Here are some frequently asked questions about how GoCo handles State Tax Withholding Information.

- Does GoCo generate copies of state withholding documents like it does with the W-4?

- Yes, we do! GoCo now generates state tax forms as global templates so that you, the full-access admin, can populate and save these forms just like we do with the W-4 forms.

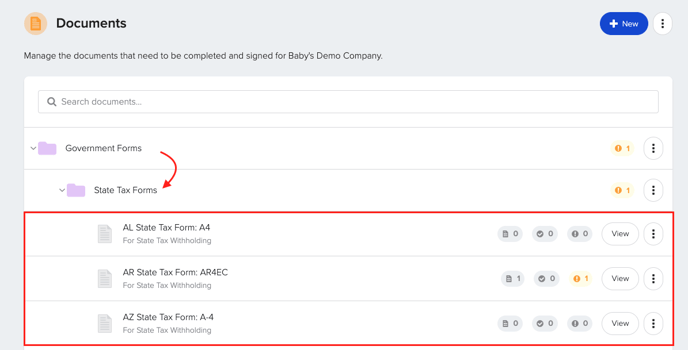

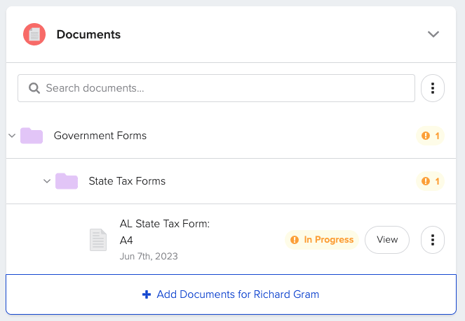

You can find these forms in a pre-created document folder called "State Tax Forms" on the company documents page. Employees will also have their specific form attached to their profile in the same folder.

- Yes, we do! GoCo now generates state tax forms as global templates so that you, the full-access admin, can populate and save these forms just like we do with the W-4 forms.

- How does GoCo handle reciprocity agreements between states?

- GoCo automatically detects when an employee qualifies for state reciprocity agreements and will prompt the employee to fill out the tax information corresponding to the state for which the employee qualifies.

- Why don't I see state tax info on my profile?

- Some states do not have income tax and, therefore, do not require a separate W-4 form. GoCo will only capture the appropriate Federal W-4 tax information for those employees located in these states.

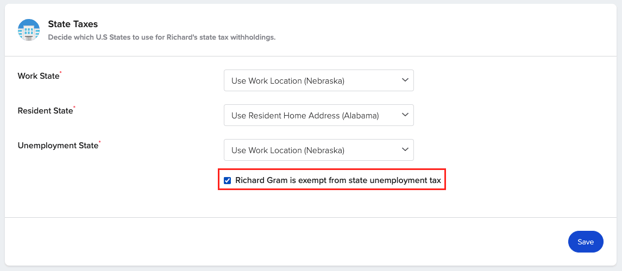

- What if I'm exempt from state tax?

- If you know that you are exempt from your state taxes, you will be able to select exempt in GoCo and fill out the necessary documents to claim exemption.

- If you know that you are exempt from your state taxes, you will be able to select exempt in GoCo and fill out the necessary documents to claim exemption.

- How do I know if I'm exempt from state taxes?

- Each state has its own process for claiming exemption. Please visit your state government's website for more information.

- What else should I know about GoCo & State Taxes?

- GoCo uses state and federal W-4 forms to collect employee withholding information for payroll purposes only and does not necessarily collect ALL the information required by a particular state. Thus W-4 forms downloaded from GoCo, may not be complete from a tax compliance perspective and should not be used for tax purposes or submitted to tax agencies.

- Since the generation of State Tax forms is Summer 2023 feature, please be aware that GoCo processed a migration to carry over all existing state tax information and automatically populate the information onto the proper state tax forms, however, we did not carry over existing employees’ signatures. They will need to resign on their profile to prevent misleading signatures.

For more information about State Taxes, please visit:

https://www.irs.gov/businesses/small-businesses-self-employed/state-government-websites

If you have any additional questions, please reach out to your GoCo Client Success team or email us at help@goco.io.

Happy Hiring! 💚