New Hire Paperwork and Compliance for New Hampshire

Proper onboarding paperwork and processes are vital for employers in New Hampshire. This guide contains everything you need to know.

by Anna Coucke - February 5th, 2024

Hiring employees is a critical process for any organization, and with it comes legal requirements and paperwork that can seem overwhelming. In the state of New Hampshire, employers must adhere to specific rules and regulations to ensure compliance with New Hampshire labor laws.

This article will provide a comprehensive overview of the essential aspects of new hire paperwork and compliance in New Hampshire, focusing on New Hampshire's new hire paperwork requirements, the new hire reporting program, and best onboarding practices.

Download The Ultimate New Hire Paperwork Checklist

Understanding onboarding paperwork and other New Hampshire new hire standards is vital for business owners and HR professionals.

Don’t worry, though, because this guide will break down each step!

Mandatory New Hire Paperwork in New Hampshire

In addition to complying with labor laws, employers must complete specific mandatory paperwork when hiring new employees. These documents are essential for tax reporting, verification, and employment records.

Let's take a closer look at these pieces of paperwork and discuss how they affect the new hire process.

Form I-9 (Employment Eligibility Verification)

Form I-9 is required by the U.S. Citizenship and Immigration Services (USCIS) to verify the identity and employment eligibility of all employees, including citizens and non-citizens.

Employers must ensure employees complete Section 1 of the form on their first day of employment and that the employer completes Section 2 within three business days of the employee's start date.

Form W-4 (Employee's Withholding Certificate)

Form W-4, issued by the Internal Revenue Service (IRS), is used to determine federal income tax withholding from an employee's paycheck.

New hires must complete this form to specify their withholding allowances, which affects the amount of federal income tax deducted from their pay.

New Hampshire does not have a state income tax, so employees are not required to fill out a separate state tax withholding form.

New Hampshire Employer Requirements

New hire paperwork isn’t the only thing that needs to be completed to be compliant – employers in New Hampshire must meet a number of other requirements when hiring new employees. These requirements aim to protect both employers and employees by ensuring compliance with state and federal laws.

Here are some essential New Hampshire employer requirements to consider regarding hiring practices.

Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses for tax purposes. In New Hampshire, as in any other state, obtaining an EIN is a crucial step in the hiring process.

Employers must apply for an EIN to report and pay federal employment taxes, including income tax withholding, Social Security, and Medicare taxes. The EIN is also necessary for reporting state taxes and compliance with other federal and state employment requirements.

To obtain an EIN, employers can apply online through the IRS website or complete Form SS-4 manually. Once you have your EIN, it must be used on all tax-related documents and forms, including payroll records, W-2 forms, and other tax reporting.

New Hire Reporting Program

New Hampshire, like many states, has a New Hire Reporting Program in place. This program is designed to assist state and federal agencies in enforcing child support payments.

Employers are required to report newly hired employees to New Hampshire Employment Security within 20 days of their hiring or rehiring.

Employers must provide the employee's full name, address, and Social Security number along with the employer's name, address, and EIN. Compliance with the New Hire Reporting Program is vital, as failure to report new hires can result in penalties and legal consequences.

Wage and Hour Regulations

New Hampshire follows federal wage and hour regulations set by the Fair Labor Standards Act (FLSA). It's crucial for employers to understand minimum wage and overtime requirements as well as child labor laws.

The federal minimum wage is $7.25 per hour. New Hampshire's state minimum wage is aligned with the federal minimum wage.

Employers must also be aware of overtime regulations. In New Hampshire, non-exempt employees are entitled to overtime pay for hours worked over 40 in a workweek. Overtime pay should be at a rate of at least 1.5 times the regular hourly wage.

Hiring Practices in New Hampshire

Efficient and legally compliant hiring practices are essential to any organization's success. Here are some best practices for hiring employees in New Hampshire.

Pre-Employment Screening

Employers should conduct thorough pre-employment screening, including background checks, reference checks, and drug testing as necessary.

However, to avoid discrimination and privacy issues, it's important to be aware of federal and state laws governing these practices, such as the Fair Credit Reporting Act (FCRA) and the New Hampshire Employment Security (NHES) guidelines.

Employee Classification

Employers must properly classify employees as exempt or non-exempt under wage and hour laws. Misclassifying employees can result in legal consequences and financial penalties. Be sure to consult with legal counsel or the New Hampshire Employment Security office if you're uncertain about employee classifications.

Employee Handbook and Policies

It's advisable to have a comprehensive employee handbook that outlines the company's policies, procedures, and expectations for all employees. This handbook should be distributed to new hires, who should acknowledge receipt of it. It can help prevent misunderstandings and disputes in the future.

Equal Opportunity Employment

Employers should adhere to equal-opportunity employment practices and refrain from discrimination based on factors such as race, color, religion, sex, or national origin. It's important to be familiar with federal and state anti-discrimination laws, including Title VII of the Civil Rights Act of 1964 and the New Hampshire Civil Rights Act.

Onboarding and Training

Once new hires are onboarded, provide them with proper training and orientation. This helps them integrate into the workplace smoothly and understand their roles and responsibilities.

Record-Keeping

Maintain accurate records of all employment-related documents, including applications, offer letters, I-9 forms, W-4 forms, and tax records. These records should be kept in compliance with federal and state laws.

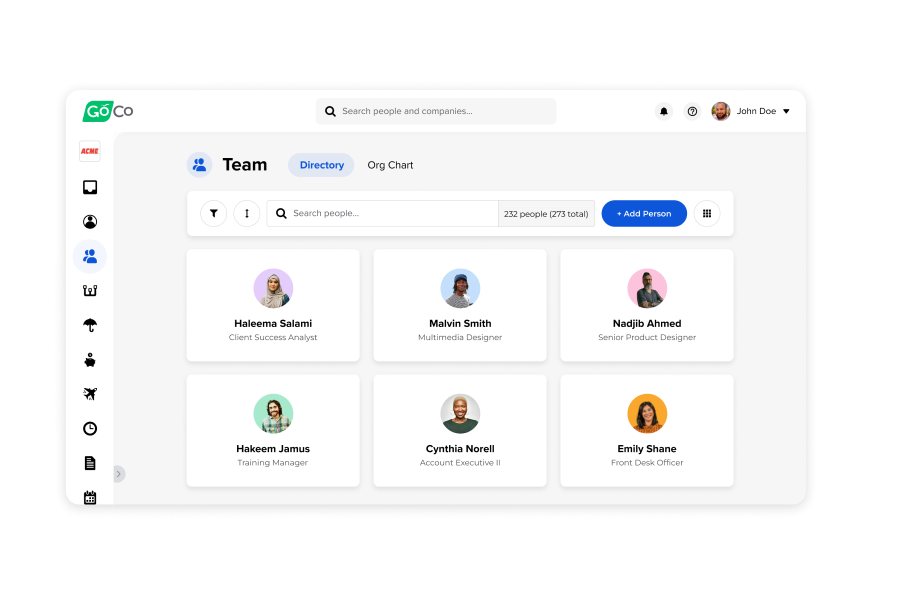

How GoCo Supports New Hampshire Employee Onboarding

Onboarding paperwork and compliance can feel complicated – but it doesn’t have to. New Hampshire businesses can gain more confidence in hiring and onboarding compliance with an HRIS that takes out much of the guesswork.

GoCo supports state-specific hiring by staying in tune with current and evolving regulations for paperwork, reporting, and other legal implications. Plus, our intuitive onboarding software makes the entire onboarding process a delight for employers and new hires alike.

Take a tour of GoCo today to see how we can transform your onboarding (and much more)!

Recommended Posts

HR’s Guide to Remote I-9 Verification & Compliance

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![4 Offer Letter Templates to Boost Hiring Success [Free Download]](/img/containers/assets/goco/featured_images/posts/CreatingAPerfectOfferLetterIn2022_BlogFeatImg.png/eed93d011f63ee771501e57f1170dcfd/CreatingAPerfectOfferLetterIn2022_BlogFeatImg.png)