New Hire Paperwork and Compliance for Rhode Island

Getting new employees up to speed quickly depends on how organized your onboarding process and paperwork is. These tips will help you orient new hires effectively.

Hiring a Rhode Island employee while ensuring all compliance regulations and laws are met is no easy feat. Between the onboarding paperwork and everything else to bear in mind, it can be an overwhelming amount of information. Fortunately, we're here to break it down in this easy guide.

Here's everything you need to know about getting a Rhode Island employee on board and up to speed quickly.

Table of Contents

- Rhode Island Labor Laws

- Mandatory New Hire Paperwork in Rhode Island

- Form I-9 (Employment Eligibility Verification)

- W-4 Form (Employee's Withholding Certificate)

- Rhode Island State Tax Withholding Forms

- Direct Deposit Forms

- What Happens if Onboarding Paperwork Isn't Filled Out Correctly?

- Get Help With Your Onboarding Paperwork

Rhode Island Labor Laws

Rhode Island has some specific labor laws. Here's what to bear in mind.

Minimum Wage

Rhode Island has a higher minimum wage than the federal minimum wage. Ensure you check for the most recent updates. The minimum wage is subject to change, and there may be different rates for tipped employees.

Overtime Pay

Overtime pay is typically required for non-exempt employees who work more than 40 hours in a workweek. The overtime rate is usually one and a half times the regular hourly rate.

Child Labor Laws

There are restrictions on the hours and types of work that minors (individuals under 18) can perform. This includes limits on working hours during school days and the types of hazardous occupations.

Equal Pay

Rhode Island has laws promoting equal pay for equal work regardless of gender. Employers are generally prohibited from paying employees of one gender less than employees of another gender for substantially similar work.

Family and Medical Leave

Rhode Island has its own Family and Medical Leave Act (FMLA) that provides eligible employees with up to 13 weeks of unpaid leave in a 24-month period for specific family or medical reasons.

Workers' Compensation

Employers in Rhode Island are generally required to have workers' compensation insurance to provide benefits to employees who are injured on the job.

Unemployment Benefits

The Rhode Island Department of Labor and Training manages the state's unemployment insurance program. Eligible individuals who are unemployed through no fault of their own can apply for unemployment benefits.

Discrimination and Harassment

Rhode Island has laws prohibiting workplace discrimination and harassment based on protected characteristics such as race, gender, age, disability, and others.

Mandatory New Hire Paperwork in Rhode Island

Let's dive further into the new hire forms and what you need to ensure is filled out. Here's what's necessary.

Download The Ultimate Onboarding Checklist

Form I-9 (Employment Eligibility Verification)

The Form I-9, mandated by the U.S. Citizenship and Immigration Services (USCIS), is a crucial document used to authenticate the identity and employment eligibility of individuals hired to work in the United States.

Structured into three sections, the form necessitates employees to furnish personal details in Section 1 upon commencement of employment. Employers are then responsible for verifying the legitimacy of identity and eligibility documents presented by the employee in Section 2.

Employers are required to complete Section 2 of I-9 documents within three business days of the employee's commencement date. Section 3, employed for re-verification and rehires, is filled out as necessary.

The Form I-9 plays a pivotal role in ensuring a legal and authorized workforce, safeguarding both employers and employees from potential legal consequences associated with immigration compliance.

Regular updates from USCIS and meticulous record-keeping practices are imperative to maintain compliance with the evolving regulations governing this critical employment verification process.

W-4 Form (Employee's Withholding Certificate)

The Employee's Withholding Certificate, commonly known as the W-4 Form, is a pivotal document overseen by the Internal Revenue Service (IRS) in the United States. Filled out by employees, the W-4 plays a crucial role in determining the precise amount of federal income tax that employers should deduct from their paychecks.

Employees should fill in details about their filing status, dependents, and any additional withholding allowances they wish to claim, influencing the calculation of their tax withholding. It is crucial to regularly update the W-4, particularly when employees undergo life changes such as marriage, having children, or alterations in their financial situation.

Employers depend on the information supplied in the W-4 to ensure accurate and compliant tax withholding, facilitating the fulfillment of employees' tax obligations and preventing situations of over- or under-withholding.

Rhode Island State Tax Withholding Forms

Rhode Island, like many other U.S. states, requires employees to complete state tax withholding forms to determine the amount of state income tax that employers should withhold from their paychecks. The specific form used for this purpose in Rhode Island is the RI W-4, officially known as the Employee's Withholding Certificate for Rhode Island.

The RI W-4 is used by employees to provide information about their filing status, allowances, and any additional amount they want to be withheld for state income tax purposes. Like the federal W-4 form, the information provided on the RI W-4 helps employers calculate the correct amount of state income tax to deduct from employees' wages.

It's important for employees to review and update their RI W-4 forms when there are changes in their personal or financial situations, such as getting married, having a child, or experiencing changes in income. Employers use the information from the RI W-4 to ensure accurate and compliant state income tax withholding.

Direct Deposit Forms

A direct deposit form is a document employed by employees to facilitate the electronic transfer of their wages or salary directly into their bank account. This form gathers essential information, including the employee's full name, identification or account number, Social Security number, and details about the designated bank account, such as the bank name, routing number, and account number.

Employees may also indicate whether the account is a checking or savings account.

The form typically requires the employee's signature, serving as authorization for the employer to initiate direct deposits.

What Happens if Onboarding Paperwork Isn't Filled Out Correctly?

Filling out employment-related forms incorrectly can have serious consequences for both employees and employers. Employers may face legal ramifications if errors on forms result in non-compliance with federal or state laws, leading to potential penalties, fines, or legal actions.

Inaccuracies on forms can cause delays in processing, affecting critical aspects such as work authorization for new hires or timely payroll processing.

Mistakes on tax-related forms, such as W-4 or state withholding forms, may result in incorrect tax withholding, potentially leading to financial complications for employees during tax filing.

Additionally, inaccuracies contribute to flawed employee records, creating potential issues during audits or employee performance evaluations. Therefore, ensuring accuracy in completing employment forms and compliance processes is crucial to avoid these detrimental outcomes.

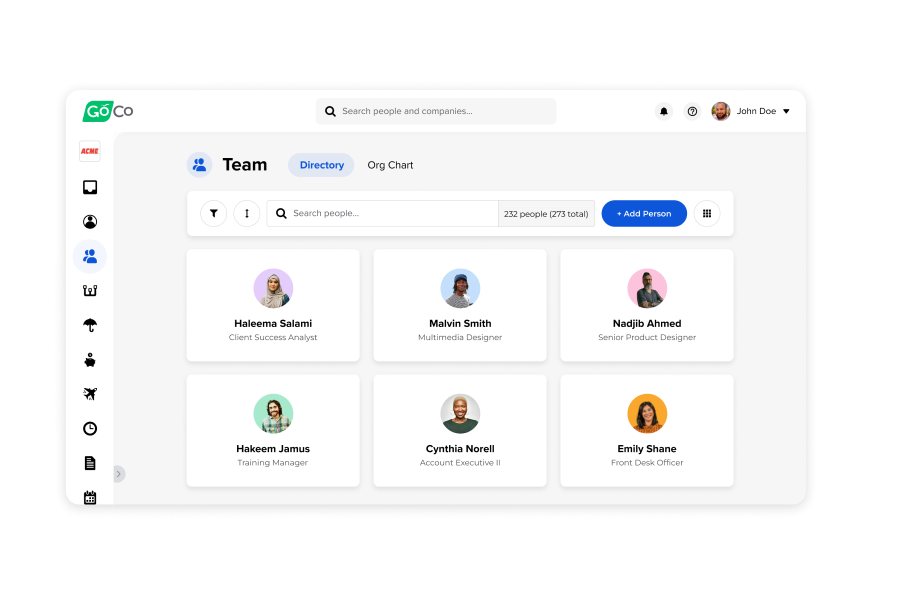

Get Help With Your Onboarding Paperwork

Onboarding paperwork for a new hire in Rhode Island can seem daunting, especially as the laws are ever-changing, and you may not be up to speed on the latest HR laws and regulations.

That's why we're here to help.

At GoCo, we have years of experience partnering with businesses and taking complex HR and paperwork tasks off their hands so they can focus on their company. Take a tour today to see how GoCo can simplify your onboarding and much more.

Recommended Posts

The Complete Employee Offboarding Process [+ Checklist]

Blog Articles

HR’s Guide to Remote I-9 Verification & Compliance

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories