Payroll

Run Payroll Without the Hassle

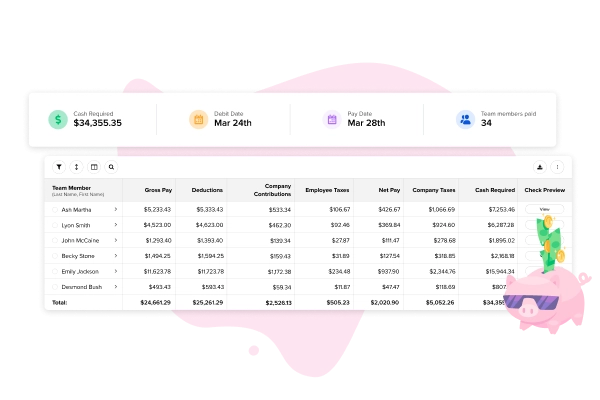

Run payroll start-to-finish in GoCo with our Embedded Payroll Powered by Gusto. With our best-in-class Payroll Grid, you can easily prepare and run payroll in minutes instead of hours.

Run Payroll Your Way

Streamline Your Payroll Data

Consolidate your payroll data into one workspace to easily reconcile and prepare everything you need to get employees paid. Our payroll knows what information is required to process payroll accurately. If something is missing (employee information, direct deposit details, timesheets), it will be flagged automatically so nothing falls through the cracks.

Prepare Payroll More Efficiently

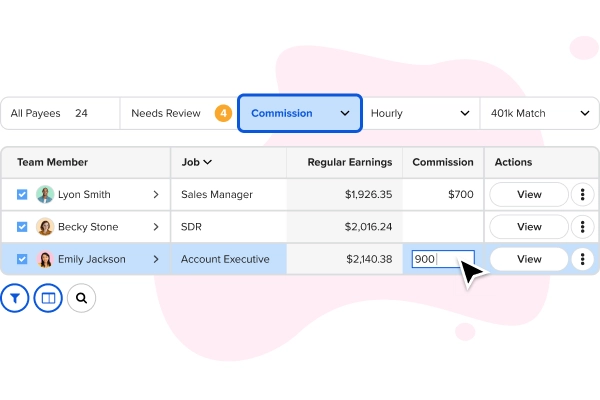

Customize the Payroll Grid to fit your team and streamline your process. Whether it’s bonus season or time to enter commissions for your sales team, it’s easy to create and save custom views of your payroll data to quickly review or adjust specific segments of your workforce.

Hosting PTO or time tracking outside of GoCo? No problem! Import any spreadsheet into the Payroll Grid and earnings data will update automatically.

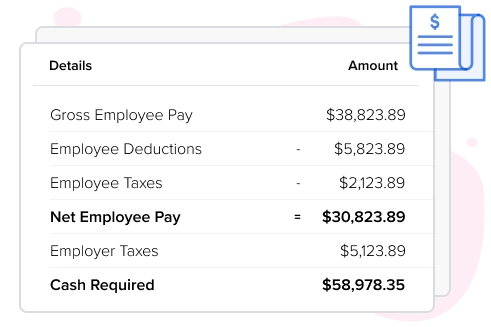

Automate Taxes and Benefit Deductions

Full-service payroll means new hire reporting and tax filings are handled for you. Plus, we'll make benefit administration a breeze by automatically calculate deductions, start dates, catch-up amounts, and more!

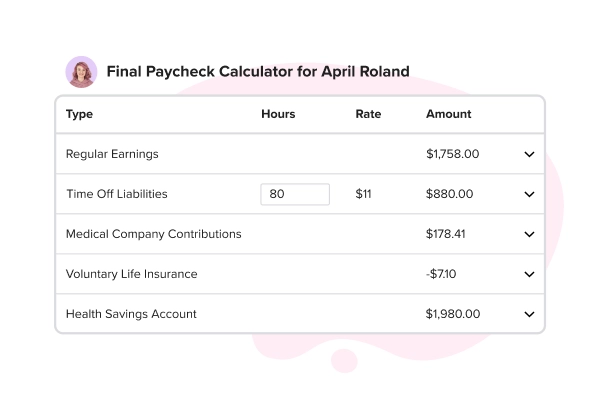

Quickly Calculate That Final Paycheck

Final paychecks aren’t always easy, but essential to process correctly. With GoCo’s Final Paycheck Calculator, you can quickly review and calculate final earning amounts, benefit costs, and any unused PTO.

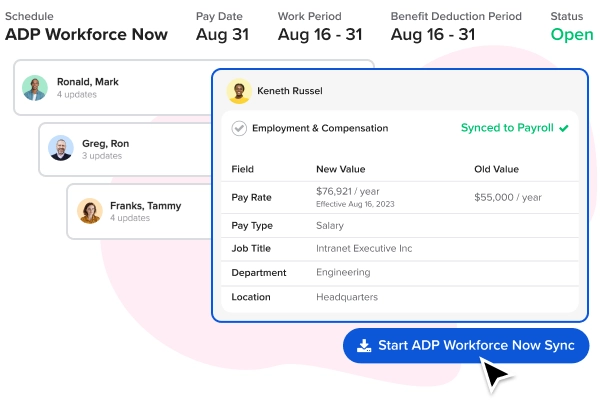

Love Your Current Payroll System? No Problem!

GoCo syncs with any cloud-based payroll solution. Eliminate the frustration of double data entry and manual errors, and keep employee data in sync with your payroll system. All you have to do is log in and run payroll.

Support You Can Count on

GoCo sets you up for success with a dedicated client success team for every client. Our payroll specialists will help you transfer from your prior payroll system, hold your hand through your first pay runs, and provide ongoing support for day-to-day tasks.

Top-Rated Employee Management Software

GoCo helped us improve our relationship with our employees because they started to see that we were taking steps to ensure that they were being treated properly, and that they were receiving the attention that they needed.

Erica R.

Ease of use and clean look. I'm the administrator for my company's GoCo account and it's super easy to get new employees onboarded and enrolled in benefits. We were using digital e-forms for benefits enrollments and I'm so glad to have an automated system for employees to elect insurance!

Jay G.

I looked at a lot of HRIS products before we went with GoCo. The feature set was great and it had everything we needed for our growing company, at a great price point.

Micah K.

I think GoCo's biggest shining star is its customer service. It is hard to find reliable customer service, and they are always quick to respond, solution-oriented and friendly.

Mel R.

Every year [during open enrollment], I would have sleepless nights just trying to get people to finish their paperwork on time. With GoCo, the process is just so much easier.

Robin G.

Very user friendly not only for the admins but also for the rest of the staff users.

Claudia A.

Join the 10,000+ small and mid-sized US businesses using the GoCo platform.

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories