New Hire Paperwork and Compliance for Montana

A complete guide to essential onboarding paperwork in Montana, along with new hire reporting requirements and best practices.

by Anna Coucke - May 10th, 2024

Table of Contents

Now that you've found the perfect candidate to join your Montana-based business, next comes the crucial step of onboarding your new hire with the necessary paperwork. While it might seem complex, understanding the requirements and following best practices will ensure a smooth transition for both you and your new employee.

This guide dives into the essential new hire paperwork specific to Montana, focusing on federal and state-specific forms. We'll explore the I-9, W-4, state tax withholding, and New Hire Reporting process, along with valuable tips for streamlining the onboarding experience.

Download The Ultimate Onboarding Checklist

Employment Eligibility Verification (Form I-9)

The I-9 form is a mandatory document for all employers in the United States, including Montana. It verifies your new hire's eligibility to work legally within the country. The form has two sections:

Section 1: Your new employee completes this section, providing document choices (like a driver's license and Social Security card) to prove their identity and employment authorization.

Section 2: Within three business days of your new hire's first day of work, you, the employer, must verify the documents presented in Section 1. Ensure the documents are genuine and from the list of acceptable options listed on the I-9 form itself.

Here are some key points to remember about the I-9:

You cannot require your employee to complete the I-9 before their first day of work.

You must retain the completed I-9 form for three years after the hire date or one year after employment ends, whichever is later. You may be required to present the form in the case of an inspection by U.S. Citizenship and Immigration Services (USCIS).

The U.S. Citizenship and Immigration Services website offers a wealth of information on the I-9 form, including a downloadable version and a helpful online assistant tool: https://www.uscis.gov/i-9

Federal Withholding Allowance Certificate (Form W-4)

The W-4 form helps determine the amount of federal income tax withheld from your employee's paycheck. The information provided by your new hire on the W-4 dictates the number of withholding allowances they claim, ultimately affecting the amount of federal tax withheld.

The W-4 form is a federal requirement and should be completed by all new hires. The IRS website provides the most recent version of the W-4 form: https://www.irs.gov/forms-pubs/about-form-w-4 While you cannot advise your employee on how to complete the W-4, you can provide them with resources from the IRS for guidance.

State of Montana Withholding Tax Form (MW-4)

In addition to federal income tax withholding, Montana also has its own state income tax that needs to be withheld from employee paychecks. Montana uses a separate form for state withholding: the Montana Employee's Withholding Exemption Certificate (Form MW-4). This form allows your new hire to claim withholding allowances for Montana state income tax.

Obtaining the Montana Withholding Tax Form (MW-4):

The Montana Department of Revenue (MTDOR) provides the MW-4 form on its website. You can download the form electronically and have it readily available for your new hires.

Processing the Montana Withholding Tax (MW-4):

Similar to the federal W-4, your new hire will complete the MW-4, indicating their filing status and the number of withholding allowances they wish to claim for Montana state income tax. It's important to retain the completed MW-4 form along with the federal W-4 for your records.

New Hire Reporting in Montana

Montana law mandates that employers report all new hires and rehires within 20 days of their start date. This reporting helps the state enforce child support obligations. There are three ways to submit the New Hire Report:

Online: This is the most convenient method. Visit the Montana Department of Public Health and Human Services (DPHHS) website to access the online reporting system.

Mail: Download the Montana New Hire Reporting Form from the DPHHS website and mail it to the designated address.

Fax: You can also fax a copy of the completed form or your employee's W-4 to the DPHHS.

How to Complete the Montana New Hire Reporting Form

The form has three sections:

Employer Information: Fill in your business details, including your Federal Employer Identification Number (FEIN).

Employee Information: Collect your new hire's Social Security number, date of hire, name, and address.

Optional Employee Information: This section includes details like your employee's date of birth and phone numbers. However, completing this section is not mandatory.

Best Practices for Montana New Hire Paperwork

While navigating new hire paperwork can feel like a hurdle, following these best practices will ensure a smooth and efficient onboarding process:

Preparation is Key: Gather all the necessary forms beforehand, including the federal I-9, W-4, Montana MW-4, and the Montana New Hire Reporting form. Having them readily available on your new hire's first day reduces stress and streamlines the process.

Clear Communication: Briefly explain the purpose of each form and answer any questions your new hire may have regarding the paperwork.

Organized Filing System: Establish a clear and secure filing system for completed new hire paperwork. This ensures easy access for future reference and simplifies recordkeeping.

Confidentiality Matters: Employee information is confidential. Implement procedures to safeguard all employee data collected during the onboarding process.

Stay Updated: Federal and state regulations can change. Regularly check for updates on the I-9, W-4, MW-4, and New Hire Reporting requirements to ensure compliance.

Additional New Hire Paperwork

Beyond the core federal and state requirements, some employers in Montana may need to provide additional new hire paperwork specific to their industry or company policies. These could include:

Benefit Enrollment Forms: If your company offers health insurance, retirement plans, or other benefits, your new hire may need to complete enrollment forms to participate.

Direct Deposit Authorization Forms: Many businesses offer direct deposit for employee paychecks. If your new hire chooses direct deposit, they will need to complete an authorization form with their bank account information.

Company Handbook Acknowledgements: Some companies have employee handbooks outlining policies, procedures, and expectations. A signed acknowledgment form from your new hire confirms they have received and reviewed the handbook.

By understanding the essential new hire paperwork requirements and following best practices, Montana businesses can ensure a smooth and compliant onboarding process for their new employees. This not only saves time and reduces administrative headaches but also fosters a positive experience for your new hires as they begin their journey with your company.

How GoCo Supports Montana Employee Onboarding

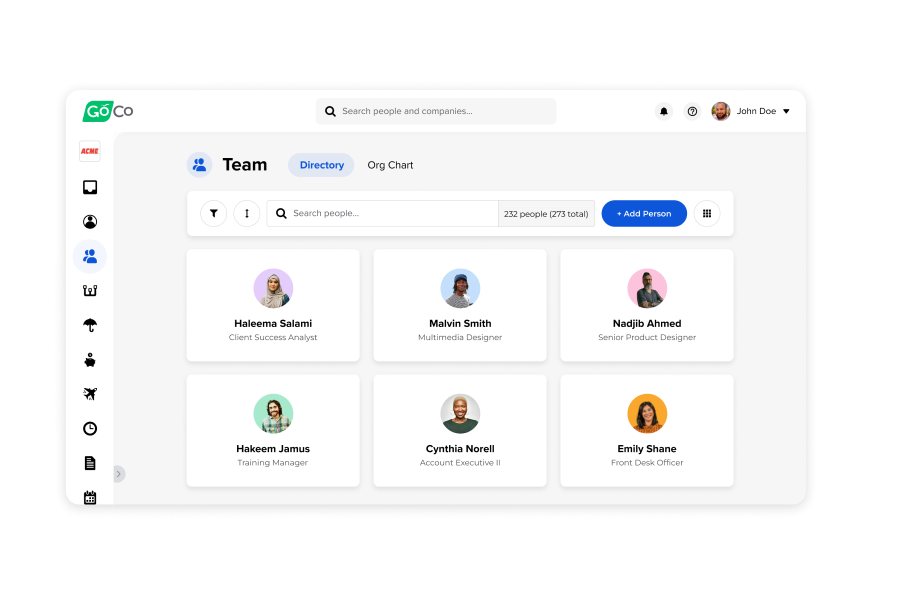

For businesses looking to streamline their onboarding process, a modern, all-in-one HR software solution empowers employers with increased confidence in their hiring and onboarding compliance by keeping everything organized and automating mundane tasks.

GoCo simplifies state-specific hiring in Montana by staying on top of current and evolving regulations for paperwork, reporting, and other legal requirements. Plus, our user-friendly onboarding software makes the entire experience simple for both employers and new hires.

Want to see it for yourself? Take a free tour of GoCo today and see how we can transform your onboarding and other HR processes — including performance management, time tracking, and much more!

Recommended Posts

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories