New Hire Paperwork and Compliance for Nevada

Discover the key elements of Nevada's employment compliance, including onboarding paperwork and new hire requirements, for a seamless onboarding process.

Nevada's vibrant job market offers endless opportunities, but it also demands rigorous adherence to required onboarding paperwork and compliance. Whether you're a seasoned HR professional, a small business owner, or a startup entrepreneur, this article will equip you with the knowledge and insights to ensure seamless transitions for your new team members.

Let's get started and ensure your new hire process is a guaranteed win.

New Hire Reporting Requirements

New hire reporting is a mandatory practice in most states, including Nevada. It is designed to keep state authorities informed about the hiring of new employees. It involves submitting specific information about newly hired workers to the appropriate government agencies.

In Nevada, this requirement applies to all employers, regardless of the size or industry. The goal of new hire reporting is to aid in the enforcement of child support orders by providing accurate and up-to-date information to the Nevada Child Support Enforcement Program (CSEP).

Nevada's new hire reporting requires employers to report essential information about newly hired employees within 20 days of their start date or the date they are rehired after a break in service.

The information to be reported includes the employee's full name, social security number, address, and other identifying details. Accurate and timely reporting is crucial to ensure compliance with the law.

Download The Ultimate Onboarding Checklist

Payroll Tax Obligations in Nevada

Payroll tax compliance is a critical component of doing business in Nevada. Understanding the state's specific payroll tax obligations is essential. Non-compliance can lead to legal and financial consequences.

Nevada levies payroll-related taxes, including state income tax, unemployment tax, and payroll-related fees. The state does not impose individual income tax, but it relies heavily on payroll taxes to fund various government programs.

Employers must navigate these obligations while keeping a watchful eye on new hire reporting.

Tax Obligations for New Hires

For new hires in Nevada, it's vital to grasp the tax implications, both for the employer and the employee.

Employers are responsible for withholding the correct amount of state and federal income taxes from employees' paychecks and ensuring timely remittance. Failing to do so can result in penalties and interest charges.

Reporting and remitting payroll taxes should be done in accordance with the state's prescribed schedule.

Employers must maintain precise records, accurately report payroll taxes, and remit them to the appropriate tax authorities on time. Failure to do so can lead to penalties and legal repercussions.

Form W-4

Form W-4 determines the amount of federal income tax to withhold from an employee's pay. This form must be completed by the employee and submitted to your HR or accounting department. Payroll will then use this to correctly withhold a portion of the new hire's taxes on each paycheck.

Ensuring Employee Eligibility and Verification

Nevada, like the rest of the United States, mandates that employers hire individuals who are legally eligible to work in the country. This includes U.S. citizens, lawful permanent residents, and those with valid work authorizations.

Employers must verify the eligibility of their workforce and maintain accurate records to meet legal requirements.

I-9 Verification Process

The I-9 form, issued by the U.S. Citizenship and Immigration Services (USCIS), is the main component of the employee verification process.

Employers in Nevada are required to complete this form for every new hire to confirm their identity and work eligibility. It is crucial to complete the I-9 accurately, retain the records, and re-verify employment authorization when necessary.

Avoiding Common Verification Pitfalls

While navigating the I-9 process, employers must be vigilant to avoid common pitfalls, such as incomplete or outdated forms, failure to re-verify, or discrimination in the hiring process based on immigration status.

Understanding these potential pitfalls and proactively addressing them is essential to maintain compliance and avoid legal complications.

Compliance with Nevada Worker Compensation Regulations

Nevada's worker compensation laws outline the rights and responsibilities of employers and employees in the event of a workplace injury or illness.

The laws specify that nearly all employers in the state must carry worker compensation insurance to cover medical costs, lost wages, and other benefits for injured workers. These laws are in place to ensure that employees receive the necessary support and care following workplace accidents.

Employers in Nevada are required to provide worker compensation insurance coverage for their employees. They must also promptly report workplace injuries or illnesses to their insurance carriers and facilitate the injured employee's access to necessary medical treatment.

Complying with these obligations is crucial for both legal compliance and employee well-being.

Handling Worker Compensation Claims

With work-related injuries, employees are entitled to file worker compensation claims to seek compensation for their medical expenses and lost wages.

Employers should be prepared to cooperate with the claims process, including addressing any disputes, and work with insurance carriers to ensure timely and fair resolution.

Labor Law Compliance for New Hires

Nevada's labor laws encompass a wide range of regulations governing the employer-employee relationship.

These laws ensure fair treatment, worker rights, and safe working conditions. Understanding the legal framework is vital for employers to build a strong foundation for their workforce.

Labor law compliance includes areas such as minimum wage and overtime requirements, workplace safety, anti-discrimination measures, and employee leave entitlements.

Employers must be well-versed in these compliance areas to avoid legal entanglements and to create a workplace that respects and upholds employees' rights.

Employee Rights

Employees in Nevada have specific rights protected by labor laws, such as the right to a safe workplace, fair compensation, and freedom from discrimination.

Employers, in turn, have obligations to uphold these rights, which may include providing appropriate training, maintaining safety standards, and adhering to fair employment practices.

Common New Hire Paperwork Challenges

Navigating the intricacies of new hire paperwork and compliance in Nevada can be fraught with challenges, but understanding these common compliance hurdles and implementing practical solutions and best practices can help employers overcome these obstacles.

Compliance challenges often arise from misinterpretation of regulations, inconsistent record-keeping, and insufficient employee training.

Common hurdles include missed deadlines, incomplete or inaccurate paperwork, and failure to keep up with changing legal requirements. Identifying these issues is the first step toward addressing them effectively.

Recommended Posts

Practical Solutions and Best Practices

To overcome these challenges, employers should consider practical solutions and best practices. This includes implementing robust compliance training for HR staff and new hires, creating standardized procedures, and regularly reviewing and updating compliance protocols to reflect changes in regulations.

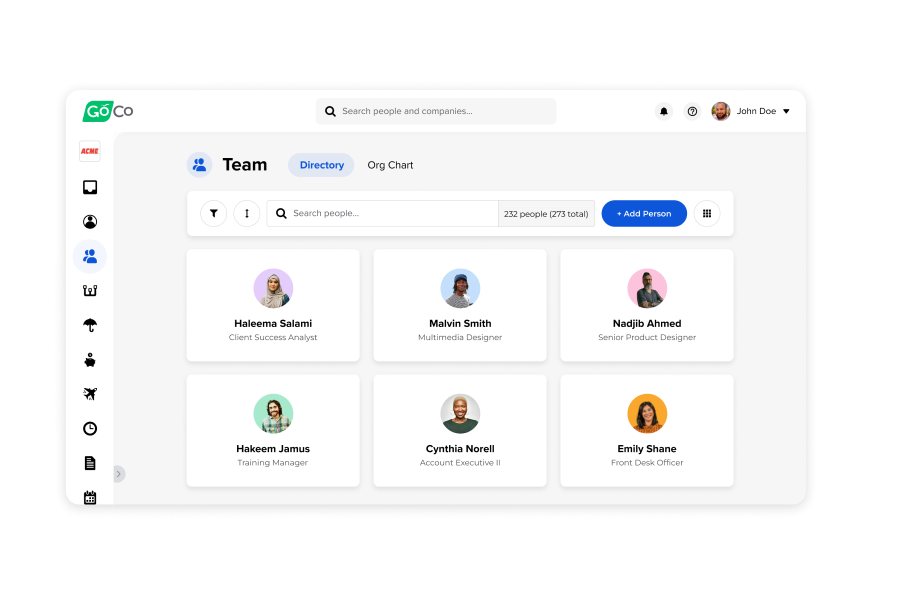

Utilizing technology to automate paperwork processes can also streamline compliance efforts.

A Smoother Path to Onboarding Paperwork Compliance

Mastering onboarding paperwork and compliance is vital for every business. By understanding and implementing the strategies, tips, and technologies discussed in this article, employers can streamline the onboarding process, reduce administrative burdens, and navigate the regulatory landscape with precision.

At GoCo, we're dedicated to simplifying HR processes for businesses in Nevada and beyond. Our HR software offers an all-in-one solution to streamline new hire paperwork, automate compliance tasks, and empower you with efficient HR management.

Take a tour of our software today to see how our product can simplify your onboarding process and delight your new hires!

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories