PTO for COVID-19 Vaccinations: How Employers Can Get Reimbursed

FAQs around COVID-19 vaccination business tax credits, from provisions to claiming instructions

by Aimie Ye - April 22nd, 2021

HR professionals have been battling with numerous COVID-19 regulations and obstacles for the past year. Luckily, it seems the end is finally in sight with the swift rollout of three authorized COVID-19 vaccines becoming widely available to the general public.

Along with President Biden’s aggressive goal of administering 200 million vaccines in the first 100 days, he is calling on businesses to offer uninterrupted, full pay to employees who need time off to get the vaccine OR to recover from any potential after-effects of the vaccine. To help support employers financially, a tax credit up to a set amount is available to qualifying organizations in order to encourage higher vaccination numbers. This amendment can help small businesses get thousands in tax credits for vaccine PTO. As an HR professional, you may be wondering what this amendment to the American Rescue Plan Act (ARPA) means, and how to get reimbursed. This guide covers FAQs around COVID-19 vaccination business tax credits, from provisions to claiming instructions.

What are the new business tax credits for?

Under the American Rescue Plan Act of 2021, businesses are entitled to claim refundable tax credits reimbursing them for the cost of providing COVID-19 paid leave to employees. The cost of providing COVID-19 paid leave now includes leave taken by team members to get the vaccine, or to recover from any potential side-effects from the vaccine. The goal of this amendment to the ARPA is to invest in employee safety, as well as productivity and health of the entire workforce -- without making employees pay the cost in order to take time off for the vaccine.

Eligibility Criteria for COVID-19 Vaccine PTO Tax Credits

Eligible employers must meet the following criteria:

Employer is a public or private business, including tax-exempt organizations

Businesses and nonprofits should have less than 500 employees at the time of application

If eligible, the tax credit will give employers the ability to give paid leave to employees for COVID-19 vaccinations and recovery, and applies to almost 50% of private sector employees in the USA. These credits are open for COVID-19 paid leave wages between April 1, 2021 and September 30, 2021. Refer to the IRS fact sheet for specific details.

Number of COVID-19 Paid Leave Tax Credits for Vaccinations

As mentioned above, the COVID-19 tax credits are applicable and reimbursable for the time frame between April 1st, 2021 and September 30th, 2021. The employer is entitled to full payment for credits if it surpasses their share of the Medicare tax.

The amount of refundable tax credits under the ARPA are as follows:

Up to 80 hours (10 work days) of qualified paid sick leave wages

Up to $511 per day for each vaccinated employee, and $5,110 in aggregate, at the full amount of the employee’s standard pay rate

For family leave, wages are paid for up to 12 weeks, and limited to $200 per day ($12,000 aggregate, at ⅔ the amount of the employee’s standard pay rate)

The IRS fact sheet adds, “The amount of these tax credits is increased by allocable health plan expenses and contributions for certain collectively bargained benefits, as well as the employer's share of social security and Medicare taxes paid on the wages (up to the respective daily and total caps).”

How to Claim the Tax Credits

If employers and HR have determined eligibility, they can begin the claiming process for tax credits pertaining to leave taken to get or recover from COVID-19 vaccines in the eligible time frame.

1. Compile and report total COVID-19 paid and family sick leave wages for Form 941.

This is the quarterly federal tax return form that businesses use for income tax, social security, and Medicare tax withholding. The report should include total qualified leave wages for each quarter, including leaves currently taken by the employees for COVID-19 vaccination PTO.

2. File Form 941

In anticipation of claiming the tax credits on Form 941, employers can keep federal employment taxes that they otherwise would have deposited, which includes withheld federal income tax, and employee shares of social security and Medicare taxes with respect to all employees up to the amount of credit eligible. The IRS has released detailed instructions on how to reflect the changes in Form 941.

Eligible employers can request an advance of the tax credits by filing Form 7200 (Advance Payment of Employer Credits Due to COVID-19), and self-employed individuals can also claim comparable tax credits on their Form 1040 (US Individual Income Tax Return).

Key Takeaways from the Tax Credit for COVID-19 Vaccination & Recovery

The recent White House statement around paid leave tax credits for employers who offer PTO for vaccine related time aims to:

Invest in the safety, productivity, and health of our workforces

Encourage all people to get vaccinated without hesitation around pay

Educate HR professionals and employers on how to claim the refundable credit in their quarterly tax filings

Using an HRIS to Help

Business tax credits under the ARPA of 2021 are subject to strict qualification requirements through the IRS. Because of this, it’s even more important for employers and HR professionals to ensure that paid leave reports and calculations are completed accurately.

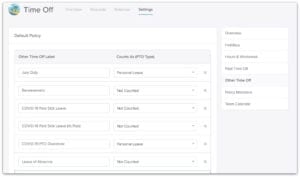

With the help of digital time tracking software like GoCo, employers can easily track and export leave according to the newest policies defined in the American Rescue Plan Act.

GoCo’s paid leave tracker makes it exponentially easier for HR to calculate and track employee leave, including leave pertaining to the COVID-19 vaccine. Additionally, when it comes to tracking vaccination documents and certifications, custom document management technology helps transform any document into a reportable form.

HR can easily customize the COVID-19 vaccination as a custom document, add custom settings, and ask employees to upload the requested document for easier tracking and management.

To see how GoCo can streamline additional HR processes, take a free interactive tour today.

Sources

Employer Tax Credits for Employee Paid Leave Due to COVID-19 Vaccinations

SHRM Update: Small Business Tax Credit for Vaccination Paid Leave

Subscribe to Beyond The Desk to get insights, important dates, and a healthy dose of HR fun straight to your inbox.

Subscribe hereRecommended Posts

What is a W-4 Form? How to Fill it Out & 2024 Changes

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![Why is HR Compliance Important in 2024? [+Free Checklist]](/img/containers/assets/goco/featured_images/posts/the-importance-of-hr-compliance.png/b73096df7f78bcf9874200ba0eaccf0a.png)

![Complete 2024 HR Compliance Calendar and Important Deadlines [+Download]](/img/containers/assets/goco/featured_images/posts/2024compliancecalendar-2.png/fd610000def14287c5dae38bf0b4ed97.png)