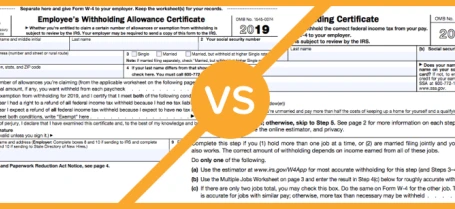

Did the W-4 Form Just Get More Complicated?

A Head-to-Head Comparison of the 2019 vs. 2020 W-4 Forms

by Michael Gugel, CPO @ GoCo - December 30th, 2019

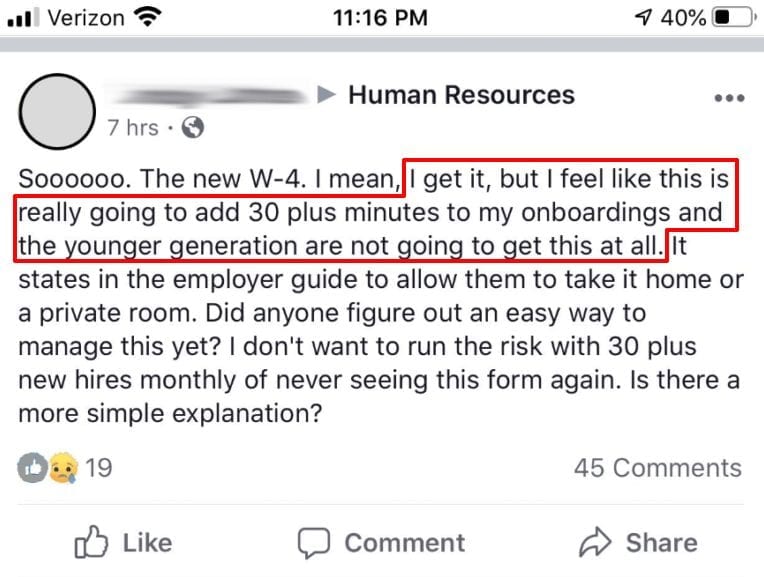

The IRS said that the 2020 W-4 should be easier to fill out and understand. The internet didn't agree.

This post sums up the general sentiment:

But I think they're wrong! I think the IRS did a good job (did I just say that!?). The new W-4 is different, but it IS easier. And it's even easier if you use GoCo :)

Let's break down the components of the old form vs the new form.

