delivered to plan participants

October 31st - Quarterly Form 941 & 720 due

November 2024 HR Compliance Deadlines

November 1st - Remind employees to submit FSA Receipts before end of year

If employees incur covered expenses in their Flexible Spending Account plan year, they’ll be able to submit these for reimbursement. Send them a reminder to submit any receipts and supporting documentation as the year-end deadline approaches.

December 2024 HR Compliance Deadlines

December 29th - Nondiscrimination testing, 401K plans, 125 Premium Only Plans (POP), and flexible spending account (FSA) nondiscrimination testing (if on calendar plan year)

December 29th - Review employee handbooks, distribute 2024 calendar

As a general rule of thumb, December is a great time to review annual documents to be sent to employees, like handbooks and updated workplace policies, and distribute the holiday calendar for the next year.

Other Compliance Considerations for HR Departments

Schedule Employee Safety Training

Employee safety training is an important part of compliance. Depending on the type of business you have, there may be specific health and safety training requirements that apply to your employees. For example, if you have employees who work with hazardous materials, they will need to receive specific safety training. Review your training requirements and create a plan to ensure all employees receive the necessary training before the deadline.

Conduct an Annual Compliance Audit

An annual audit is a good way to catch any potential compliance issues before they become problems. Schedule an audit of your HR department for late summer or early fall so you have plenty of time to correct any issues that are discovered before the end of the year.

Make an End of Year Checklist

As the year comes to a close, there are a few things you should do to wrap up loose ends and prepare for January of the new year. First, review all of the compliance deadlines that were due throughout the year and make sure they were all met. Next, conduct a self-audit of your HR department to identify any areas that need improvement. Finally, update your policies and procedures for the new year so you're ready to hit the ground running in 2024!

Conclusion

Though HR professionals will inevitably tackle unpredictable challenges this year, HR compliance is one of the few tasks they have full control over. Using our comprehensive compliance calendar as a guideline can help HR pros stay on top of important deadlines and support compliance in a range of different HR functions.

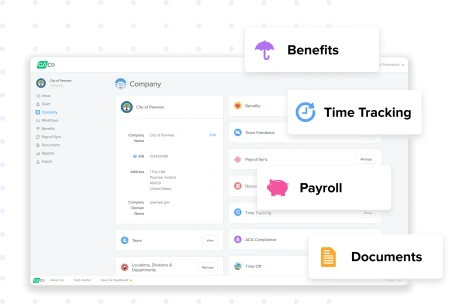

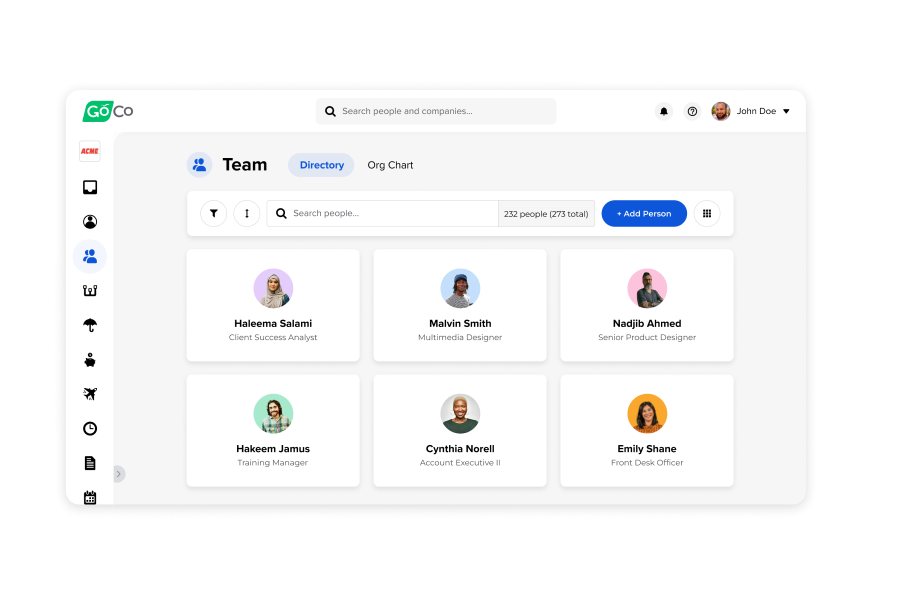

Ready to see how GoCo can help you level up your HR compliance and much more? Take a free tour today!

Subscribe to Beyond The Desk to get insights, important dates, and a healthy dose of HR fun straight to your inbox.

Subscribe hereRecommended Posts

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![Complete 2024 HR Compliance Calendar and Important Deadlines [+Download]](/img/containers/assets/goco/featured_images/posts/2024compliancecalendar-2.png/97aae4a56a92269ef17610e7753ace42.webp)

![How To Build a Business Case For HR Software [Free Calculator]](/img/containers/assets/goco/featured_images/posts/build-business-case-for-hr-software.png/523e57aedee519da6f963895c12ba0e0.png)

![How to Write Job Postings That Get Great Candidates in 2024 [+Template]](/img/containers/assets/goco/featured_images/posts/how-to-write-job-posting.png/f7e6aa15847d2324dbf2282a887f4808.png)