The State Unemployment Tax Act (SUTA) is a kind of payroll tax that employers need to pay, as required by state law. This payroll tax is meant to fund most unemployment benefit programs and is a mandatory employee benefit!

Download the 2023 HR Compliance Calendar

As an HR department leader, you need to know what is SUTA, how it is calculated, and how you can meet SUTA compliance requirements.

How Is SUTA Calculated?

Many HR department leaders want to know how SUTA is calculated and if there is a way to lower the tax rate. SUTA taxes are paid based on a percentage of each employee’s earnings (up to a maximum amount). The tax rate for SUTA varies from state to state.

States often base assign SUTA tax rates based on factors such as industry expectations, how big or long-standing your business is, and how frequently former employees file for unemployment benefits.

SUTA tax rates can vary immensely even within a single state. For example, Indiana's SUTA tax rate ranges from 0.5% to 7.4%.

States usually send a letter each December that specifies your SUTA tax rate for the following year, which means that your tax rate can fluctuate from year to year. If you did not receive it or have missed it, you may need to look on the tax site for your state and make an account using your IRS employee ID number (EIN).

Is There a Standard SUTA Tax Rate and Wage Base?

The tax rate differs depending on the state the business operates in, and the base taxable wage can differ as well. States may apply complex formulas to determine taxable wage base numbers and suitable tax rates for different industries and cases. Sometimes, the wage base is decided by a percentage of the average annual wage within the state. Certain states simply follow FUTA wage base guidelines.

If you are a new company and do not have a long history of hiring and laying off employees, you will likely face a standard SUTA tax rate that is decided by your state.

How Often Is SUTA Tax Paid?

SUTA compliance is very important, which is why you need to know how often it is paid. It is important to calculate SUTA taxes correctly. It is a required employee benefit that can also benefit you by bringing down your FUTA tax rate.

Most states require SUTA tax returns to be handed in quarterly. This means that if you do not pay your SUTA taxes on time and in full each quarter, you can incur late fees and penalties. These penalties can be quite expensive and substantial, so it is critical that your business maintains SUTA compliance quarterly.

If you are having trouble with paying SUTA taxes on time, GoCo can help you stay compliant with ease.

What Are the Penalties For Non-Compliance?

Like all missed or avoided payroll taxes, non-compliance can be an expensive mistake. Suppose your business does not fulfill your SUTA compliance requirements and pay SUTA taxes properly and on time. In that case, you may be subject to penalties such as additional business expenses in the form of fines.

State unemployment taxes need to be paid on time and in full, or your business may have to endure monetary penalties, interest on back taxes, civil and even criminal sanctions, jail sentences, as well as liens against property. The interest on back taxes depends on the type of infraction, the size of your business, and other deciding factors.

Is SUTA the Same As FUTA?

FUTA refers to the Federal Unemployment Tax Act, which is not the same as SUTA. Unlike SUTA, which involves taxes paid at the state level, FUTA is the federal equivalent. The federal unemployment tax rate is 6%.

FUTA taxes must be paid by employers if they paid employee wages of at least $1,500 in a quarter or had at least one employee work 20 weeks out of the year.

By paying your SUTA taxes properly and filing IRS Form 940, you can substantially decrease your FUTA tax rate through tax credits.

Do All States Have SUTA?

Each state has its own standards for how it collects taxes for SUTA. SUTA tax rates and taxable wage base limits differ from state to state. Some states have special exceptions that change the way SUTA taxes work.

New Jersey, Alaska, and Pennsylvania require both employers and employees to pay SUTA tax – that means if you run your business in one of these three states, you need to learn how to withhold SUTA tax from employee paychecks.

Who Is Exempt From FUTA and SUTA Tax?

Some entities may be exempt from FUTA and SUTA taxes. These are typically ones that do not run payroll. This includes certain government entities, nonprofit institutions, religious organizations, charitable organizations, and educational organizations.

In some cases, wages are exempt from FUTA taxation. This typically involves insurance premiums and other benefits that are fringe.

Even if your business is not exempt from FUTA taxes, you may still be able to reduce your tax rate by paying all of your SUTA taxes on time and in full. This can help you lower your business’ avoidable expenses and can seriously add up over the course of your business operations.

Sometimes, businesses are in a pinch and need to lay off workers. Eligible unemployed workers may become eligible for unemployment benefits, and unemployment occurs in every state.

How Can HR Professionals Make Sure They're Complying With SUTA Regulations?

Compliance with SUTA is critical in avoiding late fees and supporting state unemployment benefit programs. However, compliance can be needlessly complicated. HR departments collect and remit taxes, including potential SUTA taxes that need to be paid.

Companies can ensure compliance through clear communication, documentation policies, and staying on top of changing legislation each year.

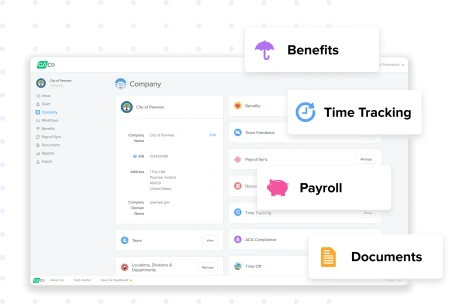

Want to make SUTA compliance easy and painless? Take a tour of GoCo and find out how our platform can help you streamline and automate SUTA compliance.

Subscribe to Beyond The Desk to get insights, important dates, and a healthy dose of HR fun straight to your inbox.

Subscribe hereRecommended Posts

2024 Employee Onboarding Checklist [3 Easy Phases]

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![2024 Employee Onboarding Checklist [3 Easy Phases]](/img/containers/assets/goco/featured_images/posts/new-hire-checklist.png/6fc8dd34ae3228988b533b18c7cbc95c.png)

![How To Build a Business Case For HR Software [Free Calculator]](/img/containers/assets/goco/featured_images/posts/build-business-case-for-hr-software.png/523e57aedee519da6f963895c12ba0e0.png)