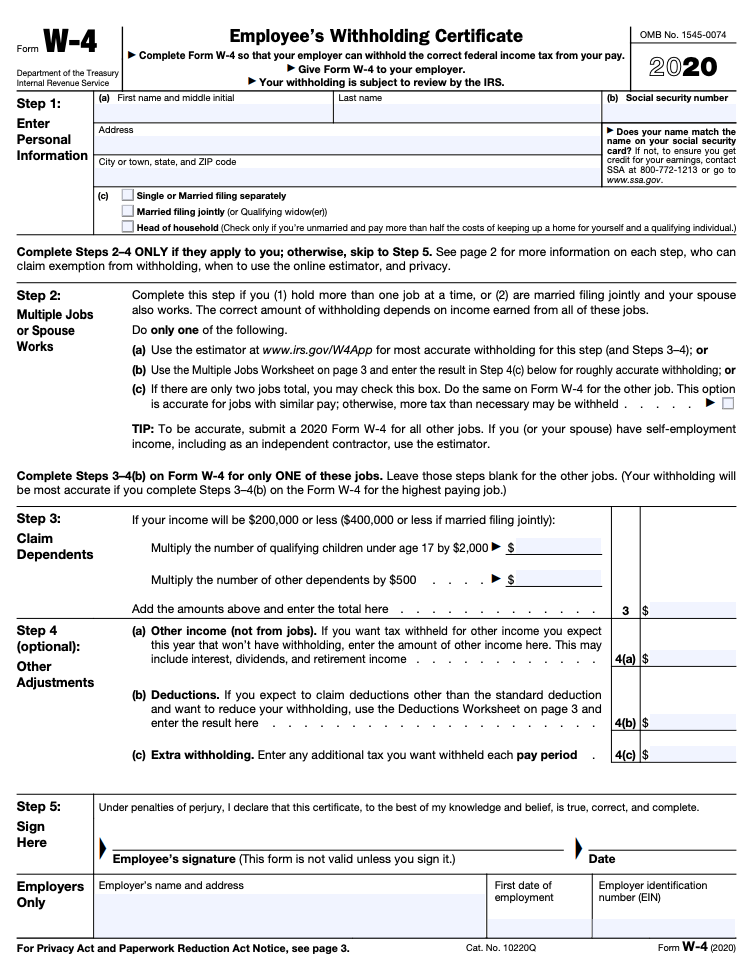

W-4 Form comparison: 2019 vs. 2020

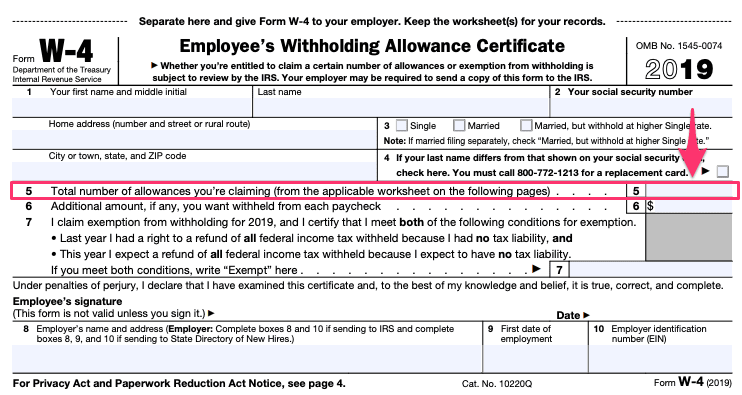

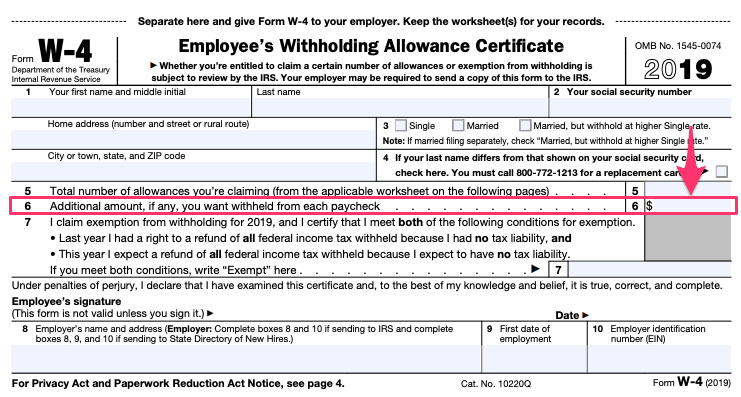

2019 W-4

Section 1-4

You just had to fill out some basic info about yourself like your name, address, etc.

Time Estimate: 2 minutes

Section 5

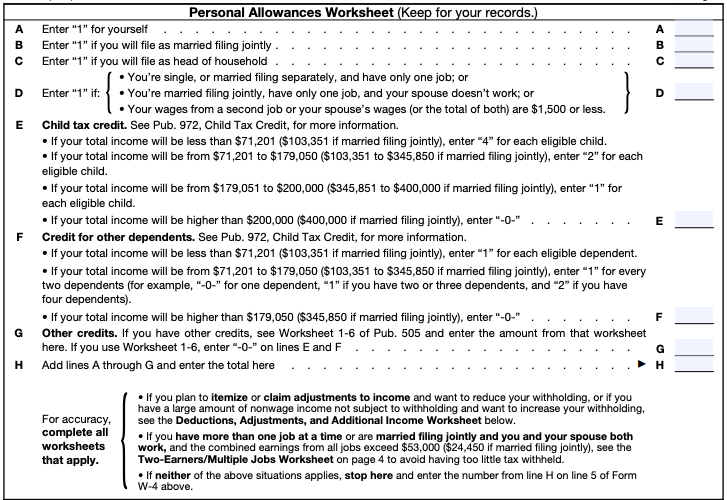

You had to calculate your Withholding Allowances.

And the IRS provided this worksheet to help you figure that out:

Time Estimate: 4 minutes

According to the IRS stats from 2017 of people that filed their returns with salaries and wages:

- 47% filed as single * 2 minutes to fill out the worksheet

- 16% filed as head of household * 2 minutes

- 35% married filing jointly * 5 minutes

- 2% married filing separately * 5 minutes

I'm assuming it takes longer for married individuals to complete the worksheet because a significantly higher percentage of them will need to do the tax credit calculations.

Section 6

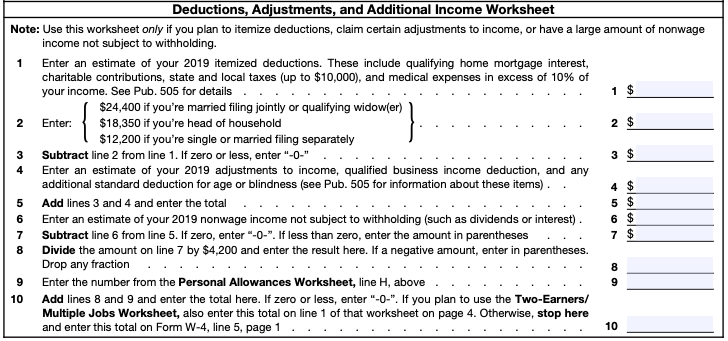

You had to figure out the Additional Withholding if you itemized your deductions, needed to claim certain adjustments to your income, had a large amount of non-wage income or had multiple earners.

The IRS provided these TWO worksheets to help you figure that out.

Time estimate: 7 minutes

- 31% of tax filings have itemized deductions * 7 minutes to fill out the Deductions Worksheet

- 69% will have the standard deduction * 0 minutes

PLUS

- Around 61.8% of tax returns¹ will be multiple earner households * 7 minutes to fill out the Two-Earner Worksheet

- 40% will be single-earner households * 0 minutes

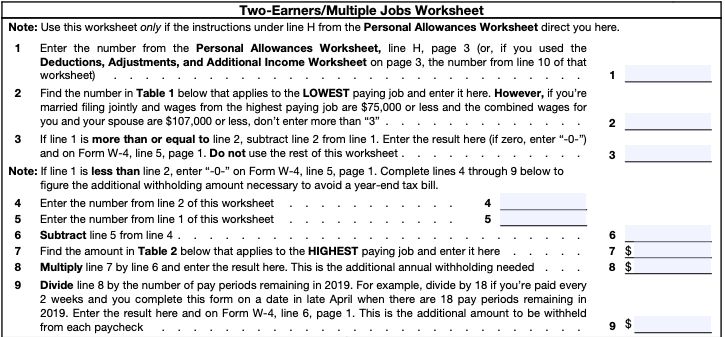

What about if you have multiple jobs?

The weighted average is just over 6 minutes, but 8.3% of tax filers also have multiple jobs (some of which are also married), so I'll just bump up the total estimate up by 1 minute.

Total estimated time for the 2019 W-4

13 minutes

Download The Ultimate New Hire Paperwork Checklist

2020 W-4

Section 1

It's pretty much the same basic info about yourself as Section 1-4 on the old W-4.

Time Estimate: 2 minutes

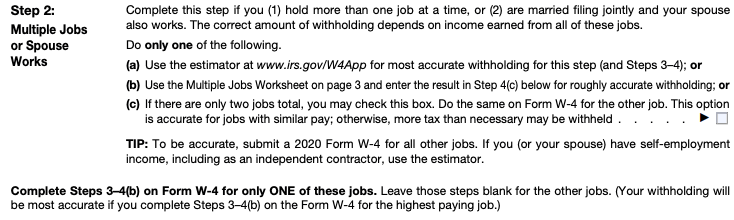

Section 2

For Multiple Jobs, the IRS now created a single checkbox (in subsection c) that will apply to most tax filers.

Time Estimate: 2 minutes

- 65% filed as single / head of household / married filing separately * 8.3% work multiple jobs * 2 minutes to check the checkbox

- 65% filed as single / head of household / married filing separately * 91.7% work 1 job * 1 minute to realize you can skip it

- 35% married filing jointly * 60% multiple earners * 2 minutes to check the checkbox

- 35% married filing jointly * 40% single earner * 1 minute to realize you can skip it

The weighted average is around 1.5 minutes, but some sole breadwinners in married households have multiple jobs (again only 8.3% in aggregate), so I'll bump it up to 2 minutes.

Note:

- Only 0.6% of people work 3 jobs so I ignored them in this analysis. It's recommended that they fill out the Multiple Jobs Worksheet.

Related Articles: The Definitive Guide to W-4 Federal and State Withholding Forms

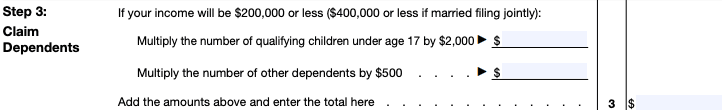

Section 3

You just do some simple math to figure out how much your tax burden is decreased due to your dependents.

You take your number of kids 16 and under and multiply it by $2,000 and you take all your other dependents and multiply it by $500.

You add the 2 together and voila!

Time Estimate: 1 minute

If you don't have any dependents, you'll skip it. If you do have dependents, it'll take you a minute or two.

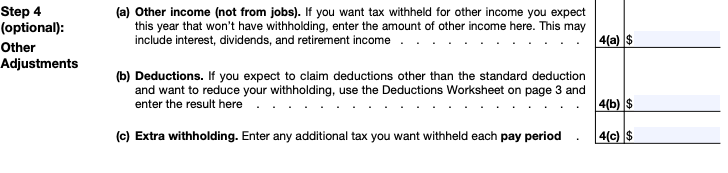

Section 4

Section 4 has three subsections for other income, deductions, and extra withholding.

(a) Other Income: In the 2019 W-4, you were directed to complete an entire worksheet. Now, you just answer a single question.

Time Estimate: 1 minute

This won't apply to most people, but when it does, it's just a single question instead of a whole worksheet.

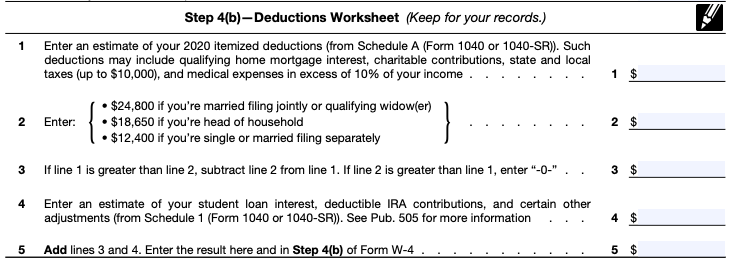

(b) Deductions: You had to complete a worksheet in 2019 and you'll have to complete a worksheet in 2020. The 2020 worksheet is simpler though.

Time Estimate: 2 minutes

- 31% of tax filing have itemized deductions * 5 minutes to fill out the worksheet

- 69% will have the standard deduction * 0 minutes

(c) Extra Withholding:

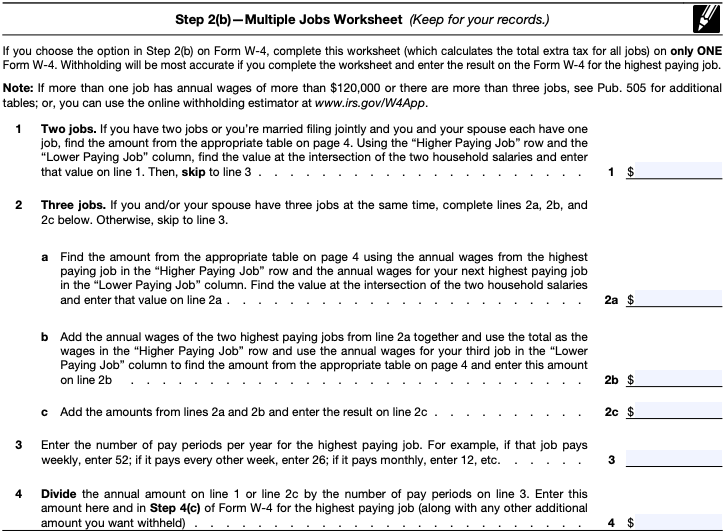

You had to complete a worksheet in 2019 if you had more than 1 job or your spouse worked. The 2020 W-4 has a simple checkbox you can check in Section 2 to bypass this entire worksheet that will work for the majority of situations.

The Multiple Jobs Worksheet is recommended when someone has 3 jobs (affects only 0.6% of employees) or if someone is married filing jointly and there's a big difference in the compensation.

Time Estimate: 2 minutes

Total estimated time for the 2020 W-4

10 minutes

Conclusion

2019 W-4: 13 minutes

2020 W-4: 10 minutes

Despite the initial negative reaction (change is hard), in my humble opinion, the new W-4 form is easier and simpler!

P.S. Let's face it, getting this form on your first day at your new is pretty intimidating

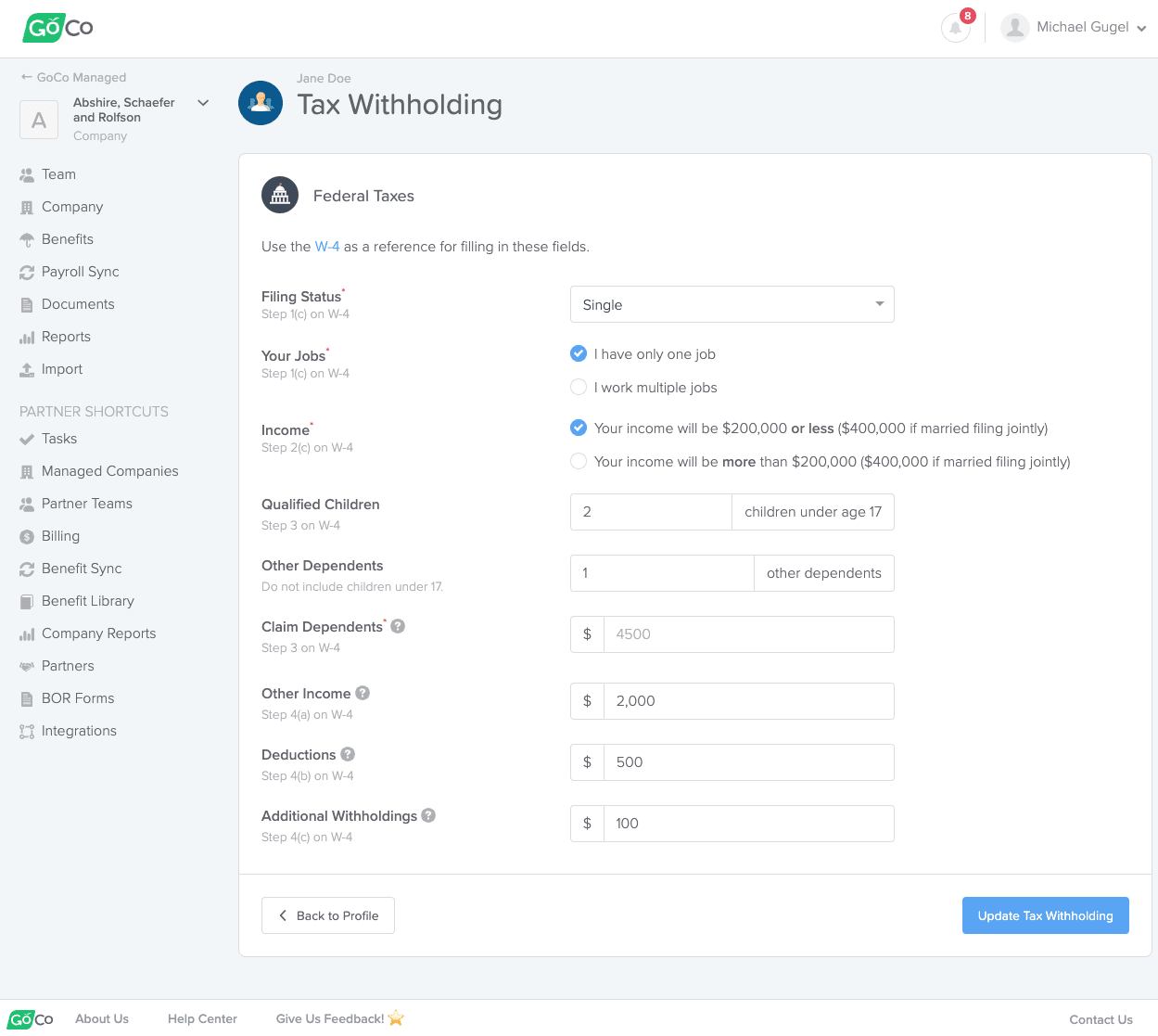

At GoCo, we've made it a lot simpler:

Your team will be able to complete the new W-4 30% faster because:

Section 1

We'll fill in all the personal info details automatically and they'll just have to fill out their filing status. That saves 1.5 minutes.

Section 2

We made it easier to scan and understand what they need to do. Instead of taking 2 minutes, it'll take 1.

Section 3

You just enter the number of dependents over and under 17 and we do the math. That'll save 30 seconds.

Section 4

Honestly, this would be pretty much the same as filling out the paper W-4 :)

Total

With GoCo, your team can complete the W-4 in 7 minutes instead of 10. That's 30% faster!

And the best part is that your new employees can fill out the form as soon as they accept their offer letter. GoCo will ask (and remind them) to complete the W-4 (which mobile-friendly BTW) before they even come in on their first day of work.

Want to see it in action? Check out the self-guided tour of GoCo here.

¹ That source references multiple earner households for families with children. It doesn't include married couples without children.

Subscribe to Beyond The Desk to get insights, important dates, and a healthy dose of HR fun straight to your inbox.

Subscribe hereRecommended Posts

What is a W-4 Form? How to Fill it Out & 2024 Changes

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![Why is HR Compliance Important in 2024? [+Free Checklist]](/img/containers/assets/goco/featured_images/posts/the-importance-of-hr-compliance.png/b73096df7f78bcf9874200ba0eaccf0a.png)

![Complete 2024 HR Compliance Calendar and Important Deadlines [+Download]](/img/containers/assets/goco/featured_images/posts/2024compliancecalendar-2.png/fd610000def14287c5dae38bf0b4ed97.png)