New Hire Paperwork and Compliance for Maine

Everything you need to know about Maine's onboarding paperwork requirements to ensure your new hires start off strong.

by Anna Coucke - March 19th, 2024

Onboarding new employees is necessary for any organization, but it also involves legal obligations and paperwork that can feel daunting to HR and new hires alike. In the state of Maine, employers have specific requirements to fulfill to ensure compliance with Maine's labor laws.

This guide will review the key aspects of onboarding paperwork and compliance in Maine. We'll delve into Maine's new hire paperwork necessities, the new hire reporting program, and recommended onboarding practices to ensure your new hires start off strong.

Mandatory New Hire Paperwork in Maine

As in all other states, Maine employers must complete specific mandatory paperwork when hiring new employees. These documents are essential for tax reporting, verification, and employment records.

Let's take a closer look at these forms and discuss how they affect the new hire process.

Download The Ultimate Onboarding Checklist

Form I-9 (Employment Eligibility Verification)

Form I-9 is required by U.S. Citizenship and Immigration Services (USCIS) in order to verify the identity and employment eligibility of all new hires.

Section 1 is completed by employees on their first day of work, and employers must finish Section 2 within three business days.

Form W-4 (Employee's Withholding Certificate)

This form is issued by the Internal Revenue Service (IRS) to determine federal income tax withholding.

New hires must complete this form to specify their withholding allowances, which affects the amount of federal income tax deducted from their pay.

Form W-4ME (Maine State Withholding Allowance Certificate)

As Maine has a state income tax, a separate tax form is required to be completed in order to determine state income tax withholding. This form, known as W-4ME, should be completed at the same time as the federal W-4.

Maine Employer Requirements

New hire paperwork isn't the only aspect of new hire compliance. Maine employers must fulfill some additional requirements.

Employer Identification Number (EIN)

As in every other state, Maine employers must obtain a federal tax ID, also known as an Employer Identification Number (EIN), from the IRS for tax purposes before beginning to hire employees.

New Hire Reporting

Maine mandates that employers report all new hires, rehires, and terminations to the Department of Health and Human Services Division of Support Enforcement & Recovery (DHHS-DSER) within seven business days. Employers can report electronically through the DSER New Hire Portal or by fax.

This report requires the following employee information: full legal name, address, and Social Security number. Additionally, the employer's business name, address, and Employer Identification Number (EIN) must be included. Compliance with the New Hire Reporting Program is crucial, and failure to report new hires can result in penalties and legal consequences.

Best Practices for Onboarding Employees in Maine

Building a successful organization requires efficient and legally sound hiring practices. Here are some key areas to focus on when hiring new employees in Maine.

Pre-Employment Screening

Although it is not a state requirement, conducting thorough background checks, reference checks, and drug testing (when necessary) will help ensure the qualification of your workforce.

If your organization conducts these checks, it must carefully follow federal and state regulations (outlined below) in order to avoid discrimination and privacy concerns.

Equal Opportunity Employment

In hiring and employment, ensure that your organization upholds equal opportunity practices and avoids discrimination based on race, color, religion, sex, or national origin. Be familiar with federal and state anti-discrimination laws including the Maine Human Rights Act, the Fair Credit Reporting Act (FCRA), and Equal Employment Opportunity (EEO) laws.

Employee Classification

Be sure to accurately classify employees as exempt or non-exempt, as misclassification can lead to legal repercussions and financial penalties. If unsure about classifications, consult with legal counsel or the FLSA.

Employee Handbook and Policies

Many organizations choose to develop an employee handbook that outlines company policies, procedures, and employee expectations. You should distribute this to new hires and obtain confirmation that the employee has read and understands the handbook to help prevent future disputes or confusion.

Record Keeping

Be sure to maintain accurate records of all employment-related documents, including applications, offer letters, I-9 forms, W-4 forms, and tax records. Ensure compliance with federal and Maine state laws regarding record retention.

While these are not required, following these best practices can help Maine employers establish a strong foundation for a compliant and efficient hiring and onboarding process.

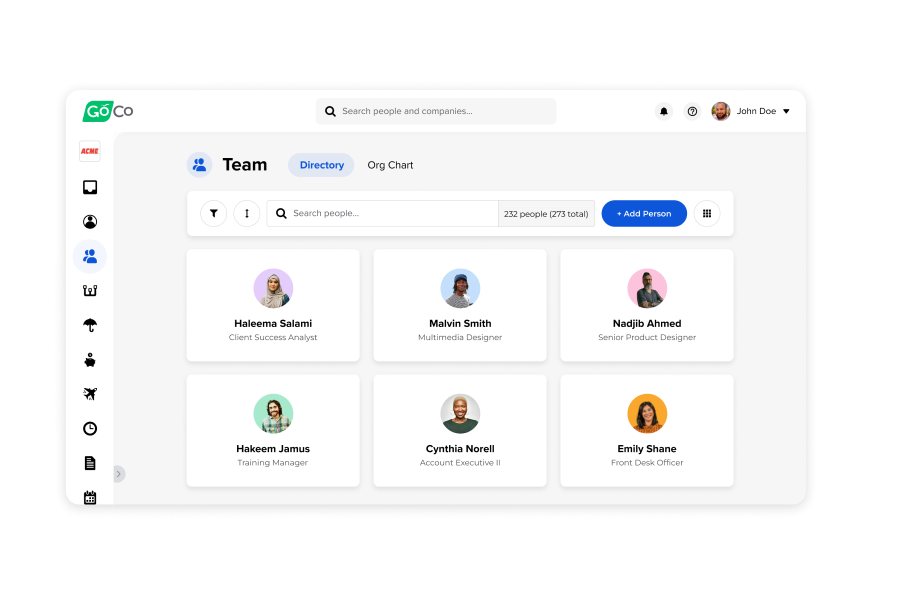

How GoCo Supports Maine Employee Onboarding

Keeping up with onboarding paperwork and compliance can feel complicated, but it doesn't have to. Maine businesses can gain more confidence in hiring and onboarding compliance with HR software that eliminates much of the guesswork.

GoCo supports state-specific hiring by staying in tune with current and evolving regulations for paperwork, reporting, and other legal implications in Maine. Plus, our intuitive onboarding software makes the entire onboarding process a delight for employers and new hires alike.

Take a free tour of GoCo today to see how we can transform your HR processes — including onboarding, performance management, time tracking, and more!

Recommended Posts

New Hire Paperwork & Onboarding Forms 2025

Blog Articles

Creating an Effective 90-Day New Hire Onboarding Plan

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![How to Write Job Postings That Get Great Candidates in 2025 [+Template]](/img/containers/assets/goco/featured_images/posts/how-to-write-job-posting.png/f7e6aa15847d2324dbf2282a887f4808/how-to-write-job-posting.png)