The Best HR & Payroll Software in 2025

Finding the best HR and payroll software in 2025 can transform how you manage your team, streamline processes, and ensure compliance. With a wide range of options available, selecting the right HR and payroll solution is critical to support your company’s growth and success. To assist you in making an informed choice, we’ve compiled a list of the best HR and payroll software for 2025, ranking GoCo as the number one choice.

Why Does Your Business Need HR & Payroll Software?

In today’s fast-paced and rapidly evolving business environment, relying on manual processes for HR and payroll can severely limit your company's potential and lead to costly errors. HR and payroll software automates routine tasks while also providings strategic insights that can drive smarter decision-making and foster business growth.

Unlocking Operational Efficiency: HR and payroll software goes beyond mere automation. It centralizes your data, allowing for a seamless flow of information across departments. This integration reduces redundancy, minimizes errors, and speeds up critical processes like payroll and benefits administration. With real-time access to data, your HR team can operate more efficiently, leaving them free to focus on higher-level initiatives like talent development and organizational culture.

Enhancing Compliance and Security: In an era where regulations are constantly evolving, staying compliant is more challenging than ever. HR and payroll software keeps your business up-to-date with the latest legal requirements, automating compliance tasks to reduce the risk of non-compliance. Moreover, advanced security features protect sensitive employee data, ensuring that your business adheres to privacy standards and avoids costly breaches.

Driving Employee Engagement: Today’s workforce expects more from their employers, including streamlined digital experiences. HR and payroll software offers self-service portals where employees can access their information, manage benefits, and even participate in performance reviews. This level of autonomy not only enhances the employee experience but also contributes to higher engagement and retention rates. Engaged employees are more productive, more satisfied, and more likely to contribute to a positive workplace culture.

Scalability and Flexibility: As your business evolves, your HR needs will change. HR and payroll software provides the flexibility to scale up or down, adapting to your growth trajectory. Whether you’re expanding your workforce, entering new markets, or navigating complex organizational changes, these platforms offer the customization and modularity needed to support your business every step of the way.

Strategic Decision-Making: The best HR and payroll software doesn’t just automate—it analyzes. With built-in analytics and reporting tools, you gain valuable insights into workforce trends, productivity levels, and financial metrics. This data-driven approach allows you to make informed decisions that align with your business objectives, from optimizing payroll costs to identifying areas for employee development.

In an increasingly competitive landscape, investing in HR and payroll software isn’t just about operational efficiency—it’s about positioning your business for long-term success. Explore our top picks for 2024 to find the solution that best aligns with your strategic goals, and discover why GoCo stands out as the premier choice.

Best HR Software for Mid-Sized Businesses

Best Software

- GoCo

- Gusto

- Paycom

- Remote

- Justworks

- ADP TotalSource

- QuickBooks Payroll

- CheckMark Payroll

- factoHR

1. GoCo

Website: Visit GoCo

G2 Rating: 4.6 (389)

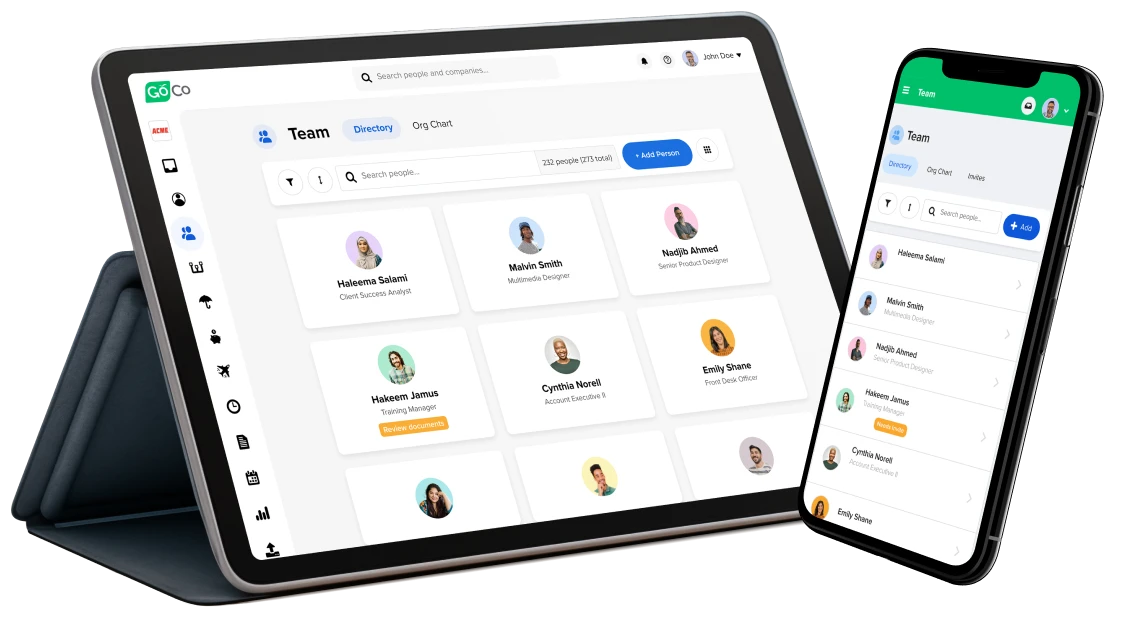

GoCo is the ultimate HR and payroll software for 2024, designed to simplify and streamline HR processes with its modern, intuitive platform. GoCo’s unique combination of customization, ease of use, and powerful automation tools makes it the top choice for businesses that want to focus on growth rather than getting bogged down by administrative tasks. Unlike traditional HR platforms, GoCo offers a user-friendly interface that requires no technical expertise, allowing businesses to implement and adapt it to their needs quickly.

GoCo offers an all-in-one HR platform that covers everything from hiring to retiring. The software is fully customizable, allowing businesses to build workflows that fit their specific processes. Whether you need to automate onboarding, manage employee benefits, track time and attendance, or handle payroll, GoCo has you covered. The platform’s modular design ensures that you can pick and choose the features you need, making it a cost-effective solution that grows with your business.

GoCo’s HR and Payroll Features include:

- Custom Workflows: Tailor every aspect of the HR process to match your business’s unique needs. With GoCo, you can create custom workflows that automate repetitive tasks, saving time and reducing errors.

- Embedded Payroll: Run payroll start-to-finish in GoCo with their powerful embedded Payroll solution. With GoCo, you can process payroll in minutes instead of hours, ensuring your team gets paid accurately and on time, every time.

- Bring Your Own Payroll: Love your current payroll system? Not a problem! GoCo allows you to bring your own payroll and keeps your systems in sync by tracking all the changes to your data so you know what needs to be updated in payroll.

- Employee Self-Service: Empower your employees with self-service capabilities. They can easily access and manage their personal information, request time off, and complete onboarding tasks—all from a single, intuitive dashboard.

- Benefits Administration: GoCo simplifies benefits management by integrating with a wide range of benefits providers and providing an easy-to-use benefits administration wizard. The platform automatically handles compliance tracking, ensuring that you meet all legal requirements without extra effort.

- Automated Onboarding: Streamline the onboarding process for new hires. GoCo automates your hiring and onboarding workflow so you can greet your employees with a smile on the first day — instead of a stack of paperwork. New hires can complete their onboarding and sign documents from anywhere on any device.

- Document Management: Securely store and manage employee documents with GoCo’s built-in document management system. You can easily upload, share, and sign documents electronically, reducing paperwork and increasing efficiency.

- Time Tracking and PTO Management: GoCo’s time tracking and PTO management features make it easy to monitor employee hours, manage leave requests, and ensure accurate payroll processing. The system integrates with popular payroll providers, further simplifying payroll management.

GoCo doesn’t just automate HR tasks—it creates a better experience for both HR teams and employees. The platform’s modern design and user-friendly interface are easy for everyone to navigate, reducing the learning curve and encouraging adoption across the organization. GoCo also supports a variety of integrations with other business tools, allowing you to create a seamless workflow that fits your business’s existing ecosystem.

Pricing: GoCo offers transparent, competitive pricing tailored to businesses like yours. With customizable plans and no hidden fees, you can find a solution that fits your budget and scales as your business grows.

Best For: Businesses that need a flexible, all-in-one HR and payroll solution that grows with them, offering powerful automation tools, customization, and exceptional support.

2. Gusto

Website: Visit Gusto

G2 Rating: 4.5 (2095)

Gusto is a leading choice for businesses that want to simplify payroll and benefits management. Known for its user-friendly platform, Gusto offers a range of HR tools that make managing payroll, benefits, and compliance straightforward and efficient.

Gusto’s HR and Payroll Features include:

- Automated Payroll: Simplifies payroll processing with automation, direct deposits, and tax filing.

- Employee Benefits: Provides a wide range of employee benefits, including health insurance, 401(k) plans, and more.

- HR Management: Includes basic HR tools for onboarding, time-off tracking, and employee management.

- Compliance Support: Helps businesses stay compliant with federal, state, and local payroll regulations.

Pricing: Gusto’s Simple option starts with a base fee of $40 per month plus $6 per employee per month (PEPM). Tiers increase rapidly with the base fee ranging from $80-$180 and the per employee per month fee ranging from $9-$16.50.

While Gusto excels in payroll and benefits, its HR features are less comprehensive compared to dedicated HR platforms. Some reviews also mention issues with customer support and a relatively high price tag.

Best For: Businesses with under 10 employees focused on payroll efficiency and benefits management.

3. Paycom

Website: Visit Paycom

G2 Rating: 4.2 (1219)

Paycom is an HR and payroll software solution that offers a range of features that help manage the entire employee lifecycle, from recruiting and onboarding to payroll and performance management.

Paycom’s HR and Payroll Features include:

- Payroll Processing: Automates payroll with real-time data and compliance tools to ensure accuracy.

- Employee Self-Service: Employees can manage their payroll, benefits, and time-off requests through an intuitive portal.

- Talent Acquisition: Includes recruiting and onboarding tools to streamline the hiring process.

- Performance Management: Provides tools for tracking employee performance and managing reviews.

Pricing: Paycom's pricing is not publicly available and typically requires a consultation for a customized quote based on the size and needs of the business. But according to Outsail, “Paycom charges companies on a per paycheck basis. When converted to a Per Employee Per Month fee, a Paycom subscription can cost anywhere from $25-36 PEPM, depending on the size of your company and the modules included in your scope.”

Paycom is highly rated for its comprehensive features but can be more expensive and complex to implement, particularly for smaller businesses. Some users have noted that the extensive features can lead to a steeper learning curve. Additionally, users on G2 often note poor and slow customer service as well as issues with payments and payroll.

Best For: Large businesses looking for an all-in-one HR and payroll solution with advanced features who have dedicated resources to learn the platform.

4. Remote

Website: Visit Remote

G2 Rating: 4.6 (1923)

Remote is an HR software focused on managing global payroll and compliance for distributed teams. It's beneficial for companies with remote workers spread across different countries, offering tools to handle international payroll, benefits, and compliance.

Remote’s HR and Payroll Features include:

- Global Payroll: Manages payroll for employees in multiple countries, ensuring compliance with local laws.

- Employee Benefits: Offers global benefits packages that can be customized by region.

- Compliance Management: Handles the complexities of international labor laws, reducing the risk of non-compliance.

- Remote Onboarding: Streamlines the onboarding process for remote employees with tools designed for a distributed workforce.

Pricing: Remote has a number of different offerings. For Employer of Record (EOR) services, Remote starts at $599 per month for annual plans. For multi-country payroll, Remote costs $50 per employee per month. Remote Talent starts at $119 per month. Additional costs may apply based on specific services required. GoCo customers can get 10% of Remote services.

Remote is ideal for businesses with global teams, but may not be necessary for companies operating solely within a single country. It’s well-suited for those looking to manage international HR and payroll complexities.

Best For: Businesses with remote or distributed teams needing global payroll and compliance management.

5. Justworks

Website: Visit Justworks

G2 Rating: 4.6 (685)

Justworks offers a platform combining payroll, benefits, compliance, and HR tools. As a Professional Employer Organization (PEO), Justworks is suited for businesses that need to outsource HR functions to stay compliant while offering competitive benefits. Justworks handles payroll processing while also managing payroll taxes and compliance with local, state, and federal regulations.

Justworks’ HR and Payroll Features include:

- PEO Services: Provides comprehensive PEO services, including payroll, benefits, and compliance management.

- HR Tools: Includes basic HR tools for onboarding and performance management.

- Automated Payroll Processing: Justworks takes care of all aspects of payroll, from calculating wages and deductions to processing direct deposits and issuing paychecks.

- Tax Filing and Compliance: The platform automatically files payroll taxes and generates the necessary reports to keep your business compliant with ever-changing tax laws.

Pricing: For PEO Basic, Justworks starts at $59 per employee per month, and PEO Plus starts at $109 per employee per month.

Justworks can be more expensive than other HR software due to its PEO services. It’s also important to note that as a PEO, Justworks essentially becomes the employer of record for your employees. This means that they take over many aspects of HR management, including payroll, benefits, and compliance. While this can relieve your business of significant administrative responsibilities, it also means you lose a degree of control over your HR processes.

For businesses that prefer to maintain ownership of their HR functions and have the flexibility to make independent decisions, this loss of control can be a drawback. Additionally, Justworks' PEO model may not offer the same level of customization and flexibility that non-PEO HR software solutions provide.

Best For: Businesses that prioritize comprehensive payroll and compliance management but are comfortable with outsourcing much of their HR operations to a third-party provider.

6. ADP TotalSource

Website: Visit ADP TotalSource

G2 Rating: 4.3 (237)

ADP TotalSource is a well-known name in the HR and payroll space, particularly as a Professional Employer Organization (PEO) that offers an HR solution, including payroll. While ADP’s reputation is built on decades of experience, there are critical aspects to consider before opting for TotalSource, especially if your primary focus is on payroll efficiency.

ADP TotalSource’s Payroll Features include:

- Payroll Processing: ADP TotalSource handles payroll with a high degree of automation, covering everything from wage calculations to tax deductions. While the system is robust, the complexity of ADP’s platform can be overwhelming for smaller businesses or those without dedicated payroll staff, often leading to a steep learning curve.

- Tax Filing and Compliance: ADP’s payroll services include automatic tax filing at all governmental levels, which is essential for compliance. However, users have reported that ADP’s support can be slow to respond to issues, which can be a significant problem when dealing with time-sensitive tax matters.

- Employee Self-Service: While ADP’s self-service portal is a valuable tool, feedback indicates that it can be difficult for employees to navigate, leading to frequent questions and increased dependency on HR for payroll-related issues.

Pricing: Contact ADP TotalSource to get a custom quote for your business.

Despite its comprehensive offering, ADP TotalSource’s PEO model comes with significant trade-offs. By choosing TotalSource, your business effectively outsources not just payroll but a broad array of HR functions, which can lead to a loss of control over critical aspects of your operations. For businesses that value autonomy and flexibility in managing HR and payroll, this could be a major downside.

Moreover, ADP’s pricing is notably high, reflecting the breadth of services offered but also making it less accessible to smaller businesses or those with tighter budgets.

Best For: Larger businesses or those willing to trade control and flexibility for a comprehensive outsourced HR and payroll solution, despite the high cost and potential for service delays.

7. QuickBooks Payroll

Website: Visit QuickBooks Payroll

G2 Rating: 4 (3329)

QuickBooks Payroll is part of the QuickBooks suite of accounting software, offering seamless integration for businesses already using QuickBooks for their financial management. It simplifies payroll processing and tax management, making it a popular choice for small to mid-sized businesses.

QuickBooks Payroll Features include:

- Automated Payroll: Process payroll quickly with automated calculations, tax filing, and direct deposit.

- Integration with QuickBooks: Easily sync payroll with your QuickBooks accounting software, streamlining financial management.

- Employee Self-Service: Employees can access pay stubs, W-2s, and manage their direct deposit information online.

- Tax Management: Handles federal and state tax filings, reducing the risk of errors and penalties.

Pricing: QuickBooks Payroll starts $35 per month for limited features. The Essentials Plan begins at $65 per month or Plus for $99 a month. Advanced starts at $235 a month. To add Payroll to any of these plans, it costs between an extra $50 per month and $130 per month as a base plus a PEPM cost.

QuickBooks Payroll is ideal for businesses already using QuickBooks, providing a seamless experience. However, for businesses needing more robust HR features, it may fall short compared to other dedicated HR platforms.

A major win for Quickbooks is that it works seamlessly with GoCo!

Best For: Small to mid-sized businesses using QuickBooks for accounting and needing a streamlined payroll solution.

8. CheckMark Payroll

Website: Visit CheckMark Payroll

G2 Rating: 4.2 (6)

CheckMark Payroll is a simple and affordable payroll point solution designed for small businesses. It offers basic payroll features with a focus on ease of use and compliance.

CheckMark Payroll Features include:

- Payroll Processing: Offers straightforward payroll processing with support for direct deposit and check printing.

- Tax Reporting: Handles federal and state tax calculations and filings.

- Employee Management: Manage employee records, including pay rates, deductions, and tax information.

- Multi-State Payroll: Supports payroll processing across multiple states, making it suitable for businesses with a distributed workforce.

Pricing: CheckMark Payroll is available as a one-time purchase starting at $549, but their more popular plan costs $619 per year.

CheckMark Payroll is best suited for small businesses looking for a budget-friendly payroll solution. However, it lacks the advanced features of more comprehensive HR and payroll software, making it less ideal for growing businesses with complex needs. Additionally, they offer limited support, with their more affordable payroll plan only including 90 minutes of support per year.

Best For: Small businesses seeking a simple, affordable payroll solution and are okay with limited support and features.

9. factoHR

Website: Visit factoHR

G2 Rating: 4 (11)

factoHR is a cloud-based HR and payroll software designed to automate and streamline HR processes. It offers a range of features, including payroll management, employee attendance tracking, and performance management.

factoHR’s HR and Payroll Features include:

- Automated Payroll: Simplifies payroll processing with automation and compliance management.

- Employee Self-Service: Provides employees with access to their payroll details, leave balances, and other HR-related information.

- Attendance Management: Integrates with biometric devices to track employee attendance and automate payroll accordingly.

- Performance Management: Helps track employee performance, set goals, and manage reviews.

Pricing: factoHR offers customized pricing based on the specific needs of your business, with plans available for small to large organizations.

factoHR is an option for businesses of various sizes. However, users on G2 note that there are limited integration options, slow load time, and software bugs. Finally, the business is based in India, which may make it harder to receive timely support for US companies.

Best For: Businesses, particularly those based in Asia, who are looking for a payroll and performance solution

How to Choose the Best HR & Payroll Software for Your Business

Selecting the right HR and payroll software is a strategic decision that can significantly impact your business's efficiency and growth. Payroll accuracy and compliance are non-negotiables, but modern HR and payroll software should also enhance your overall HR operations, providing a solid foundation for managing your workforce effectively.

Start with Your Core HR and Payroll Needs: The foundation of any HR and payroll software should be its ability to handle the essentials—accurate payroll processing, benefits administration, and employee record management. However, it’s not just about covering the basics. Consider how the software integrates with your existing systems and whether it offers the flexibility to grow with your business. An effective solution should reduce manual work, minimize errors, and ensure compliance, all while freeing up your HR team to focus on strategic initiatives.

Look for Advanced Features that Drive Efficiency: Beyond core functionalities, the right software should offer features that streamline and optimize your HR processes. Tools like automated tax filing, time tracking, and self-service portals empower both your HR team and employees, reducing administrative burdens and enhancing productivity. Additionally, consider whether the software includes advanced HR capabilities such as performance management, employee engagement tools, and comprehensive reporting features. These elements are crucial for not only managing your workforce effectively but also gaining insights that drive better decision-making.

Evaluate Flexibility and Customization: No two businesses are alike, so your HR and payroll software should be flexible enough to accommodate your unique needs. Whether it’s the ability to customize workflows, integrate with other business tools, or scale as your company grows, flexibility is key. Some businesses may benefit from an all-in-one platform that consolidates HR functions, while others might prefer a solution that allows them to integrate specialized tools into a broader HR ecosystem.

Consider the User Experience: The software’s usability is critical for ensuring high adoption rates among both HR teams and employees. A user-friendly interface that simplifies complex processes will make the transition smoother and reduce the time spent on training. Remember, the goal is to enhance efficiency, not add layers of complexity.

Critical Factors to Consider When Choosing HR and Payroll Software

If you're uncertain about which HR and payroll software is right for your business, focus on these crucial factors:

-

Company Size and Complexity: The scale of your business, including the number of employees and the complexity of your HR needs, should guide your choice. Larger companies may require more robust solutions with advanced features, while smaller businesses might prioritize simplicity and ease of use.

Company Size and Complexity: The scale of your business, including the number of employees and the complexity of your HR needs, should guide your choice. Larger companies may require more robust solutions with advanced features, while smaller businesses might prioritize simplicity and ease of use.

-

Automation Capabilities: Identify opportunities for automation within your HR processes. Automating tasks such as payroll calculations, tax filings, and compliance monitoring can save time, reduce errors, and ensure you’re always up-to-date with regulations.

Automation Capabilities: Identify opportunities for automation within your HR processes. Automating tasks such as payroll calculations, tax filings, and compliance monitoring can save time, reduce errors, and ensure you’re always up-to-date with regulations.

-

Budget and ROI: While it’s essential to stay within budget, consider the long-term return on investment (ROI). Factor in not only the upfront cost but also the potential savings in time, error reduction, and improved compliance. Calculate how much time and money an HRIS can save your business.

Budget and ROI: While it’s essential to stay within budget, consider the long-term return on investment (ROI). Factor in not only the upfront cost but also the potential savings in time, error reduction, and improved compliance. Calculate how much time and money an HRIS can save your business.

-

Training and Support: Evaluate the level of training and ongoing support your team will need to effectively use the software. A solution that offers comprehensive onboarding and responsive customer support can make a significant difference in your overall experience.

Training and Support: Evaluate the level of training and ongoing support your team will need to effectively use the software. A solution that offers comprehensive onboarding and responsive customer support can make a significant difference in your overall experience.

-

Integration with Existing Systems: Consider how the software will fit into your current technology stack. Seamless integration with other business tools like accounting software, benefits platforms, or CRM systems can enhance workflow efficiency.

Integration with Existing Systems: Consider how the software will fit into your current technology stack. Seamless integration with other business tools like accounting software, benefits platforms, or CRM systems can enhance workflow efficiency.

-

Security and Compliance: Payroll and HR data are sensitive, so ensure the software has robust security features to protect your information. Compliance with regulations such HIPAA should be a given.

Security and Compliance: Payroll and HR data are sensitive, so ensure the software has robust security features to protect your information. Compliance with regulations such HIPAA should be a given.

-

Advanced HR Features: Look for additional tools that might be beneficial, such as e-signatures, applicant tracking, or detailed analytics and reporting capabilities. These features can provide deeper insights into your workforce and help you manage HR operations more effectively.

Advanced HR Features: Look for additional tools that might be beneficial, such as e-signatures, applicant tracking, or detailed analytics and reporting capabilities. These features can provide deeper insights into your workforce and help you manage HR operations more effectively.

-

Scalability: As your business grows, your HR needs will evolve. Choose a solution that can scale with you, adding new features or modules as required without needing to switch platforms.

Scalability: As your business grows, your HR needs will evolve. Choose a solution that can scale with you, adding new features or modules as required without needing to switch platforms.

Answering these questions will help you understand your business's unique needs and guide you toward the best HR and payroll software solution that aligns with your goals.

GoCo’s Comprehensive HR and Payroll Platform: GoCo offers an all-in-one HR solution specifically designed to streamline HR and payroll management for businesses of all sizes. By consolidating key HR functions—such as payroll, onboarding, benefits, and more—into a single, intuitive platform, GoCo eliminates the need to juggle multiple systems, providing the flexibility and scalability to grow with your business.

With features like electronic forms, integrated provider management, employee databases, and self-service portals, GoCo simplifies your HR processes, enhances accuracy, and reduces administrative overhead. Plus, GoCo's commitment to customer support ensures that you’re never alone in navigating your HR challenges.

Book a demo today and discover how GoCo can revolutionize your HR and payroll operations, enabling you to focus on what matters most—growing your business.

FAQs

What is HR and payroll software, and why do I need it?

HR and payroll software is a digital solution that helps manage various HR functions such as payroll, benefits administration, employee records, and more. It streamlines HR processes, reduces manual work, and ensures compliance with legal requirements, allowing business owners to focus on growth and employee satisfaction.

What features should I look for in the best HR and payroll software?

When choosing the best HR and payroll software, look for features like payroll processing, benefits management, time tracking, employee self-service, and automated onboarding. Customizability and integration with existing tools are also important factors to consider.

Is there affordable HR and payroll software for businesses?

Yes, there are many affordable HR and payroll software options designed specifically for businesses. Solutions like GoCo offer customizable pricing plans that scale with your business, ensuring you only pay for the features you need.

Can HR and payroll software grow with my company?

Yes, many HR and payroll software solutions are designed to scale with your business. Platforms like GoCo offer modular features that allow you to add or remove functions as your business evolves, ensuring the software continues to meet your needs as you grow.

What makes GoCo the best HR and payroll software?

GoCo is considered the best HR and payroll software due to its intuitive interface, customizable workflows, and powerful automation tools. It covers all essential HR functions, including payroll, benefits administration, and time tracking, while offering flexible pricing plans tailored to businesses.

How easy is it to implement HR and payroll software in a business?

Implementing HR and payroll software in a business is generally straightforward, especially with platforms like GoCo, which offer user-friendly interfaces and comprehensive customer support. Most HR and payroll software solutions provide step-by-step guidance and training resources to help your team get up to speed quickly.

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories