5 Payroll Headaches and How To Deal With Them

Payroll is one of the biggest headaches for HR departments. Here are 5 common payroll challenges and how to tackle them.

June 1st, 2022

No matter how long you’ve been in the people ops field, manual processes cause a lot of headaches. If you Google “HR headaches,” you’ll get a long list of trends and challenges that you face on a daily basis. And payroll is one of the most common ones you’ll read about.

Let’s get straight to the point and define what can go wrong in managing payroll and how to prepare and avoid the most troublesome situations. Want to compare payroll solutions? Read our Gusto vs Rippling guide to learn more.

Watch Out For These 5 Payroll Mistakes

Here are five things that trigger the biggest issues with payroll:

1. Employee misclassification

If you employ temporary and freelance workers or contractors, you may stumble upon this issue. In short, the problem with misclassification of an employee lies in treating one as a contractor. You deprive such workers of the minimal salary standard and payments for overtime work if it exceeds 40 weekly hours.

Additionally, it raises issues with the taxes that need to be withheld. You need to pay close attention to the differences between a W-2 form for an employee and 1099-MISC or 1099-NEC forms for a non-employee.

What if we told you that this payroll error may cost your company $500,000? It may also lead to other penalties for classifying employees improperly.

2. Miscalculation of workers’ hours

Have you ever made mistakes calculating employee salaries? Have you done it more than once? Consider the following: 49% of workers start looking for a new job after two errors in their paycheck. The wrong-number-of-hours issue correlates with two more headaches, tracking absence and tracking of overtime.

“Every scenario when pay is calculated incorrectly will lead to frustration on the behalf of workers, huge and pointless loss of time, more time on recalculations and your painstaking endeavors to make amends, of course,” says Jerry Han, CMO at PrizeRebel.

3. Non-conformity in taxable income & employee compensation reports

Occasionally, HR professionals leave some taxable types of compensation and employee benefits unreported. This may concern:

Dividends

Stock options

Royalty payment

Gift certificates or coupons

Achievement awards in cash, etc.

To prevent additional payroll corrections due to these and other issues, recheck taxable vs non-taxable income listings.

4. Incorrect amount of payroll withholdings

Do you correctly deduct taxes from paychecks during every pay period?

Here’s what you should mind:

Federal and local income tax rates

State tax withholdings

Social security and Medicare tax rates

Workers’ comp

401(k) plans

To make the procedure more effective, use an official tax withholding estimator. Alternatively, you might want to try some payroll deductions calculators online.

5. Mistimed or late paycheck

It’s no wonder that people get irritated with late paychecks - 78% of US workers live paycheck to paycheck. At best, late paychecks will tarnish your company’s reputation. At worst, they can have devastating effects on the livelihood of your employees and their families.

“Compensating your workers in a timely manner can save you from other snowballing headaches,” believes Michael Nemeroff, CEO & Co-Founder of Rush Order Tees. “You’re late with payroll? So there you go – you distort your reputation, decrease employee satisfaction and get yourself into more trouble with possible fines, because taxes are not paid in time,” Michael adds.

How to Handle Payroll Effectively – Proven Tips for HRs

Did you know that 25% of small businesses still track finances on paper? Another 45% of these companies never bother to hire a professional accountant or payroll service provider. That gives an additional headache to HR experts.

How do you eliminate mistakes and handle your payroll like a pro?

Simply follow these 5 tips:

1. Create your own payroll handbook

Different pay structures require unique approaches to map out employees’ path to higher salary and career growth. Depending on the established compensation scheme, your handbook should be ultimately instructional.

David Patterson-Cole, CEO & Co-Founder of Moonchaser, states that “An effective payroll handbook should include all legal documents, resources and tax withholding forms to navigate easily between those in the case of an emergency, for example. Moreover, make sure you have all employee records with confidential & sensitive info (Social Security number, address, etc.)”

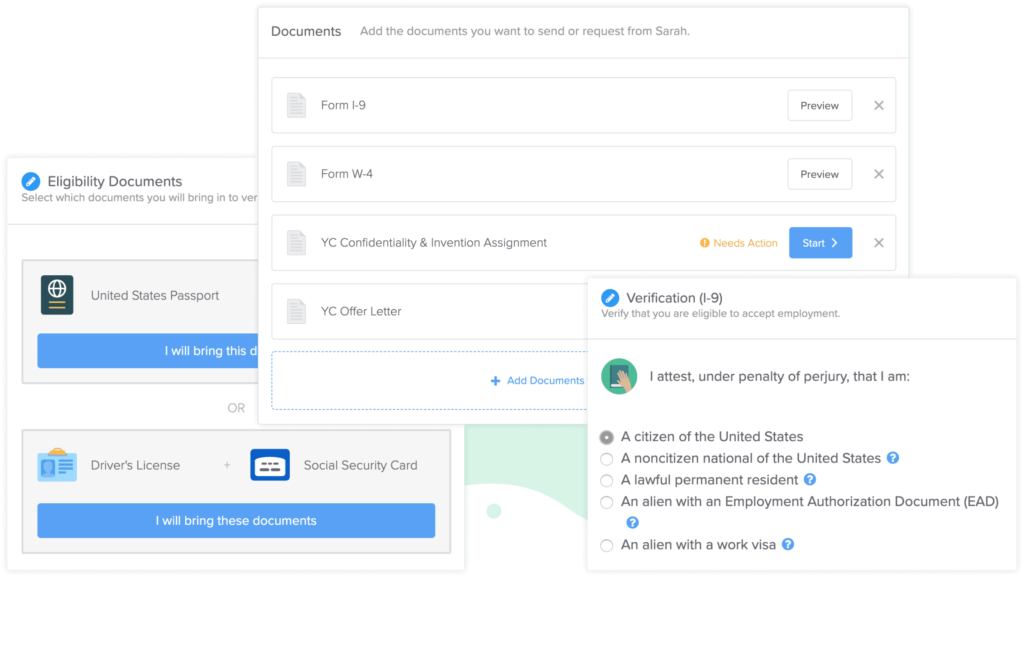

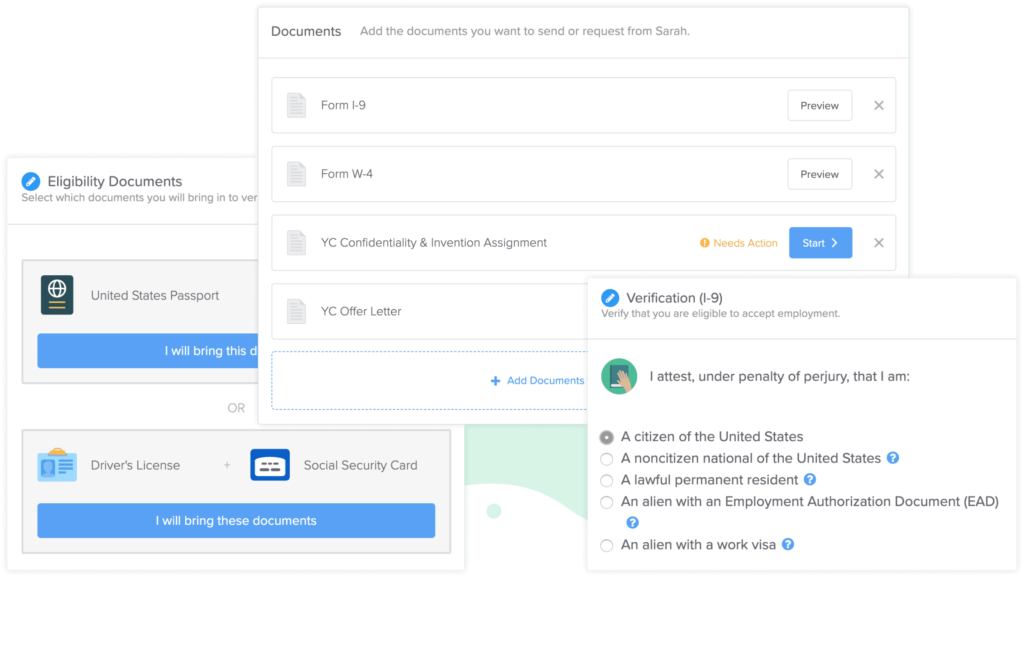

2. Prepare all required forms

There’s no way to escape new hire paperwork. And that’s when you need an onboarding checklist with all the forms.

There’s no need to learn them by heart. But you should have all up-to-date payroll forms in your handbook.

3. Schedule payroll

It sounds so simple, but the easiest check you can put in place is to choose a standard payroll period. It can be biweekly, weekly, semimonthly or monthly, for example. Set reminders several days ahead to ensure you calculate salaries in time and prepare error-free paychecks.

4. Allow real-time access to working hours

“Your workers are mobile addicts, like all of us nowadays. Why is this info crucial for you? Let each worker have a personal time record and check it from mobile round-the-clock,” recommends Logan Mallory VP of Motivosity.

Take advantage of a digital time clock system to manage attendance and sync to payroll. You may also make group boards to monitor team work hours, create encouragement cards and boost workplace appreciation.

5. Use technology to automate payroll management

Manual payroll processes are the stuff of nightmares. A lot can go wrong, from misclassifying employees to miscalculating work hours and withholding incorrect tax amounts. Fortunately, GoCo offers a free Expense Reimbursement Template that helps reduce errors and improve efficiency.

The template lets you track company expenses more efficiently, providing visibility into who is spending what and why. Plus, employees can initiate the process anytime and from anywhere.

This tool works in four easy steps:

Send a unique permanent link to your employees for all their reimbursement requests.

The employees then enter the expense details and upload an image of the receipt or invoice.

Automatic notifications inform you when an expense request is ready for review and approval.

Finally, use reports generated by the system to incorporate approved reimbursements into your payroll swiftly.

Automating your payroll management can save you significant time, estimated at about 20% of your time spent on financial tasks. It significantly reduces the chances of human error and ensures a smooth, accurate payroll process.

Max Wesman, COO of GoodHire, advocates for automation in payroll. "Automation is your golden key to handling payroll, breathing out, and doing your other HR stuff. Just think about what you get with an automated system to tackle all wages-related questions: accuracy, security of employee data, convenience, and accessibility 24/7," he shares.

Experience firsthand the revolution in payroll and expense management by trying out GoCo's Expense Reimbursement Template. We're confident that this tool will prove to be a game-changer in how you handle payroll and manage employee expenses. Try it for free!

A Final Word On Payroll Headaches

If you handle payroll at your company, you know how much stress it can cause. Employees look closely at their paychecks with great attention to detail and even a tiny payroll error will be noticed.

If you want to handle salary calculations as accurately as possible productively, consider some improvements in payroll processes with an emphasis on automation.

Managing payroll is considerably simpler with GoCo. It allows automated payroll solutions at breakneck speed. Take a tour of GoCo’s all-in-one HR software today!

Recommended Posts

How to Streamline Remote Employee Expense Management

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories