HR’s Guide to Employee Benefits Administration

Everything HR needs to know about employee benefits administration.

June 5th, 2024

Table of Contents

- The Importance and Complexities of Benefits Administration

- What is Employee Benefits Administration?

- What Are Employee Benefits, and Why Offer Them?

- What Are Common Types of Employee Benefits?

- What Additional Benefits or Perks Can Businesses Offer?

- What Are the Emerging Types of Employee Benefits?

- Which Benefits are Right for Your Business?

- Automating Employee Benefits Administration

The Importance and Complexities of Benefits Administration

Salary alone isn’t enough. Offering a total compensation package that includes benefits is the standard for attracting and retaining candidates – and most of the large, public, and government companies do so. And while their benefits packages might not be as robust, smaller businesses are often offering benefits, too, which means any business that isn’t is at a disadvantage in today’s market.

With 51% of employers stating that benefits will be crucial to retaining employees in the next three to five years, having a good benefits package is no longer an option, but a necessity. But if you have a limited budget or you’re a newly established business, you might be wondering where to start. This will be a complete guide to everything HR needs to know about benefits, including common types of benefits and new benefits to consider in order to attract and retain top talent at your organization.

What is Employee Benefits Administration?

Benefits administration is the process of designing, managing, and delivering employee benefits programs. It's essentially how a company handles the perks and programs offered to its employees besides their base salary. These typically include things like health insurance, retirement savings plans, paid time off, stock options, and even wellness programs.

Benefits administration is usually the responsibility of the Human Resources (HR) department. Depending on the size of the organization, it might have a dedicated team of HR professionals who are also responsible for benefits administration, or it might outsource it to a third-party administrator.

What Are Employee Benefits, and Why Offer Them?

Employee benefits are any form of compensation outside of the standard salary or hourly wage – and they are critical for both recruitment and retention. In fact, research has suggested that satisfaction with benefits can be linked to employee commitment and job satisfaction.

However, what can be challenging for HR is the way that benefits – and expectations around them – continue to expand. Perhaps ten years ago, medical, dental, vision, and a 401(k) might have been enough to woo any candidate – but as the nature of work has changed, so have benefits. They’ve expanded into areas impacting health and wellness, such as telemedicine or EAPs addressing mental health, and they’ve also expanded into home and family life, such as childcare benefits. An ideal or competitive benefits package might look completely different across industries, making it challenging for HR at small or newly established businesses to figure out where to start. Below, we’ll review some of the key “anchor” benefits as well as emerging benefits.

What Are Common Types of Employee Benefits?

Paid Time Off

This is an essential part of any benefits package, and it can come in many forms. While some employers opt for a set amount of paid time off to be applied for any reason, others break it down into sections such as:

Paid holidays: These are holidays recognized by the company and are often in sync with federal holidays (e.g., Christmas Day).

Paid vacation days: These are typically up to the employee to use at a time that is convenient for them. Some employers allow these to roll over year-to-year while others do not, as a way to encourage regular vacations.

Paid sick days: These are allotted for employee illness and health-related concerns or appointments.

Bereavement: These are allotted for time off related to grief, arrangements, and other circumstances in the event of the death of a person close to the employee.

Maternity and Paternity Leave: This leave is provided for new parents, and many companies have included people of all genders and all forms of family expansion, including adoption.

Retirement Planning

This has long been a cornerstone of employee benefits, and it can take several forms, ranging from heavily employer-funded to not-at-all.

401(k): One of the most popular vehicles used by for-profit businesses, this allows employees to contribute pre-tax dollars and employers to match their financial contributions. There are similar 403(b) and 457(b) plans for nonprofit and government institutions.

Simplified Employee Pension (SEP): This allows businesses of any size to contribute to a SEP IRA account on behalf of the employees, but employees are not able to contribute.

Simple IRA: This option is designed for small businesses with lower headcounts, offers lower fees, and allows both employer and employee contributions.

Employee Stock Ownership Plan: For companies with stock options, this plan provides a way of making retirement contributions in the form of stock.

Profit sharing plan: This option is for employers that want to reallocate profits to employee retirement accounts.

Insurance

Health insurance is one of the foundations of a benefits package. This often includes:

Medical insurance: This is often referring to baseline medical care (e.g. physicians, specialists) including preventative care and emergency treatment.

Dental insurance: A separate benefit from standard medical insurance specific to teeth and oral hygiene and care, both preventative and emergency.

Vision insurance: Distinct from medical and dental, this form of care is specific to eye health including glasses, contacts, and exams.

Legal insurance: This is becoming more standard and often includes third-party consultation and assistance with a variety of matters that may occur in an employee’s life.

Life insurance: This includes coverage on the life of an employee for their designated beneficiaries.

Short-term and long-term disability insurance: This protects employees by ensuring they maintain income in the event that they’re unable to work due to illness, injury, or accident for a long or short period of time.

What Additional Benefits or Perks Can Businesses Offer?

The types of fringe benefits your company can offer are seemingly endless and can greatly depend on your industry and workforce. Here are just a few that you may consider:

Employee discounts

Childcare benefits

Pet insurance

Pet-friendly offices

Remote work or hours flexibility

In-office perks such as gaming rooms or on-site facilities

Free meals

Transportation reimbursement, including gas, tools, and public transit

Volunteer time off

Learning time off

Free parking

Cell phones and paid internet

Company technology

Housing and relocation benefits

Travel allowance

Investment opportunities

Company transportation

Animal or creative therapy session

Home office budgets

Sabbatical leave

Identity theft protection

Financial planning and wellness resources

What Are the Emerging Types of Employee Benefits?

Bonuses: This includes any financial compensation outside of the set salary. It can include a quarterly, annual, or reward-based cash bonus that employees receive at set milestones or particular times of the year. Holiday or end-of-year bonuses, as well as anniversary bonuses, are quite common across many industries.

Mental Health: These are an increasingly popular form of benefits and can include, but are not limited to EAPs that cover counseling or therapy across a number of life domains, reimbursement or coverage of virtual therapy or similar forms of treatment, an increase in PTO to accommodate mental health days that promote general wellness, the offering of resources or tools to promote or support mental health, as well as workshops and trainings that can cover topics like stress management. Ultimately, there is a lot of flexibility in this space for employers to determine the best method for prioritizing mental health for employees in a way that resonates with them.

Fertility: These benefits can be expansive enough to include any medical treatments related to the fertility process, including but not limited to costs pertaining to IVF, surrogacy, egg harvesting and freezing, infertility consultations, treatment, specialists, adoption, and beyond. As employers start to recognize the many different forms that family can come in, these benefits will continue to expand in access in terms of eligibility.

Education: Benefits related to education can include tuition reimbursement, loan repayment, paid certification, training, tuition, continuing education, professional development, conferences, workshops, reskilling, and beyond. It can range from one-off classes and opportunities to entire degree programs.

Wellness: Perhaps one of the broadest categories, employee wellness benefits can include anything from nutrition, fitness, smoking cessation, maternity, and beyond. It can come in the form of tangible rewards for health behaviors, subsidized or reimbursed costs for wellness regimes, employer-sponsored meals or snacks, on-site gyms, and more.

Which Benefits are Right for Your Business?

Benefits can be costly. While some types (such as pet insurance) may be extremely cost-effective, others are significantly more expensive. Before investing in perks that may not be relevant or valued, tune into your employees and find out what resonates with them. Here are some questions to help you explore what’s best for your business:

What benefits are your industry or local market competitors offering? Staying in tune with the market will help you remain competitive and give you insight into which benefits are most relevant to your niche.

What benefits would increase employee satisfaction? If you ask your employees through a survey or pulse check, their answers might surprise you!

What benefits are most relevant to your employee demographics? After all, the needs of employees that in their mid-20s and employees that are in their mid-60s can be vastly different.

Automating Employee Benefits Administration

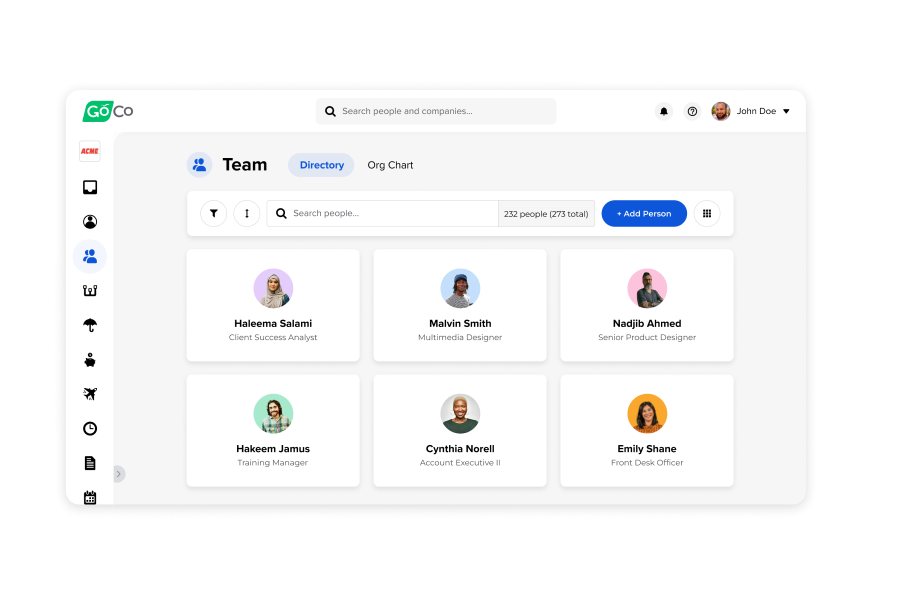

With an HRIS like GoCo, employers can easily manage benefits administration and all of your benefits in one place, including health, dental, vision, life, accident and disability, HSA, FSA, HRA, commuter benefits, and more.

With Goco, employees have self-service enrollment, which allows them to view plans at a glance, easily understand coverage, and enroll in minutes. Benefits are also kept in sync with your payroll and insurance carriers within GoCo, which makes the management process easier. Peace of mind comes as a standard as well with ACA compliance and hassle-free solutions. Want to see for yourself how simple benefit administration (and much more) can be with GoCo? Learn more about our automated benefits administration software and take a free tour of our platform today!

Recommended Posts

Why Leaders Must Prioritize Workplace Wellbeing in 2025

Blog Articles

Think Like a Marketer Series: Retention

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories