The Patient Protection and Affordable Care Act (known as the ACA, or Obamacare) is the current US federal law that governs and protects access to health care for American citizens, beyond what is provided under the Medicaid program.

The ACA's main mandate is to ensure the majority of US individuals have quality, affordable health insurance coverage that is fair, and not limited by dollar amounts or pre-existing conditions.

The current federal government plans to replace the ACA with the American Health Care Act (AHCA), but until such time the ACA remains in effect and all rules, deadlines, and penalties should be adhered to.

Katharine Marshall, principal at Mercer, a global benefits consulting agency notes,

"As employers begin to strategize for their 2018 benefit programs, it is important not to lose sight of new and ongoing compliance obligations and prepare to make any changes that may be necessary in employee benefit plan design and administration [...]

Despite what may – or may not – come of ACA repeal and replace legislation, there are a number of compliance concerns that employers can count on sticking around – like HIPAA [Health Insurance Portability and Accountability Act of 1996] privacy and security requirements, mental health parity requirements and ERISA fiduciary duties, just to name a few."

Under the ACA, individuals must get insurance coverage or pay an annual penalty. Individuals and small businesses (those with fewer than 49 employees) can get coverage through a health insurance marketplace, or may be eligible to receive federal subsidies and tax credits.

Statistics show that 96% of employers fall into this category making them exempt from the employer responsibility provisions.

Employers with more than 50 full-time equivalent (FTE) employees are considered "Applicable Large Employers" (ALE).

ALEs are subject to employer shared responsibility provisions, the crux of which is providing affordable health insurance for a minimum of 95% of its employees for each month of the filing year, or pay a penalty for each uninsured employee. Depending on the size of the employer, penalties can range from thousands to millions of dollars!

ALEs also must issue annual benefits statements to employees and file insurance information reports with the IRS outlining the coverage offered to employees.

Want even More HR Goodness? Sign up now to receive the latest HR tips and GoCo updates straight to your inbox!

ACA General Guidelines

If you employ multiple workers in your business (even if you don't think you're an ALE), it's in your best interest to know the ACA compliance responsibilities and risks. Particularly understanding exactly where the thresholds are that might bump you into a different category, making you liable under ACA regulations.

Should an ALE not meet its obligations and provide acceptable coverage to at least 95% of its full-time employees, an employee can choose to apply for the premium tax credit and purchase coverage instead through the Health Insurance Marketplace.

This is often what can land employers in hot water, potentially subjecting them to huge penalties.

The ACA states:

"In general, a full-time employee could receive the premium tax credit if: (1) the minimum essential coverage the employer offers to the employee is not affordable; (2) the minimum essential coverage the employer offers to the employee does not provide minimum value; or (3) the employee is not one of the at least 95 percent of full-time employees offered minimum essential coverage."

There's more detail below on these definitions.

Employees that are eligible for government-sponsored plans such as Medicaid, may be exempt from obtaining employer-sponsored coverage, but the employer still needs to report this fact to the IRS.

ALEs and FTEs

In order to determine whether an employer is an ALE, it's necessary to examine the working status of all of its employees. Generally, an FTE is considered an employee who works more than 30 hours per week, or 130 hours a month.

But it can get tricky for companies who employ part-time, temporary, and seasonal workers, or that have offices in different US jurisdictions since these all affect FTE numbers.

The hours worked by each of these employees go toward calculating whether an employer is considered an ALE. The average the number of hours worked by each employee during a three to 12 month measurement period in the preceding year is a determining factor.

As an example, despite their itinerant status, if an employee averaged more than 30 hours per week, or 130 hours per month, during the measurement period they could be considered an FTE.

Also be aware that two part-time employees who each work 15 hours a week, could be considered one FTE.

Affordable Coverage

In order for health insurance to be affordable, the employee must not be required to contribute more than 9.69% of their household income toward the cost of single coverage plan, after their employer's contribution. (The percentage changes each year).

Spouses are not required to be covered but dependents under the age of 26 must be if they do not have coverage elsewhere.

The IRS recognizes that it's almost impossible for an employer to know the household income of its employees, so the ACA has three "safe harbors" that the employer can use instead to determine affordability: Form W-2 which shows an employee's wages; the employee's rate of pay; or the federal poverty line.

Minimum Value and Essential Coverage

To meet the minimum value requirement, an employer-sponsored plan must pay for at least 60% of the total allowed cost of benefits expected to be incurred under the plan.

Minimum essential coverage isn't a specific benefit, it's based on the source and length of coverage. Generally, most major medical plans provide minimum essential coverage because they also have to be ACA compliant.

Employees and employers must maintain coverage throughout the year (unless they are exempt), or pay a fee/penalty for each month of non-coverage, per employee.

Penalties

Under the ACA, employers have to report the value of their employer-provided health benefits to the IRS each year. This is all based on coverage during in the previous year, and it affects both ALEs, and small businesses that provide health insurance to employees.

As mentioned earlier, there are penalties for employers who do not provide health care insurance to 95% of its full-time employees. Currently, the fee is set at $2,000 per year, per full-time employee (minus the first 30 full-time employees).

For employers who do provide coverage but do not meet minimum value and affordability requirements, the fee is $3,000 per year, per full-time employee.

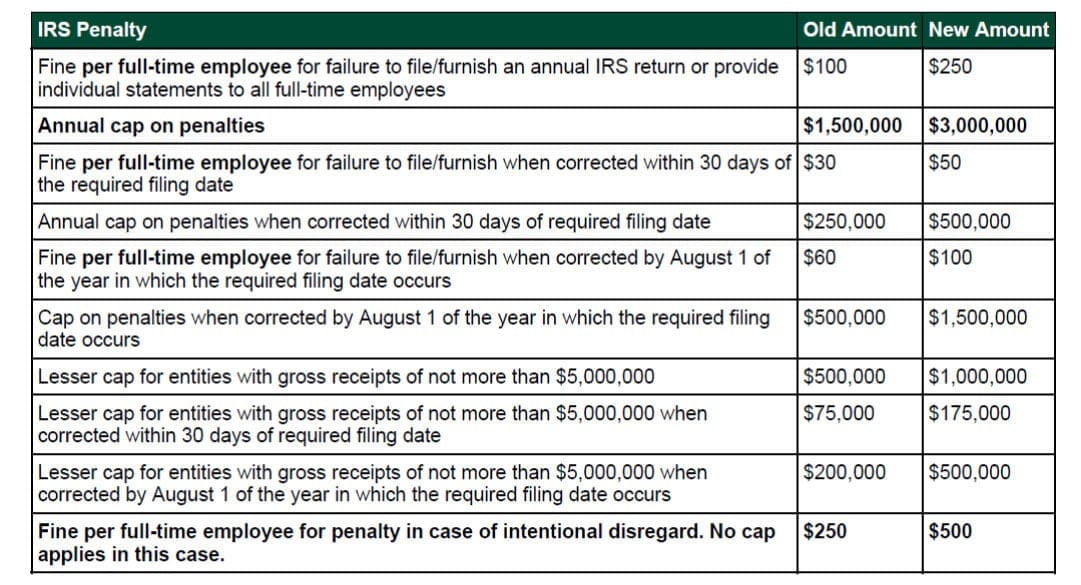

There are also penalties for incorrectly filing the required forms with the IRS, or failing to give employees their forms. Except where a cap is shown, these penalties are per incident (e.g. per employee or per incorrectly filed form), so the costs really can rack up quickly:

SOURCE

Another tricky part about the ACA -- and why it is critical to manage records monthly -- is that many businesses don't realize they've had a period of non-compliance until they examine their records end of the year.

By then it's too late and they still have to pay a penalty.

Hope is not lost; appeals and waivers may be permitted if the employer can prove they did not willfully neglect their filing obligations or fail to meet the provisions required as an ALE.

ACA Forms

Every January, ALEs are required to give form 1095-C, which outlines the employee's health insurance enrollment and affordability information, to every enrolled employee. That form must also be filed with the IRS before the applicable deadline which varies every year. Transmittal form 1094-C must accompany each 1095-C form when it is sent to the IRS.

Employers of any size who self-insure their health plans must give form 1095-B to each enrolled employee and file it with the IRS before the applicable deadline.

That form also shows the employee's health plan enrollment and affordability for the previous year. ALEs who self-insure may opt to use form 1095-C instead of 1095-B. Transmittal form 1094-B must accompany each 1095-B form when it is sent to the IRS.

If all this seems very onerous, it doesn't have to mean the end of your sanity. You're not alone. Many employers have felt the stress of trying to be compliant with ACA regulations.

Thankfully, there are many different tools available to help businesses with the process.

Tools That Help with Compliance

More and more businesses are looking for solutions to help them navigate the complexities of ACA regulations.

There are varying ACA compliance software programs out there geared to helping employers collect data and administer all or certain aspects of their ACA compliance.

No matter what program a company chooses, the end result should mean reduced operational costs, improved data and filing accuracy, year-over-year data repetition, and increased peace of mind.

Good ACA compliance software is designed to:

stay current with ACA reporting regulations and deadlines

calculate each employee's hours worked to determine if they qualify as FTEs and alert the employer of benefit entitlements

securely store employee's private information under HIPAA requirements

compare salary to existing health insurance coverage and payments to ensure employees are not paying more than the current maximum

permit online open enrollment for employees to change and obtain coverage as necessary

produce all required forms to be filed with the government

notify employers of any deadlines and changes that could result in non-compliance penalties.

GoCo now makes it super easy to track ACA Compliance for your entire company!

Read more in our blog post →

Recommended Posts

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories