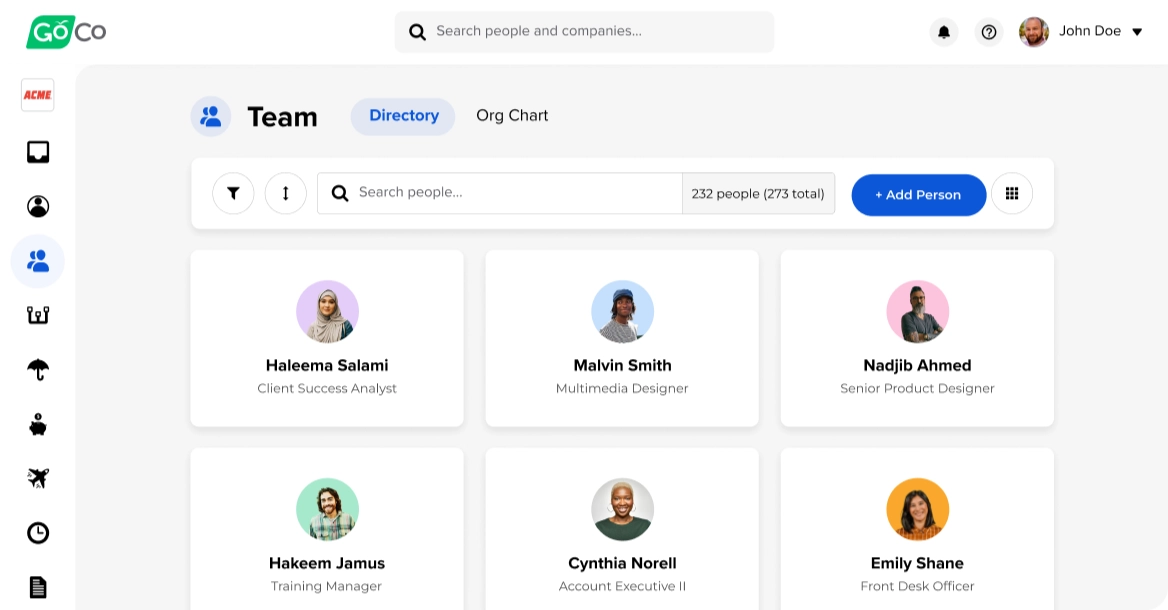

Use Our Payroll

Bring Your Own

Use Our Payroll

Hassle-Free Payroll

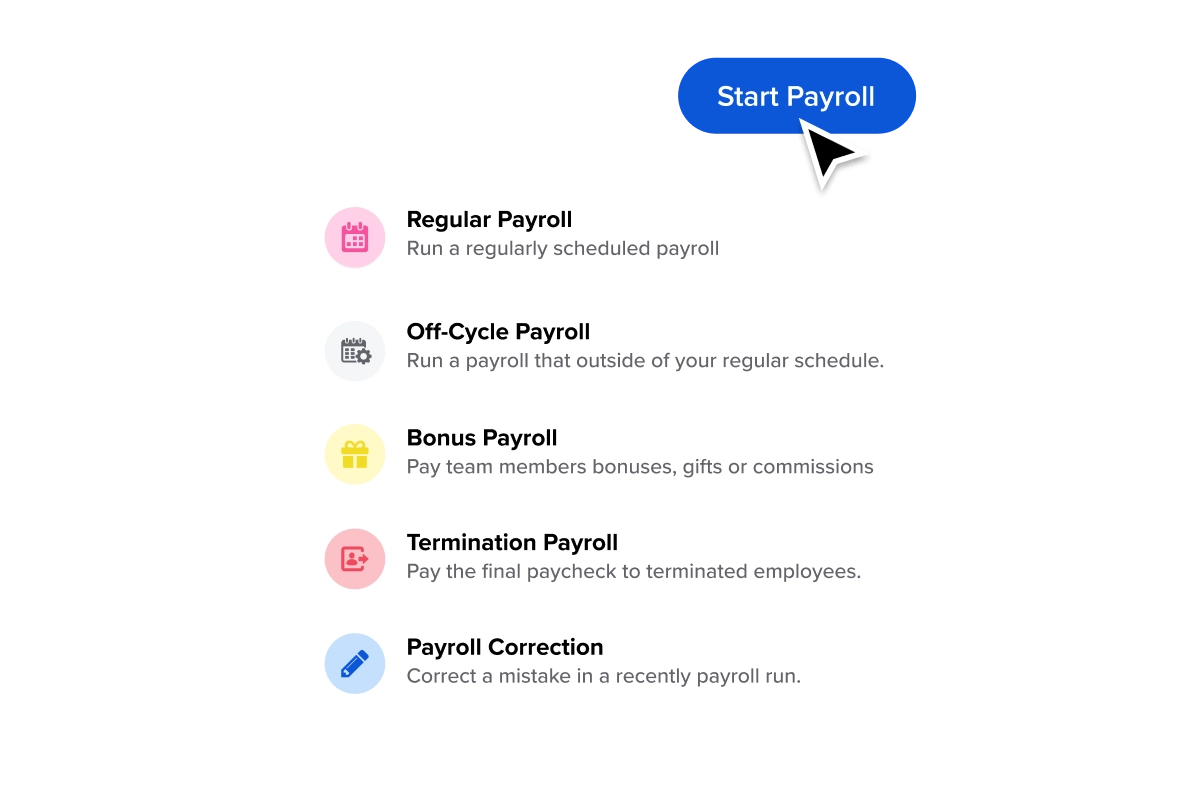

Run payroll start-to-finish in GoCo with our powerful embedded Payroll solution. With GoCo, you can process payroll in minutes instead of hours, ensuring your team gets paid accurately and on time, every time.

Bring Your Own

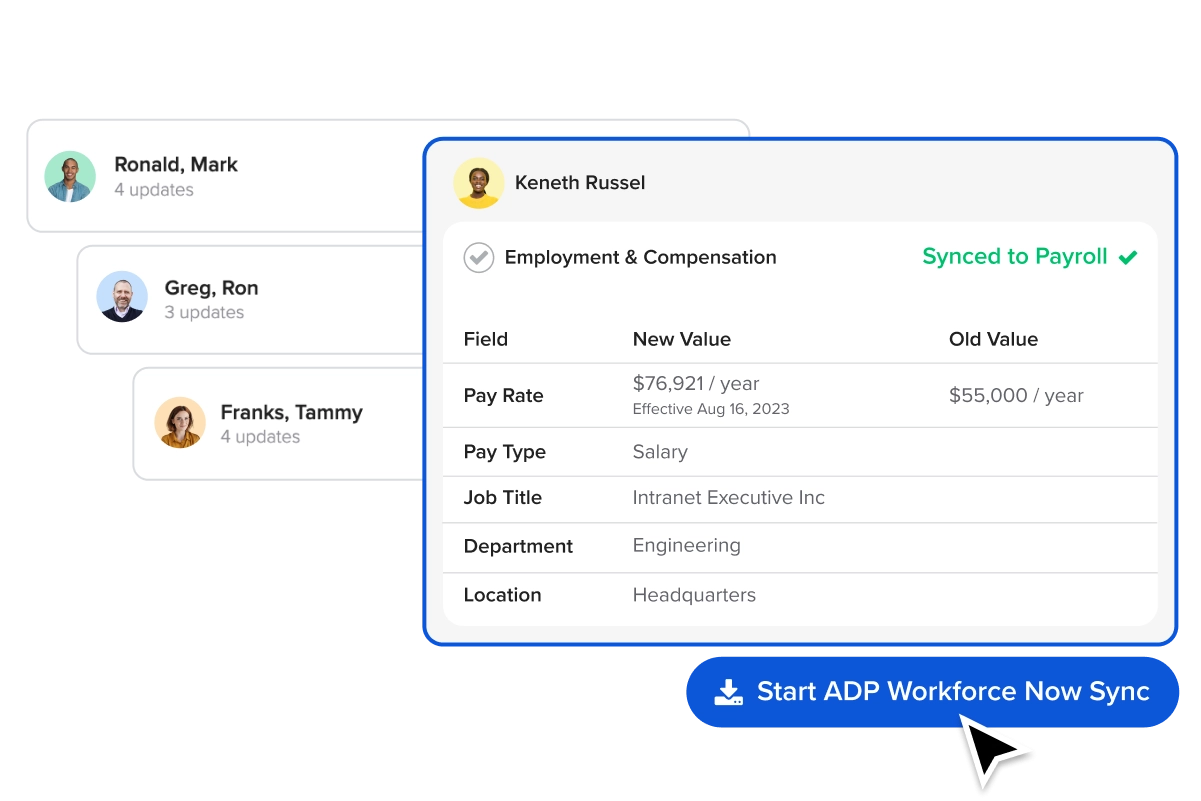

Keep Your Payroll Platform Up to Date With GoCo

Love your current payroll system? Not a problem! GoCo keeps your systems in sync by tracking all the changes to your data so you know what needs to be updated in payroll.

Does payroll keep you up at night?

The Fear of Payroll Errors and Last Minute Delays

Disparate HR, Benefits and Payroll Systems

Complex Employee Classification Systems

Complicated Payroll & Tax Compliance

Different systems to track HR, benefits, and payroll

Calculating catch-up or prorated benefit deductions

Employees making changes to their data after payroll is submitted

Searching for an HR platform that works with your payroll

Just because you want to keep your existing payroll setup doesn't mean you have to settle for a not-so-modern HR experience.

GoCo gives you a modern HR experience, streamlines your benefits administration, and tracks any and all changes to employee and pay data so your systems stay in sync.

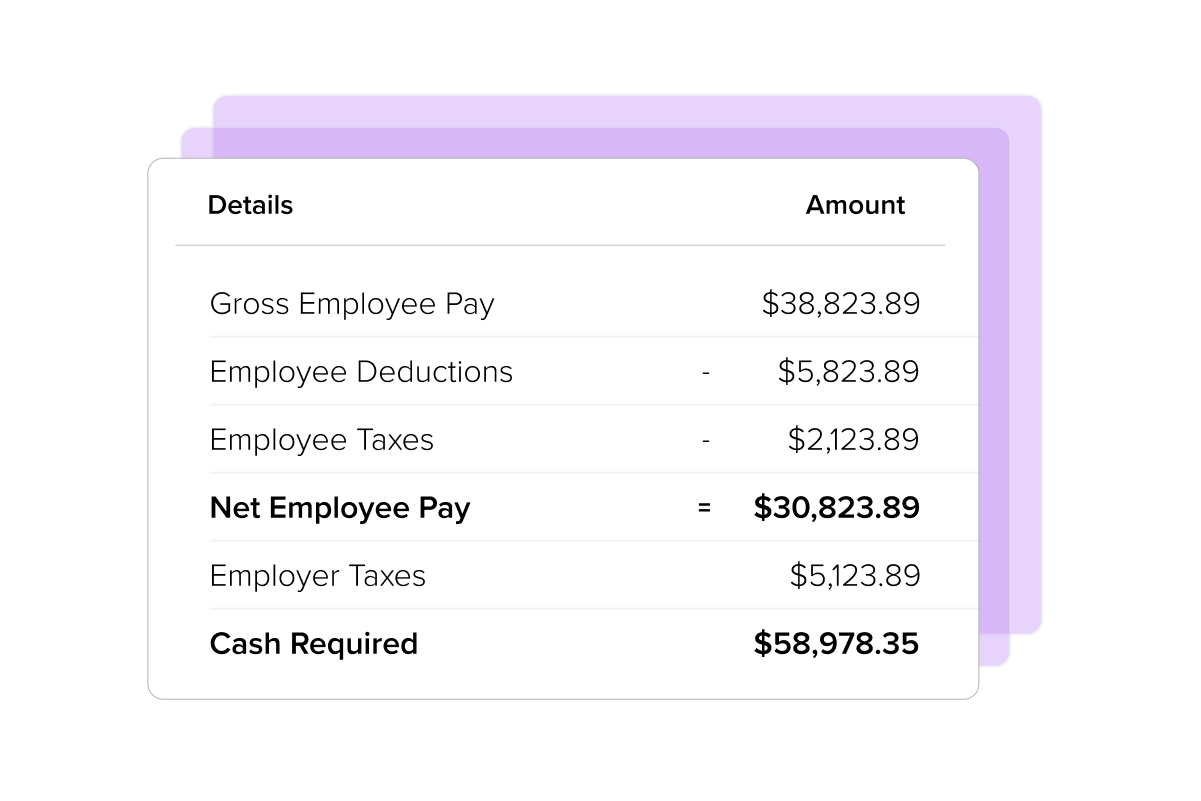

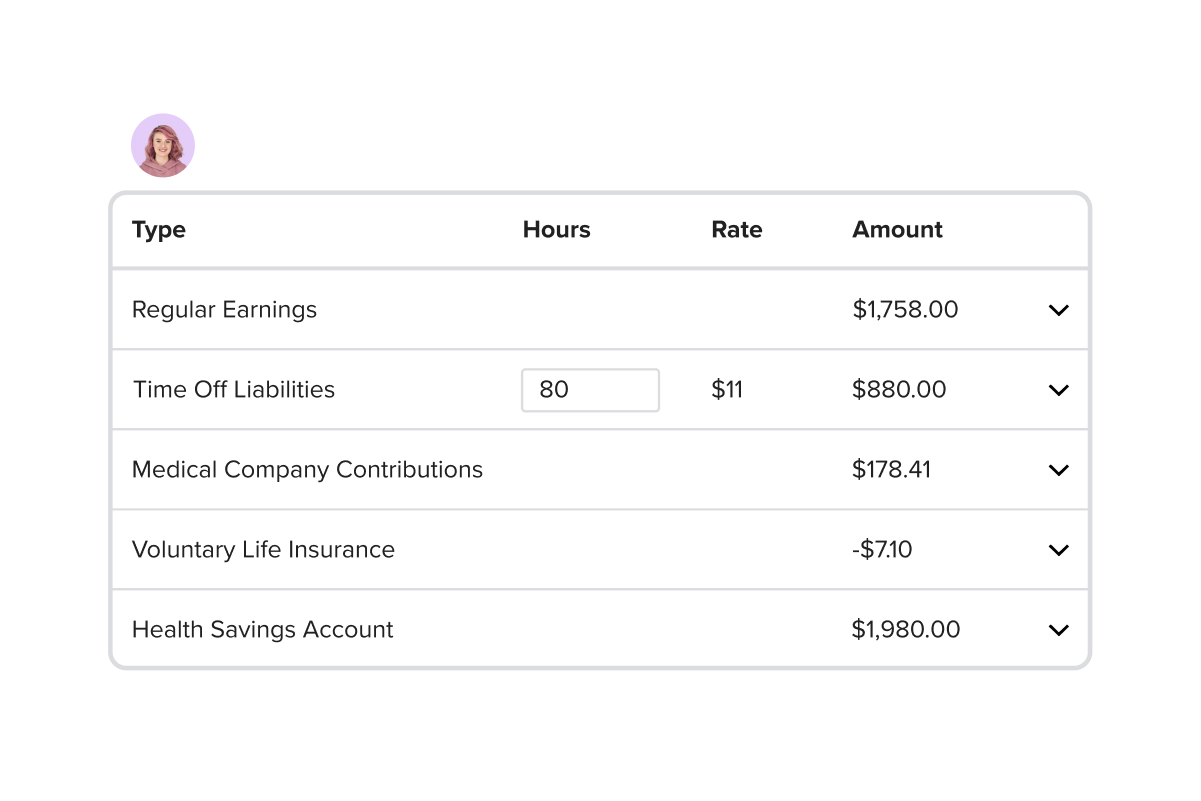

No one should have to spend days preparing payroll data to ensure nothing gets missed.

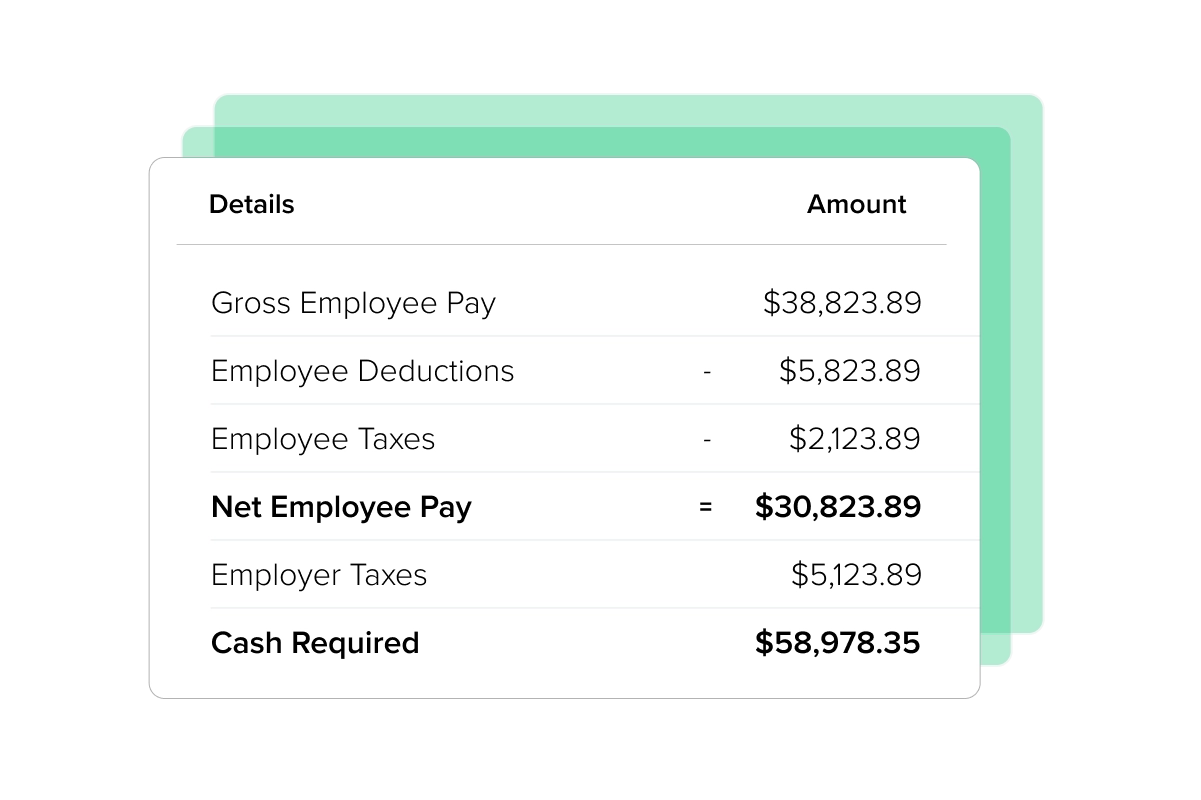

GoCo gives you a clear record of pay, expenses, deductions, and reimbursements. Plus, your employees can easily access their digital paystubs directly from their profile.

Use Our Payroll

Bring Your Own

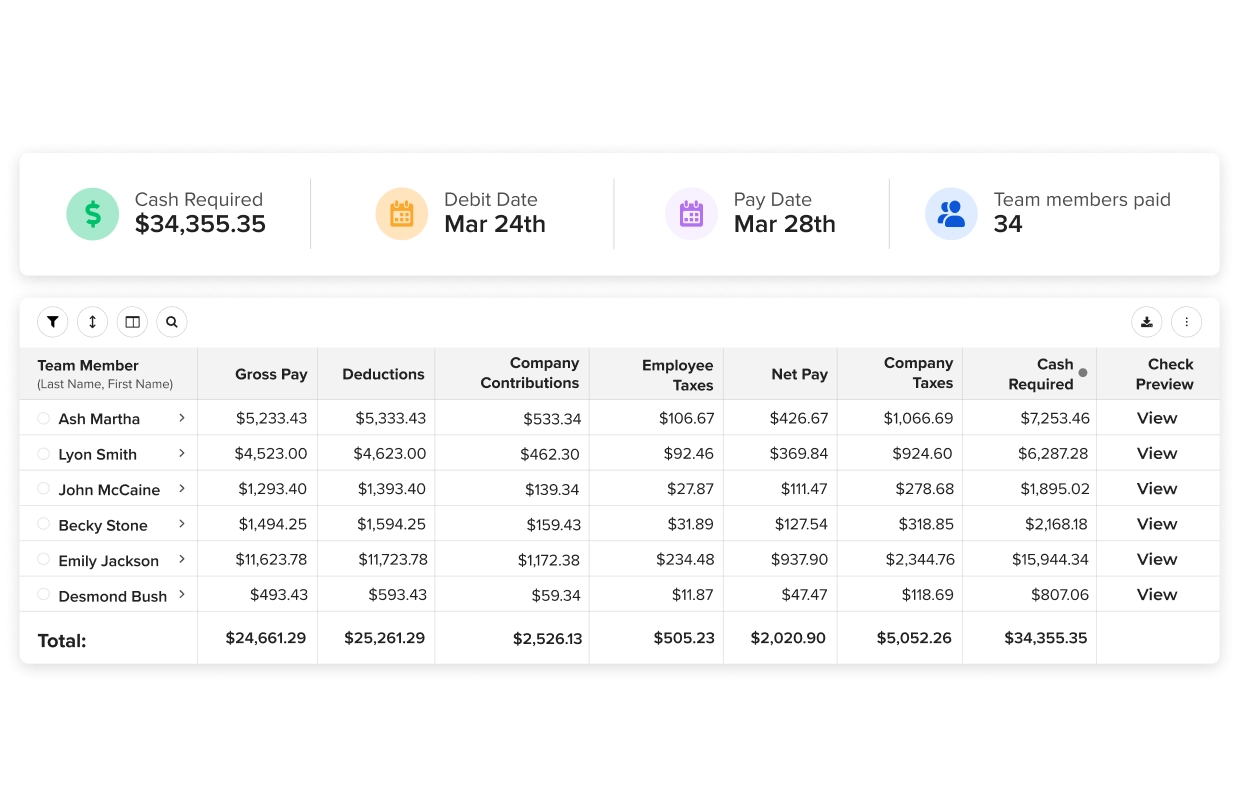

Easy, Accurate Payroll in Minutes

Streamline Your Payroll Data

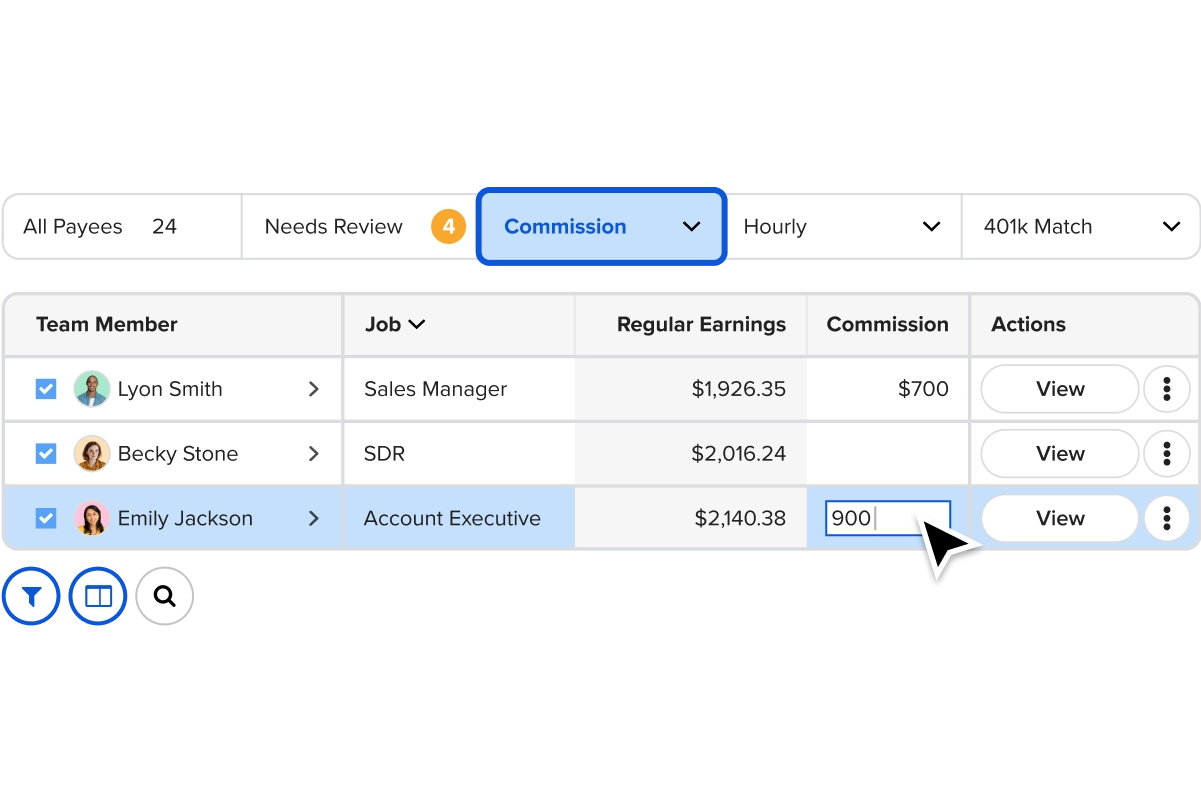

Consolidate your payroll data into one workspace to easily reconcile and prepare everything you need to get employees paid. Our payroll knows what information is required to process payroll accurately. If something is missing (employee information, direct deposit details, timesheets), it will be flagged automatically so nothing falls through the cracks.

Hosting PTO or time tracking outside of GoCo? No problem! Import any spreadsheet into the Payroll Grid and earnings data will update automatically.

Prepare Payroll Your Way

Automate Taxes and Benefit Deductions

Stop Worrying About Off-Cycle Pay Runs

Payroll Support You Can Count on

All Inclusive Payroll, No Surprises

Bring Your Own Payroll, We’ll Make It Easy

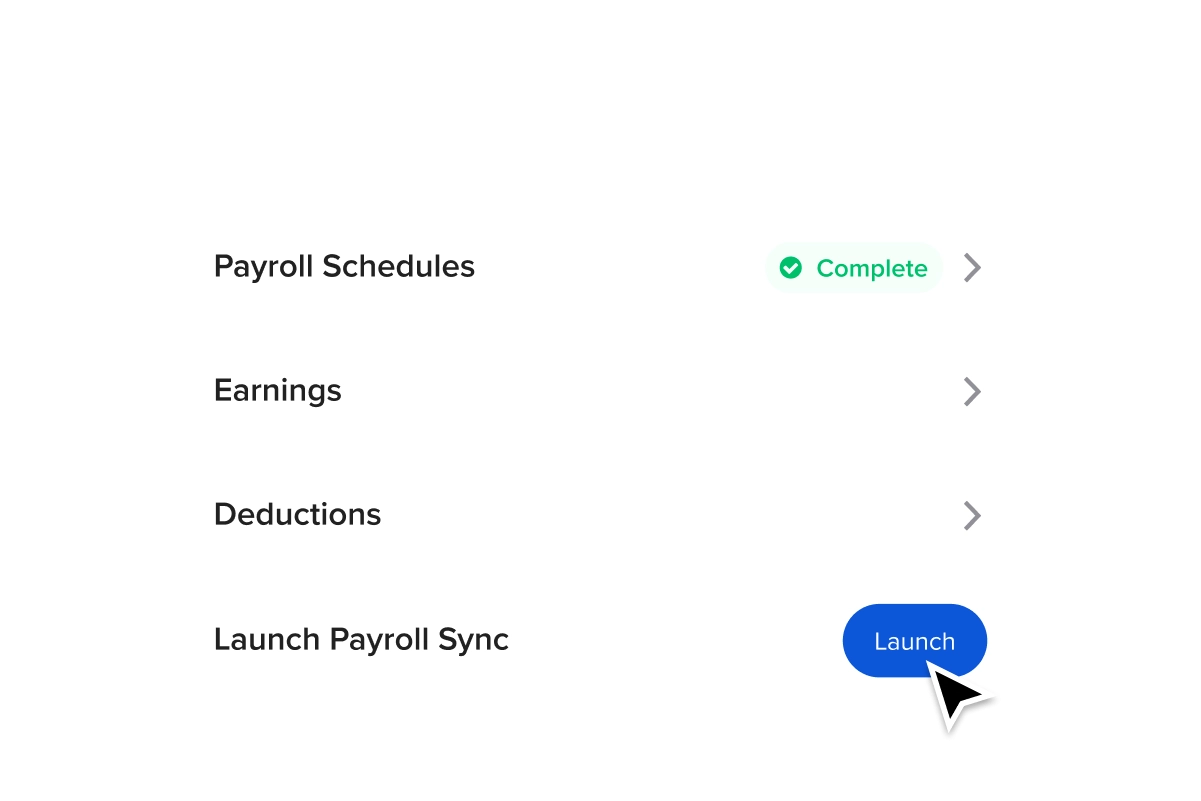

Keep GoCo in Sync With Payroll

Stay on Top of Tax and Deduction Changes

Never Miss a New Hire or Termination

Support You Can Count on

Automate Your Payroll Data Transfer

“Before GoCo, I was spending all of my time on HR. I would have to reset payroll logins 8-10 times per week because someone would get locked out. Now, it’s all self-service. Payroll used to take me an entire business day. Now, it takes just 30 minutes per location. Overall, I save about 10-15 hours per week, which allows me to be more present within the school.”

Jenny V.

It’s Easy to Get Started with GoCo!

Schedule a call with our team to get a personalized demo of the platform.

With GoCo, you don’t do it alone. We’ll guide you through the process and make sure you are set up for success.

With a modern solution and streamlined workflows, you have more time to focus on what matters – your people!

33%

of employers make payroll errors costing billions of dollars annually.

Avoid stale data and manual errors with GoCo’s payroll sync dashboard so you can keep your payroll data in sync with GoCo.

Top-Rated Employee Management Software

GoCo helped us improve our relationship with our employees because they started to see that we were taking steps to ensure that they were being treated properly, and that they were receiving the attention that they needed.

Erica R.

Ease of use and clean look. I'm the administrator for my company's GoCo account and it's super easy to get new employees onboarded and enrolled in benefits. We were using digital e-forms for benefits enrollments and I'm so glad to have an automated system for employees to elect insurance!

Jay G.

I looked at a lot of HRIS products before we went with GoCo. The feature set was great and it had everything we needed for our growing company, at a great price point.

Micah K.

I think GoCo's biggest shining star is its customer service. It is hard to find reliable customer service, and they are always quick to respond, solution-oriented and friendly.

Mel R.

Every year [during open enrollment], I would have sleepless nights just trying to get people to finish their paperwork on time. With GoCo, the process is just so much easier.

Robin G.

Very user friendly not only for the admins but also for the rest of the staff users.

Claudia A.

Join the 15,000+ small and mid-sized US businesses using the GoCo platform.

Not Ready to Talk to Sales but Want to Learn More?

See how GoCo can simplify your HR and Payroll!

FAQs

Why does a company need full-service payroll software?

GoCo’s embedded payroll makes managing payroll simple by automating employee wages, accurately filing taxes, and keeping employee data, such as hours and deductions, in sync. By handling tasks such as new hire reporting, tax filings, and compliance updates, GoCo’s embedded payroll reduces the risk of errors and penalties associated with manual payroll processing.

Does GoCo generate W2s at the end of the year?

Yes! With GoCo's embedded payroll solution, taxes will be automatically filed with tax authorities. W2s and 1099s (for contractors) will be generated at the end of the year and digitally distributed to employees so it’s accessible right from their profiles.

How long does it take to run payroll with GoCo?

You can run payroll in about 90 seconds with GoCo. And, we have tools to help you prepare payroll quickly and efficiently every time.

What if I don’t want to switch my payroll?

No problem! At GoCo, we encourage you to come as you are. If you love your current system (or just can’t switch right now), we’re here to help you streamline your data. We provide a dashboard that tracks changes in GoCo so you know what information needs to be updated in payroll.

Can I pay an international employee or contractor?

You can leverage our integration with Remote Global Payroll so you can keep all your HR in one place and streamline international payment.

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories