New Hire Paperwork and Compliance for California

A complete guide for California employers around federal and state requirements for onboarding, including paperwork and new hire reporting.

by Anna Coucke - September 13th, 2024

Hiring a new employee in California involves more than just welcoming a fresh face to the team — it also requires employers to navigate a list of state and federal paperwork. For employers, ensuring every document is completed correctly is crucial for compliance and avoiding penalties. The requirements in California can be more extensive than in many other states, with additional regulations and forms to manage.

From federal employment verification to state-specific tax forms and notices, this guide will walk you through all the essential paperwork you need to complete before your new hire can officially begin. Plus, we'll cover the key reporting requirements and tips for streamlining the process, so your onboarding is both efficient and compliant.

For additional resources, check out our complete onboarding guide!

Download The Ultimate Onboarding Checklist

What New Hire Paperwork Is Required in California?

Paperwork is one of the most important (and most dreaded) parts of hiring a new employee. Collecting all the right documents is nerve-wracking because you know how important it is to get it right.

And in California, the stack of new hire paperwork is a little thicker compared to other states.

IMPORTANT: Before collecting any personal information, employers must provide applicants and employees with a copy of the California Consumer Privacy Act.

Required Federal Onboarding Paperwork

I-9 Employment Verification Form

Form I-9 is mandatory for all new hires in the United States in order to verify their identity and authorization to work in the US. You, the employer, have three business days to complete Section 1 (employee information) after your new hire starts working. They then have three business days to complete Section 2 (providing documents proving work authorization). The U.S. Citizenship and Immigration Services (USCIS) offers a helpful I-9 Employment Eligibility Verification guide with a list of acceptable documents.

Important Note: Always retain copies of completed I-9 forms for at least three years (or one year after employment ends, whichever is later). Failure to properly complete and maintain I-9 forms can result in significant fines for employers.

W-4 Federal Tax Withholding Form

The W-4, which is also federally required for all U.S. workers, determines how much federal income tax is withheld from your employee's paychecks. The information the employee provides dictates the number of allowances they claim, impacting their take-home pay. The Internal Revenue Service (IRS) offers a W-4 instructions and publications page for further details.

Required State Onboarding Paperwork

Required onboarding forms and pamphlets that are specific to California include:

California Employee’s Withholding Allowance Certificate (Form DE-4)

This form is used by employees to specify how much state income tax should be withheld from their paychecks. It works similarly to the federal W-4 form but is specific to California’s state tax regulations. Employers are required to retain this form but do not need to submit it to the state unless requested. However, they must ensure the correct amount of state tax is withheld based on the information provided.

Additional CA New Hire Forms and Pamphlets:

Rights of Victims of Domestic Violence, Sexual Assault and Stalking handout

Health Insurance Marketplace Coverage Options Form OMB No. 1210-0149

Wage and Employment Notice to Employees Form DLSE-NTE (for non-exempt employees only)

Work Permit for Minors (if applicable) (CDE Form B1-4)

You should consider having the employee verify they received and reviewed any handouts and papers that don’t require a signature. This could be one extra signed form that lists all the documentation you gave them so they can check off each one, sign the form, then store it in their employee file.

California New Hire Reporting Requirements

State and federal law requires all employers (public and private) to report newly hired, rehired, or returning employees within 20 days of their start date. This form can be completed electronically through the California Employee Development Department website, faxed, or mailed to the address listed.

Top Priorities on Day 1

When your new hire shows up for their first day, there’s usually a mix of legal formalities and getting to know people and places. But before they can officially start work, HR needs to make sure they fill out all the necessary paperwork.

Paperwork and Policies

Most of the required new hire paperwork in California can be filled out on the employee’s first day. The exception is the Disability Insurance Provisions (Form DE 2515), which must be provided to the employee within five days of hiring.

New hire orientation is also a good time to provide any company-specific documents before your employee begins work. Additional policies may include:

Non-Disclosure Agreement (NDA): If your company deals with confidential information, an NDA might be required.

Benefits Enrollment Forms: If you offer health insurance, retirement plans, or other benefits, new hires will need to choose their coverage options.

Direct Deposit Authorization: This form allows for electronic payroll deposits into the employee's bank account.

State and Local Requirements: Depending on your industry or location within California, there may be additional state or local requirements for new hires. Research any specific regulations that might apply to your business.

Employee Handbook: Provide your new hire with a copy of your employee handbook, which outlines company policies, procedures, and benefits. This serves as a valuable resource for them throughout their employment.

Background Checks: While not mandatory in California, some employers choose to conduct background checks on new hires. If this aligns with your company's policy, ensure you comply with all federal and state laws regarding background checks.

Take an Office Tour

Help your new hires start feeling at home. An office or facilities tour gives them a big picture feel of the company, plus it allows them to meet with various employees.

Treat Your New Hires to Lunch

Hosting a luncheon with your new hires gives them a chance to network with other new and current employees in the company. This is a good time to check in to see how their experience is going so far, answer any questions, and show your excitement to have them on the team.

How to Comply with CA State Employment Standards

California employers need to set the stage for a compliant workplace by ensuring all required posters and notices are available in prominent places. Each poster covers an important employment-related topic, such as labor laws, wages, workplace accidents, and more.

You should regularly check to make sure the following posters are displayed and available to your employees at all times:

Workplace Discrimination and Harassment Poster

Notice to Employees — Injuries Caused by Work

Whistleblower Notice

Unemployment Insurance Benefits Notice

Paid Sick Leave Poster

Payday Notice

Emergency Phone Numbers

Minimum Wage Poster

Safety and Health Protection on the Job Poster

There are a number of other posters that are required by California state law, depending on the industry or type of employer.

In addition, California workplaces will need to display all federally required posters and notices. These include:

Your Rights Under USERRA

Families First Coronavirus Response Act Paid Leave Notice

Family Medical Leave Act of 1993 (FMLA)

Employee Polygraph Protection Act

FLSA Federal Minimum Wage Poster

OSHA Job Safety & Health Protection Poster

Equal Employment Opportunity Poster

Additional posters may be federally recommended or required depending on industry. See a complete list of required federal and California employment posters here.

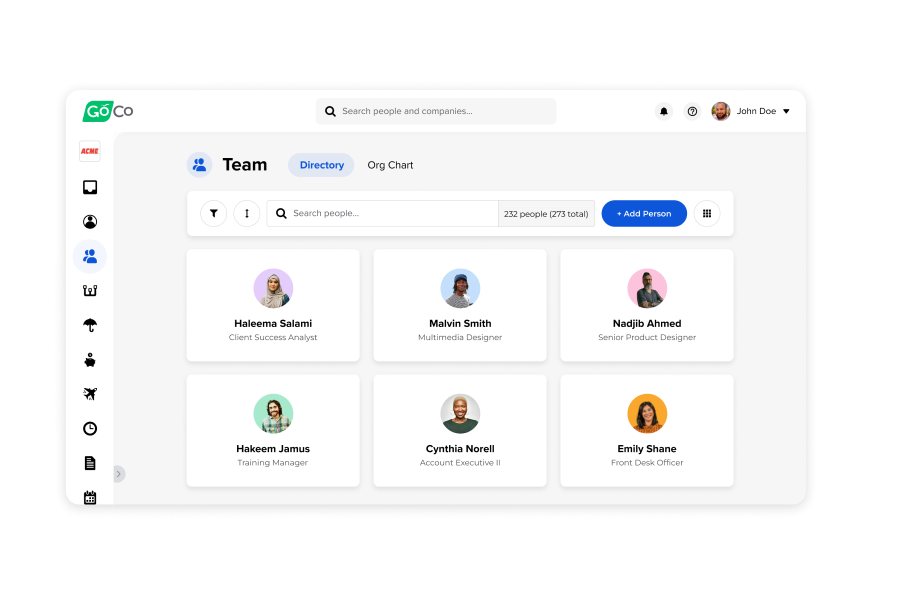

How GoCo Supports Hiring and Onboarding in California

For businesses looking to streamline their onboarding process, a modern, all-in-one HR software solution empowers employers to be confident in their hiring and onboarding compliance by keeping everything organized and automating mundane tasks.

GoCo simplifies HR for companies in California with updates to reflect current and evolving regulations for paperwork, reporting, and other legal requirements. Plus, our intuitive onboarding software simplifies the entire experience for employers and new hires.

Want to see it for yourself? Take a free tour of GoCo today and see how we can transform your onboarding and other HR processes — including performance management, time tracking, and much more!

Recommended Posts

New Hire Paperwork & Onboarding Forms 2025

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories