HR's Guide to the Federal Unemployment Tax Act (FUTA)

In this guide, we cover the Federal Unemployment Tax Act (FUTA) and discuss its potential effects on your company's unemployment insurance program.

July 22nd, 2022

Did you know the average unemployment tax paid by employers is $359.64 per employee? Many businesses think unemployment taxes are complicated and much higher than they are. But it doesn't have to be difficult!

In this guide, we cover the Federal Unemployment Tax Act and discuss its potential effects on your company's unemployment insurance program.

Keep reading to learn the answer to "what does FUTA mean?" We all discuss how to calculate and file unemployment taxes, and read HR's Guide to Compliance to learn about more compliance issues.

What Does FUTA Mean?

FUTA stands for Federal Unemployment Tax Act. This is a federal law that provides for the payment of unemployment compensation to workers who have lost their jobs.

This act was passed in 1939 and it is to provide a system of unemployment insurance and to help people who lose their jobs find other work. Unemployment taxes are a type of tax collected by the government and then redistributed to the unemployed.

Who Pays Unemployment Tax?

Many companies, including sole proprietors and corporations, must pay FUTA taxes. Generally, any company with $1,500 or more in wages during the year must pay FUTA taxes. FUTA taxes are for the first $7,000 in wages per employee each year.

This means if you have an employer that earned $30,000 in wages, you would calculate FUTA for $7,000 of those earnings.

Employers who had workers for some part of each day over a 20-week period are also subject to these taxes.

How Often Do Companies Pay FUTA tax?

Most companies pay FUTA taxes each quarter. The amount does depend on how many employees a company has. Companies that don't have more than $500 in total FUTA taxes can pay with their annual tax return.

Companies over $500 in total FUTA taxes must make at least one quarterly payment. If you have less than $500 for one quarter, carry it to the next quarter until it is $500 or more.

Who Is Exempt From FUTA Tax?

Any company paying less than $1,500 to employees per quarter is exempt from FUTA taxes. All 501(c)(3) organizations are also exempt from FUTA taxes. The following are examples of those exempt from FUTA taxes:

Agricultural labor

Domestic service

Apprenticeship programs

Schools, colleges, and universities

State and local governments

What Is the Unemployment Tax Rate?

Employers pay state FUTA taxes, which the states then transfer to the federal government. The FUTA tax rate is 6% of taxable wages up to $7,000 per employee per year.

How to Calculate Unemployment Taxes

So, how does that tax rate translate into numbers? We'll outline an example below.

Let's say your company paid employee number 1 $20,000 in wages. Employee number 2 earned $5,000 in wages. Employee number 3 earned $6,500 in wages.

Based on the tax rate, this is what you would pay in unemployment taxes for each employee:

Employee number 1 = 7,000 x .06 = $420 in taxes

Employee number 2 = 5,000 x .06 = $300 in taxes

Employee number 3 = 6,500 x .06 = $390 in taxes

How to Report FUTA Taxes

Companies can file unemployment taxes in two ways. A company can either file quarterly or annually. Quarterly filings are more common for small businesses and companies with seasonal work, while annual filings are more common for larger businesses and those with year-round work.

Companies report unemployment taxes by filing an IRS form 940. Companies must file this form quarterly. It reports all the wages paid to employees during that quarter.

Companies with under $500 in FUTA taxes file with their annual tax return. The company also needs to submit state unemployment tax reports, which are usually filed monthly or quarterly.

What Is a State Unemployment Tax Report?

A state unemployment tax report is a document that employers must submit to the state unemployment agency. This report provides information about the company's payroll. It should include the following information:

The company's name

Address

Employer identification number

Wage information for each employee

This report determines the company's contribution rate. The state unemployment agency uses this information to calculate how much money employers owe based on the number of employees it has. It also considers how much was paid in wages.

The guidelines for state filing vary based on where you live. You will need to visit your state's unemployment website and find the instructions for filing a report.

Most states have a webpage explicitly dedicated to unemployment tax reports, with instructions on how to file one. If your state doesn't have this page, it is likely that you will be able to find the information needed on their main website.

What Is Form 940 E-File?

Form 940 e-file is the electronic version of Form 940. It is the form used to report an employer's annual federal unemployment tax return.

It is a form that employers use to report federal unemployment taxes. The IRS e-file service offers an online filing option for Form 940 and all employers are able to file FUTA tax returns using the e-file option.

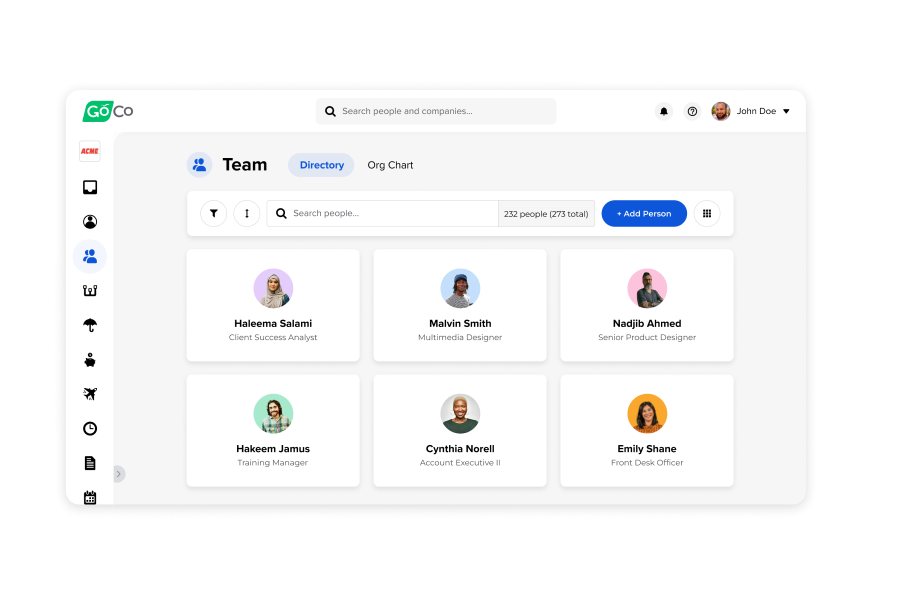

Streamline Your HR and Tax Processes

Now that you understand unemployment taxes, you can partner with an HR software provider to streamline the process. At GoCo, we offer an integrated HR platform that manages all aspects of employee management. Our compliance software makes it easier than ever to comply with state and federal taxes.

HR professionals benefit from our platform in many ways. This includes streamlined processes, a better onboarding experience, and improved compliance. Our platform simplifies many aspects of HR management, saving your team time and money.

If you are interested in learning more, contact us today to see how our platform can help with your compliance needs.

Recommended Posts

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories