New Hire Paperwork and Compliance for Texas

A guide to federal and state requirements for onboarding new hires in Texas, including required paperwork and new hire reporting.

by Anna Coucke - September 20th, 2024

Hiring new employees in Texas is a fairly straightforward process when you’re the employee. New hires are used to being confronted with a stack of first-day paperwork to read and sign. But what they don’t see is the multiple layers of Texas hiring compliance, data input, reporting, and double-checking that HR departments do to make the hire official.

It takes a lot of precious time and effort to ensure you have all the right forms ready for your new employee and are prepared for their first day of work. To help you get clear and organized with onboarding your new Texas employee, we’ve combined essential hiring and onboarding resources in this guide and made them specific to the Lone Star State.

Get ready to hire with confidence with these Texas onboarding tips, forms, and compliance requirements. To learn more about onboarding, check out our Complete Onboarding Guide.

Download The Ultimate New Hire Paperwork Checklist

What New Hire Paperwork Is Required in Texas?

Texas new hire paperwork is similar to that of other states. Here’s a list of forms you will need to share with your new employee, starting with the federal forms required of all U.S. new hires.

Required Federal Onboarding Paperwork

I-9 Employment Verification Form

Form I-9 is mandatory for all new hires in the United States in order to verify their identity and authorization to work in the US. You, the employer, have three business days to complete Section 1 (employee information) after your new hire starts working. They then have three business days to complete Section 2 (providing documents proving work authorization). The U.S. Citizenship and Immigration Services (USCIS) offers a helpful I-9 Employment Eligibility Verification guide with a list of acceptable documents.

Important Note: Always retain copies of completed I-9 forms for at least three years (or one year after employment ends, whichever is later). Failure to properly complete and maintain I-9 forms can result in significant fines for employers.

W-4 Federal Tax Withholding Form

The W-4, which is also federally required for all U.S. workers, determines how much federal income tax is withheld from your employee's paychecks. The information the employee provides dictates the number of allowances they claim, impacting their take-home pay. The Internal Revenue Service (IRS) offers a W-4 instructions and publications page for further details.

As Texas doesn't have a state income tax, there is no additional state tax withholding form to complete.

Texas Onboarding Requirements

In addition to the above federal forms, employers in Texas have a few other requirements when onboarding new employees.

Texas Notice of Paydays

Under the Texas Payday Law, employers must provide a written notice of the scheduled paydays to employees. Typically, paydays must be at least twice a month for non-exempt employees. This should be disclosed to the employee in writing during the onboarding process or in their offer letter.

Worker's Compensation Coverage Notification

Texas is unique in that it doesn't require employers to have workers' compensation insurance. However, employers must notify employees in writing whether or not they offer this coverage. This notice should be included in the new hire packet and acknowledged by the employee upon hire.

Texas New Hire Reporting

To maintain hiring compliance, HR must report all news within 20 days of their start day. Texas uses an online reporting portal, which you can access here. Alternatively, you can mail your new hire report submission to:

Central File Maintenance

P.O. Box 12048

Austin, TX 78711-2048

The new hire report must include the employee’s legal first and last name, employee home address, employee date of birth, social security number, salary frequency, and the official start date. You can use this form to complete the process.

Optional or Additional Onboarding Paperwork

Depending on your company, industry, and locality, there may be additional paperwork and policies that you will want to include in your onboarding process. These may include:

Non-Disclosure Agreement (NDA): If your company deals with confidential information, an NDA might be required.

Benefits Enrollment Forms: If you offer health insurance, retirement plans, or other benefits, new hires will need to choose their coverage options.

Direct Deposit Authorization: This form allows for electronic payroll deposits into the employee's bank account.

State and Local Requirements: Depending on your industry or location within California, there may be additional state or local requirements for new hires. Research any specific regulations that might apply to your business.

Employee Handbook: Provide your new hire with a copy of your employee handbook, which outlines company policies, procedures, and benefits. This serves as a valuable resource for them throughout their employment.

Background Checks: While not mandatory in California, some employers choose to conduct background checks on new hires. If this aligns with your company's policy, ensure you comply with all federal and state laws regarding background checks.

Voluntary Self-Identification of Disability Form CC-305 (if your company does business with the government)

Wage Deduction Agreement Form: Used to outline permissible deductions from an employee's paycheck beyond standard taxes and benefits

Pay Agreement Form: Used to clearly outline the terms and conditions regarding how and when employees will be compensated.

Each of these forms should be completed by the employee’s start date.

Complying with Texas State Employment Standards

The state of Texas requires employees to post several labor-related posters and notices within their facilities (in addition to federal labor posters). These should be placed in areas where they can be easily viewed by employees, such as break rooms or common areas. Required posters in Texas include:

Texas Payday Law Poster (Spanish optional)

Unemployment & Payday Law Poster (Spanish optional)

Worker’s Comp posters

Employer’s Notice of Ombudsman Program

Earned Income Tax Credit materials

Public employers (such as Workforce Solutions Offices) may be required to post additional posters, including:

You Have the Right to Not Remain Silent

Worker Right to Know Notice

Job Service Complaint System

In addition, employers may choose to post the following optional posters:

The Law in Texas (information on Equal Employment Opportunity law)

Child Labor Law in Texas Poster

Are You Owed Wages? Poster (information on filing a wage claim)

You can find a complete list of posters here.

Beyond the Paperwork: Additional Onboarding Tips

A first day of work filled with nothing but paperwork and procedures doesn’t do much to build excitement for the employee. In between legalities and compliance, take the opportunity to give your new hires a great experience and get them excited for what’s to come.

Create a First-Day Onboarding Kit

You can help your employees get engaged when you have less “grunt work” and details to worry about. Make things easier for everyone (including yourself) by creating a first-day onboarding kit. This should be a collection of all the required paperwork and policies, company tools and equipment, a letter from the CEO, a first-day gift, and anything else you might otherwise spend time trying to chase down once your employee arrives.

Then, try to systematize your first-day preparations to streamline this process even more. Make checklists of all the things you need to do to get ready to welcome new employees. Using automation tools like HR software can help by saving reusable templates and storing important documents in a single place.

Assign a Mentor

Mentors are an integral part of every professional’s success. Pick someone in your company who can be a resource to your new hire. This should be a person who is well informed of the company’s culture and policies, excels at their job, and can offer guidance and insight to make your new hire feel at home and confident.

Take an Office Tour

Office tours aren’t just formalities. They let new hires see departments and people they might not otherwise see and help them get a feel for the company culture by getting the full picture.

Treat Your New Hire to a First-Day Lunch

Hosting a lunch for your new employees on Day 1 is a great way to pause the paperwork and gauge how they’re feeling about their experience so far. You can also invite managers, leaders, and their team members to help your new hires network and start feeling like part of the team.

How GoCo Supports Texas Employee Onboarding

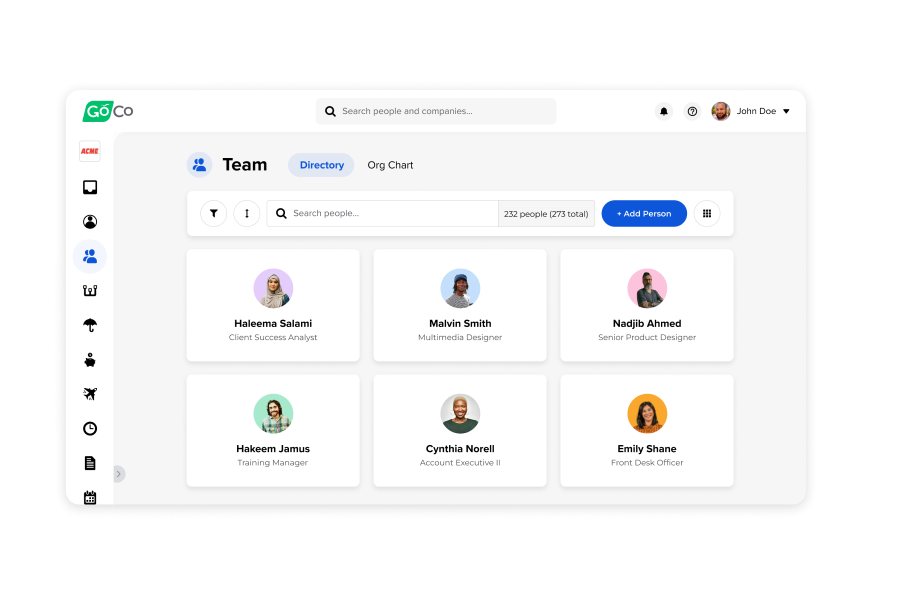

For businesses looking to streamline their onboarding process, a modern, all-in-one HR software solution empowers employers to be confident in their hiring and onboarding compliance by keeping everything organized and automating mundane tasks.

At GoCo, we developed our all-in-one HR software to streamline the complexities of hiring compliance, payroll and reporting, and paperwork. We’ve infused state-specific resources into the process to remove the guesswork when it comes to employment forms, payroll taxes, benefits, and eligibility.

GoCo simplifies HR for companies in Texas with updates to reflect current and evolving regulations for paperwork, reporting, and other legal requirements. Plus, our intuitive onboarding software simplifies the entire experience for employers and new hires.

Want to see it for yourself? Take a free tour of GoCo today and see how we can transform your onboarding and other HR processes — including performance management, time tracking, and much more!

Recommended Posts

New Hire Paperwork & Onboarding Forms 2025

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories