The HR Compliance Laws You Need to Know in 2019

Kick the year off with a strong understanding of the laws affecting your HR department.

January 7th, 2019

Along with new federal compliance laws, a slew of state-based laws will take effect in 2019. From coast to coast, new legislation has emerged on topics like pay equity, overtime, and combating harassment. In turn, human resources departments need to do their homework in order to ensure HR compliance.

Even small businesses have to abide by many of these laws--including some laws that previously exempted them. Learn more about state-by-state laws in this directory from the Society for Human Resource Management (SHRM).

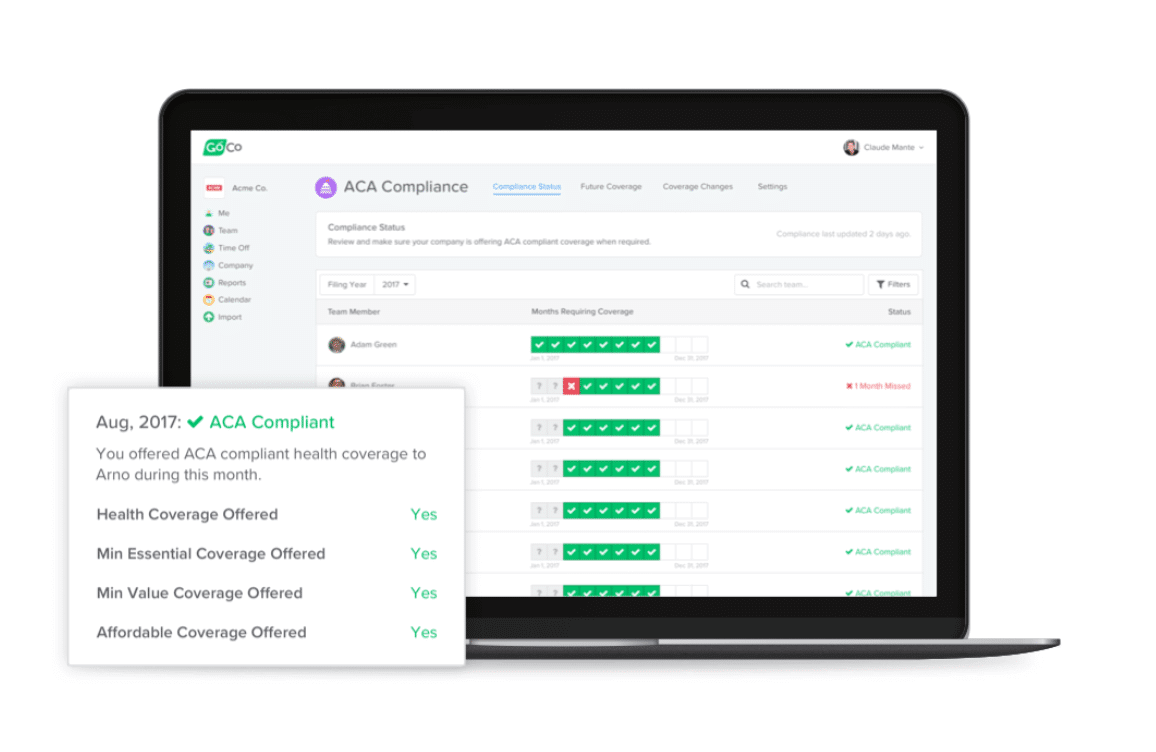

And remember, GoCo makes HR compliance easy and stress-free! As you adapt to the new regulations affecting your company, we’ll help make sure you adhere to all relevant state and federal laws.

Here are a few key ways we do that:

Making sure you collect all necessary documentation from new hires.

Automatically withholding state and federal taxes.

Ensuring you comply with all federal regulations, such as the ACA, COBRA, and ERISA.

Managing benefits administration to keep you aligned with all relevant regulations.

Helping you file taxes in the most cost-effective way.

Tracking employees’ paid time off.

Tracking your compliance, so you always know where you stand and will feel confident that you’re fully in line with all state and federal laws. We make stellar record keeping a cinch!

Make one of your New Year’s resolutions to never lose sleep about human resources compliance again. We’ll help you stay on top of the wide range of current laws that apply to you, including this checklist of new HR compliance laws you need to know. Read on for an overview of what to expect.

Wage Regulations

Several new federal regulations affect employees’ pay, while laws in some states address pay equity. Brush up on these new laws to make sure you’re paying your staff every required penny!

Overtime Pay (Federal)

The Department of Labor is planning to introduce a new regulation to determine what salary level is exempt from overtime pay. “The rule will entitle most salaried white-collar workers earning less than $913 a week ($47,476 a year) to overtime pay,” says the Department of Labor, up from $23,660.

Contractor Minimum Wage Law (Federal)

A new federal law effective on January 1, 2019, states that contract workers must be paid at least $10.60 per hour (except for those who earn tips, whose minimum wage is increasing to $7.40).

Minimum Wage Laws

Twenty states are making general minimum wage increases, effective as of January 1, 2019. The Labor Law Center outlines these wage increases here. And by the way, you’re expected to put up a poster showing minimum wage laws for your state--regardless of your company’s size!

Employees’ Tips (Federal)

The Consolidated Appropriations Act, an omnibus budget bill passed by Congress, prohibits employers from keeping any portion of employees’ tips. This new legislation amended the Fair Labor Standards Act, explains TLNT.

Pay Equity

Oregon has passed a new pay equity law that substantially increases protections against unequal pay. Work of a similar nature must receive the same compensation, the bill mandates.

The bill also provides a measure of legal protection for businesses that have conducted a pay equity audit to ensure HR compliance within the past three years, says OregonLive.

Whether you live in Oregon or not, ensuring pay equity will not only help keep your company safe from lawsuits, but will help you build lasting relationships with top talent!

Want even More HR Goodness? Sign up now to receive the latest HR tips and GoCo updates straight to your inbox!

Healthcare Legislation

Though a federal judge in Texas recently ruled that the Affordable Care Act (ACA) is unconstitutional, that won’t change employers’ reporting or coverage responsibilities, says SHRM. Employers should still be gearing up to disperse the necessary reporting forms to employees early in 2019.

While you may not need to contend with any looming changes in healthcare law at the moment, here are a couple of smaller ones to be aware of.

Health savings account contributions

Employees can contribute an extra $50 to health savings accounts for individuals in 2019, or an extra $100 for a family account, says the IRS. Make sure your employees know about this change!

Contraception access

The U.S. Department of Health and Human Services (HHS) has exempted certain types of organizations from the ACA’s requirement that health plans must provide access to contraception. “The rules will extend the exemption now available to places of worship to faith-based nonprofits, religious schools and private businesses”--if those groups oppose contraception on moral grounds, says SHRM. The two new rulings on this topic will likely be challenged in the near future, SHRM notes.

Short-term, limited-duration health plan (STLDI) extensions

The Departments of Health and Human Services, Labor, and the Treasury issued a new rule in August extending the length of time that employees can use short-term, limited-duration health plans (STLDI).

While previously the plans could only last for three months, now they can be extended to one year, with the option to renew them for three years, says SHRM. This rule may especially benefit small companies that don’t offer their own health plan options by making them more attractive to employees.

Tax Regulations

The Tax Cuts and Jobs Act may affect the deductions your company can make when filing your 2018 taxes. For example, companies can no longer deduct entertainment expenses and transportation benefits--at least until 2025, explains TLNT.

![]()

Furthermore, organizations cannot deduct settlement or attorney fees related to a sexual harassment lawsuit, TLNT adds.

However, other deductions are emerging. “Small business employers who provide paid family and medical leave to their employees during tax years 2018 and 2019 may qualify for a new business credit,” says the IRS.

Here are a few other key tax-related changes:

You can deduct more for a new purchase of equipment--instead of deducting based on a rate of depreciation, you can deduct 100% of the purchase.

Limits on depreciation of business vehicles have gone up.

Moving expenses must be included in an employee’s salary (and thus subject to taxes).

The IRS provides a side-by-side comparison of what tax filing looks like for businesses both before and after the Tax Cuts and Jobs Act. Check out that resource to gain a more in-depth understanding of the changes that will affect you.

Equity

Equity is a hot topic in the realm of compliance laws, in terms of both pay and protections against harassment. Below are some examples of state laws that address such issues--and even if you don’t live there, they may be setting the tone for laws soon to be passed in your state!

Equal representation

California’s HR compliance laws are breaking new ground when it comes to equal representation in companies. SB 826 requires publicly traded companies to include at least a minimum number of women on their boards. Companies with five board members must have two women on the board; those with six board members must include three women, SHRM explains.

Anti-harassment

In the wake of the #MeToo movement, laws against sexual harassment are growing stronger in many states. New York City and New York State have both passed new anti-harassment laws.

The Stop Sexual Harassment in NYC Act requires all organizations with more than 15 employees to provide interactive training on sexual harassment--including time for questions and answers--on a yearly basis.

In California, SB 1343 requires all businesses with at least five employees to provide anti-harassment training by 2020. Previously, only businesses with 50 or more employees were required to do so.

Parental Accommodations

In New York City, employers must strengthen the accommodations they make for nursing mothers in the workplace. According to the National Law Review (NLR), organizations in New York City with at least four employees must provide a private room (other than a bathroom) for expressing breast milk. Several accommodations for the room are necessary, such as a chair and an electrical outlet, and employers must share information about policies for use of the room with employees as well, says the NLR.

California instituted a similar law, AB 1976, which also aligns with the federal law mandating that a lactation room cannot be a bathroom and calls for similar provisions for nursing mothers. Since California may be leading the way for HR compliance across the U.S., you can get ahead of the game by taking such steps even if you’re not in the Golden State.

Brush up on these laws before the clock strikes midnight on December 31, or as soon as you can in January, and you’ll ring in the new year on the right foot!

And remember, with GoCo’s help, you’ll never miss a beat when it comes to human resources compliance. Whether you’ve been considering an HR compliance audit or are simply creating a compliance checklist for the coming year, our user-friendly tracking software will take all the headache out of compliance.

Kick-off the new year with the confidence that you’re on point with every state and federal law!

Subscribe to Beyond The Desk to get insights, important dates, and a healthy dose of HR fun straight to your inbox.

Subscribe hereRecommended Posts

What is a W-4 Form? How to Fill it Out & 2024 Changes

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![Why is HR Compliance Important in 2024? [+Free Checklist]](/img/containers/assets/goco/featured_images/posts/the-importance-of-hr-compliance.png/b73096df7f78bcf9874200ba0eaccf0a.png)

![Complete 2024 HR Compliance Calendar and Important Deadlines [+Download]](/img/containers/assets/goco/featured_images/posts/2024compliancecalendar-2.png/fd610000def14287c5dae38bf0b4ed97.png)