Benefits Administration Software

Simple and Intuitive Benefits Administration

Upgrade your company benefits administration with industry-leading technology for effortless enrollment experiences and easy management. Put your mind at ease by automating your benefits process. Bring your own broker or let GoCo pair you with one of our trusted partners.

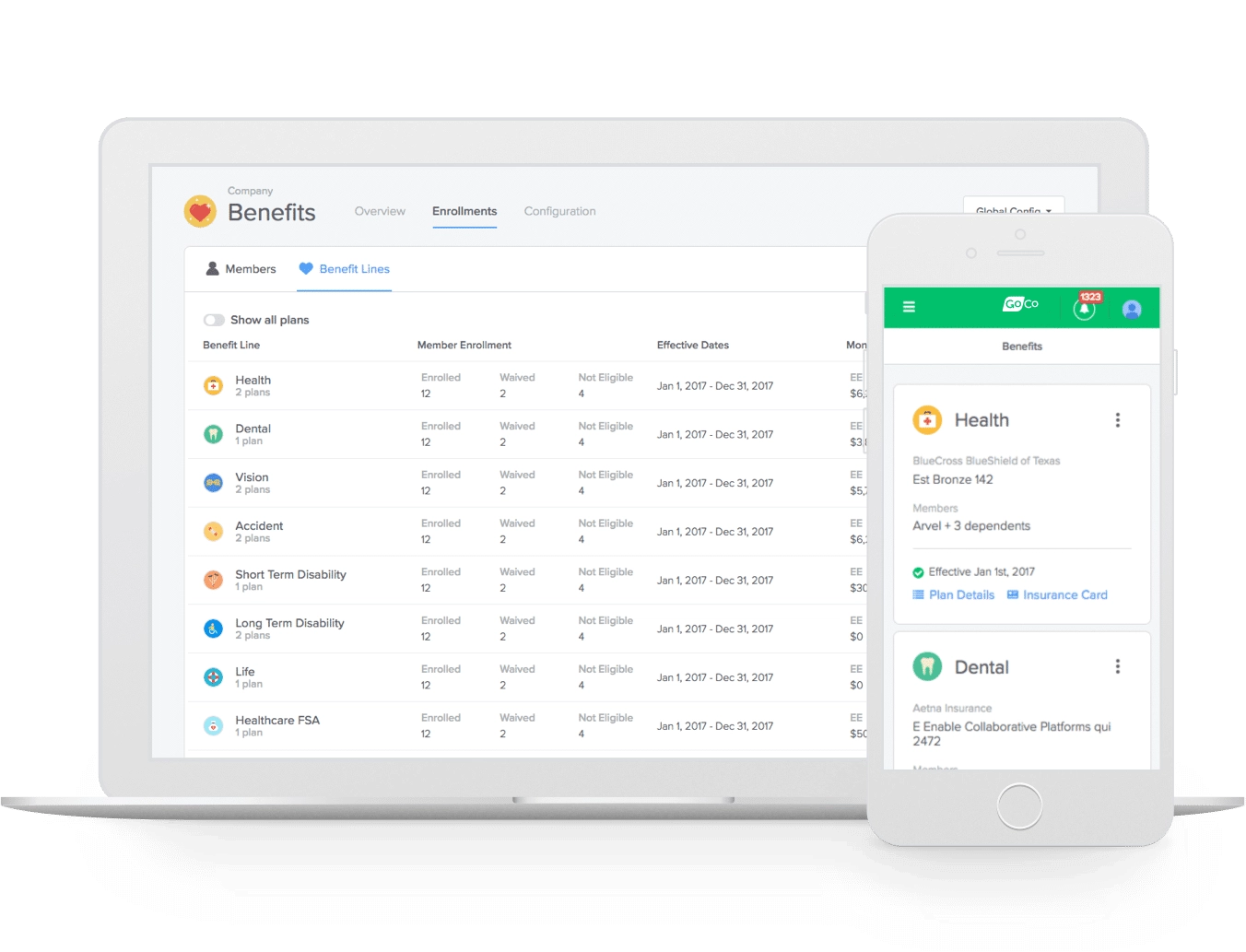

Easily Manage All Your Benefits

With GoCo’s intuitive and robust platform, benefits administration has never been easier. From detailed reports to automatic contributions and deductions, our completely paperless platform handles all the complexities of administration without the hassle. As a bonus, you stay hands off: your eligibility rules are built in so your employees will be automatically notified when it’s time to enroll.

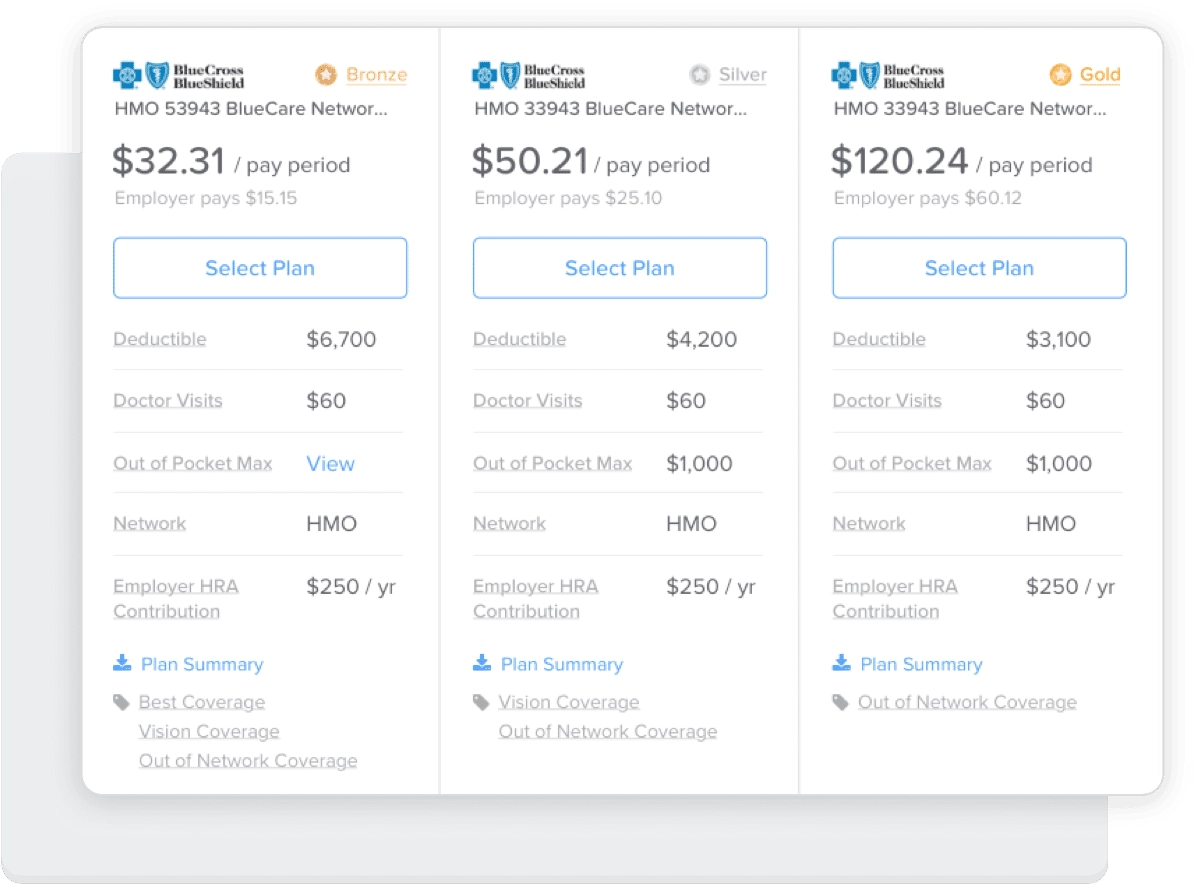

Free Your Time With Employee Self-Service

Empower your employees with the freedom of GoCo’s self service tools, available 24/7. Employees can make changes, view coverage, and enroll from any device in minutes. Plus, we’ll help them find the right plan for their families: GoCo’s benefits enrollment software compares and contrasts all eligible plan features and costs at-a-glance.

Benefits Are Kept in Sync With Payroll

With GoCo, your benefits and payroll remain in perfect harmony. Our dashboards track all changes in line with important payroll dates so you can get deductions updated on time. GoCo sends automatic reminders and notifications with all the important information needed to process enrollments or changes for your people accurately and on time.

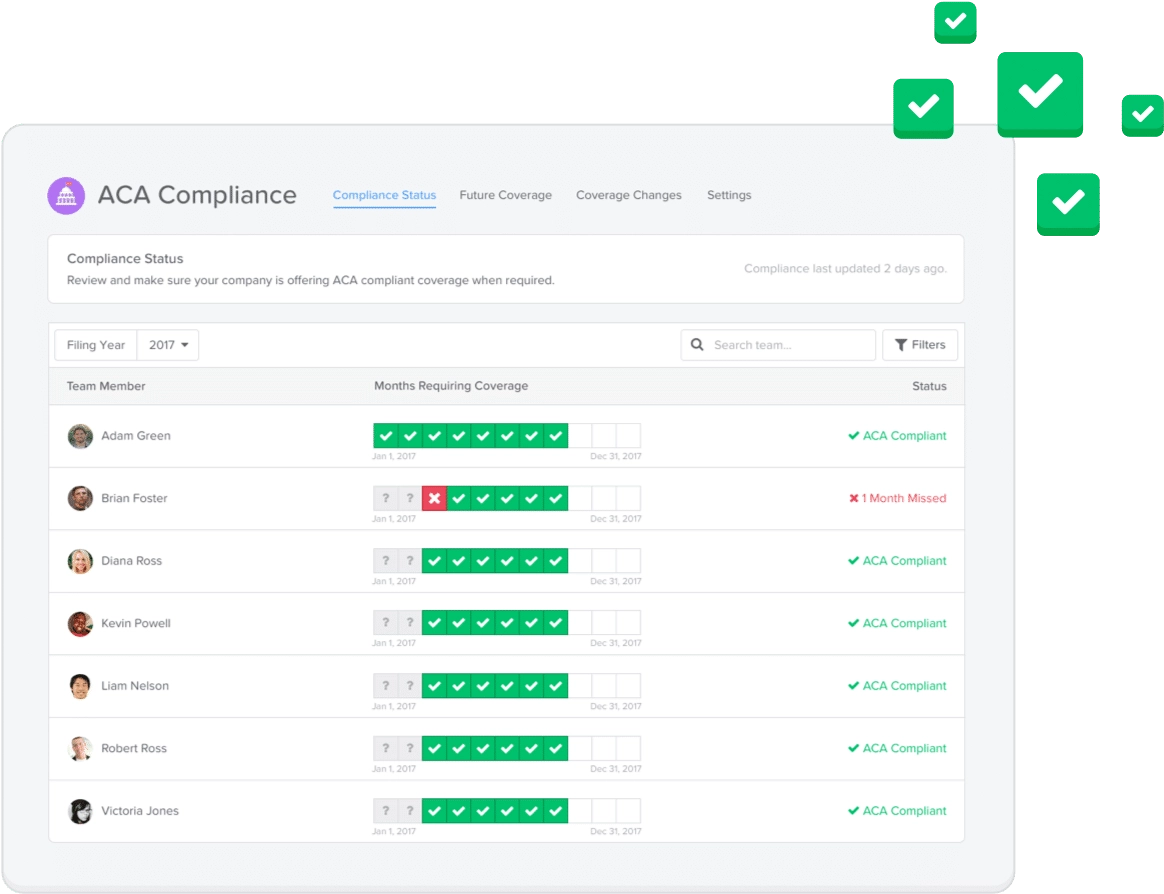

Peace of Mind Is Standard

Compliance is at the heart of GoCo. Our platform syncs directly with insurance carriers, holds payroll in lockstep, and keeps the company compliant – from ACA to integrated COBRA support when an employee departs. GoCo is the hassle-free solution to avoid potentially costly mistakes.

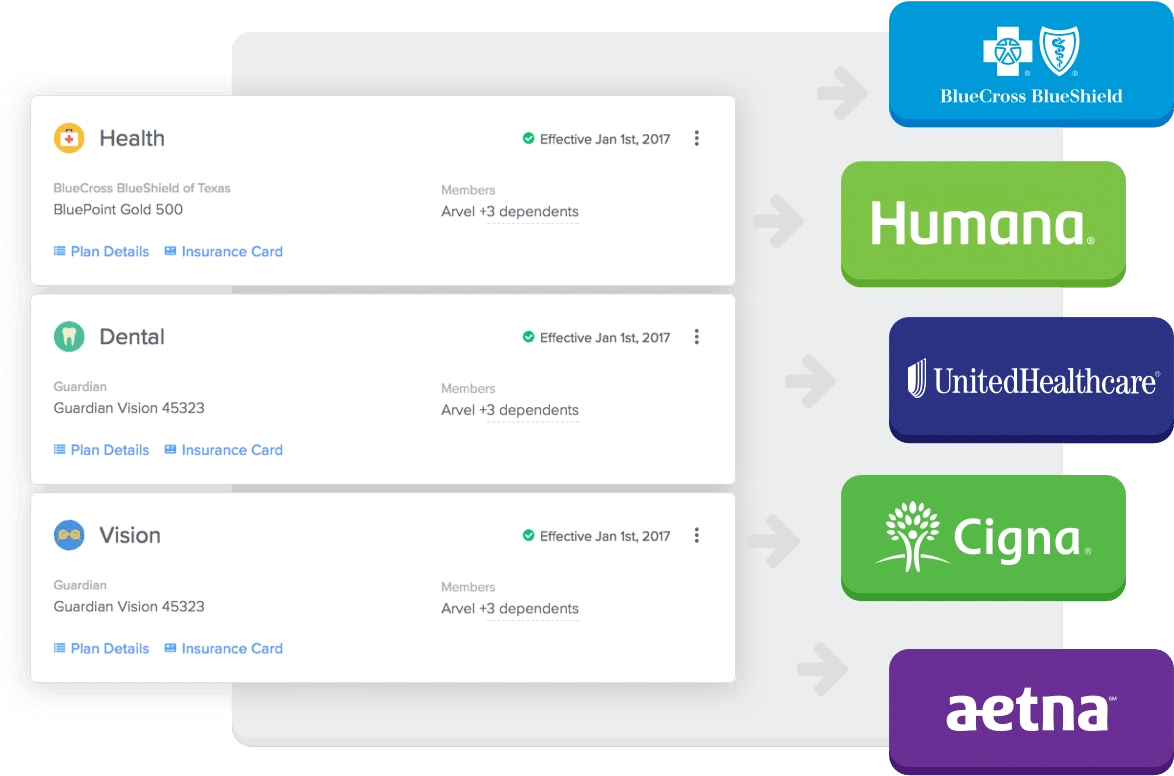

Eliminate Human Error by Syncing Directly With Carriers

Feel confident that your benefits administration process has zero risk of human error. Skip the tedious, high-stakes and error prone process of manual entry into insurance carriers. Our Integration with Ideon (formerly Vericred) uses APIs to sync benefits data in real time to avoid costly mistakes and reduce billing discrepancies.

All of your benefits in one place

Health, Dental & Vision

Seamlessly enroll and manage a full range of benefit plans available to you at the best possible prices.

Life, Accident & Disability

Quality life and disability services managed directly within GoCo. Peace of mind as standard.

HSA, FSA & HRA Benefits

Effortless management for a full suite of health saving options for your team.

401(k)

Help team members save for their retirement with a straightforward 401(k) retirement account.

Commuter Benefits

Take the misery out of the daily commute – offer tax-free benefit programs that your team will love.

And more…

Easily sync enrollments and changes to the carriers to ensure your employees have their cards in hand on time.

Top-Rated Employee Management Software

GoCo has the best service of all the platforms i've worked with in this industry

One Digital

Ease of use and clean look. I'm the administrator for my company's GoCo account and it's super easy to get new employees onboarded and enrolled in benefits. We were using digital e-forms for benefits enrollments and I'm so glad to have an automated system for employees to elect insurance!

Jay G.

GoCo has really held our hands through everything. We really see GoCo as our partner, not just a service provider.

Darby D.

Every year [during open enrollment], I would have sleepless nights just trying to get people to finish their paperwork on time. With GoCo, the process is just so much easier.

Robin G.

I love GoCo, and I adore their customer success team, because they are really who have made the experience all that it is for me.

Renee C.

GoCo helped us improve our relationship with our employees because they started to see that we were taking steps to ensure that they were being treated properly, and that they were receiving the attention that they needed.

Erica R.

Join the 10,000+ small and mid-sized US businesses using the GoCo platform.

See how GoCo can simplify your HR!

Take a Tour →Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories