HR's Guide to Employee Record Retention [+Checklist]

Employee document retention is critical to your organization's processes and compliance.

by Jennifer Kiesewetter - April 30th, 2024

Table of Contents

- The Importance and Complexities of Employee Record Retention

- Potential Legal and Financial Implications of Incomplete Record Retention

- Which Employee Documents Should You Keep?

- What Are the Legal Employee Record Retention Requirements?

- Federal Employment Document Retention Requirements

- State Employment Document Retention Requirements

- 6 Best Practices for Managing Employee Records

The Importance and Complexities of Employee Record Retention

From running payroll to providing a safe work environment, employers must satisfy a litany of federal, state, and local statutes and regulations when it comes to employees and their employment.

These legal responsibilities include creating, maintaining, and retaining employee documentation and records. Depending on the type of record and the type of law, employers must keep records for a certain period of time.

Understanding these legal requirements is pertinent to HR compliance for organizations of all sizes. This is why having an employee record retention policy – and process – in place comes in handy.

Keep reading to learn more about employee document retention and why it’s critical to your company’s organizational processes and compliance.

Which Employee Documents Should You Keep?

Employee documents cover all fronts – from personnel file records to medical records. Here are some examples of employee records that you should retain:

Onboarding Records

Job applications

Pre-employment test results

Referrals

Job descriptions

Performance Records

Promotions

Demotions

Terminations

Transfers

Rate changes

Disciplinary action documentation

Performance appraisals

Workplace safety documents

Medical, Benefits, and Leave Records

Workers’ compensation documentation

Family Medical Leave Act (FMLA) or other leave documentation

Americans with Disabilities Act (ADA) documentation and accommodation paperwork

Employee benefits elections

Payroll, Time Tracking, and Tax Records

Payroll documents

Employment tax documentation

Keeping these documents is critical, and keeping them organized helps with HR compliance. Here’s an example of an Employee Personnel Documentation Checklist to help you stay organized and on top of your legal compliance responsibilities (of course, this checklist should be tailored to your industry, location, and specific organizational requirements):

FREE HR Document Retention Checklist

This Employee Personnel Documentation Checklist helps you stay organized and on top of your legal compliance responsibilities.

What Are the Legal Employee Record Retention Requirements?

Keeping certain employee and employment documents is one thing. However, federal and state laws require employers to retain documents for a specific period of time.

Let’s take a look at some federal and state requirements in turn.

Federal Employment Document Retention Requirements

Form I-9s, Employment Eligibility Verification: 3 years after the employee’s hire date or 1 year after the employee’s termination (whichever is later). Note that I-9 forms should be kept separate from other personnel documents.

Equal Pay Act records: 2 years

Health Insurance Portability and Accountability Act (HIPAA) records: 6 years

Occupational Safety and Health Administration (OSHA) records: 5 years

Consolidated Omnibus Budget Reconciliation Act (COBRA) records: 6 years

Employee benefit plan documentation (such as 401(k) plans): 6 years following the plan termination

Form 5500 documentation (including all schedules and supporting documentation): 6 years

All other personnel and employment records, such as job applications or accommodation requests: 1 year from the termination date

Payroll records: At least 3 years

Tax records: 4 years

State Employment Document Retention Requirements

In addition to the various federal document retention requirements, HR professionals must also comply with state retention document requirements.

For example, states have requirements about how long to keep certain state tax documents in addition to federal requirements.

Further, many states have legal requirements permitting employees to request copies of the documents in their employment files.

States that currently have the “right to view personnel files” include:

Alaska

Arizona

California

Colorado

Connecticut

Delaware

Florida

Illinois

Iowa

Louisiana

Maine

Massachusetts

Michigan

Minnesota

Nevada

New Hampshire

New Jersey

North Carolina

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Virginia

Washington

Wisconsin

To stay informed about these requirements, visit your state’s Department of Labor webpage to learn which rules apply to your organization.

Potential Legal Implications of Incomplete Record Retention

Businesses that fail to maintain proper employee records open themselves up to a significant amount of financial and legal trouble. Here's a breakdown of some potential financial and legal consequences:

Fines: Government agencies like the Department of Labor (DOL) can fine businesses for non-compliance with record-keeping regulations. These fines can add up quickly, especially for repeat offenders.

Back Wages and Damages: Lawsuits from employees claiming wage theft or unfair treatment can be costly. Without proper records, employers may be unable to defend themselves and end up having to pay back wages and damages to employees.

Tax Issues: Inaccurate or missing employee records can lead to problems with payroll taxes and unemployment insurance. The IRS may impose penalties and require the business to reconstruct records, which can be a time-consuming and expensive process.

Lawsuits: Employees who believe they've been mistreated may sue the company. Missing records make it hard for businesses to defend themselves in court, increasing the chances of losing the lawsuit and facing hefty settlements.

Criminal Charges: In severe cases, willful violations of record-keeping laws, particularly those related to wage theft, can lead to criminal charges for business owners.

The potential financial and legal consequences far outweigh the cost of implementing a good system to ensure accurate and secure employee data management.

6 Best Practices for Managing Employee Records

All of this document retention can sound overwhelming. To help with this process, we’ve outlined six best practices for HR professionals to manage their employee records:

Conduct an internal HR audit annually to determine the strengths and weaknesses of your recordkeeping and document retention process.

Invest in a secure human resources information system (HRIS) to manage your employee documentation, helping you streamline your record-keeping processes while increasing your legal and operational compliance.

Stay abreast of federal and state statutes and regulations, making changes to your internal processes as the law changes.

Ensure that you have electronic document security processes and procedures in place, such as encryption, to help protect your employee and employment records.

Implement a disaster prevention and recovery plan, again ensuring that your employee and employment records are protected, secure, and retrievable when disaster strikes.

Train all HR employees on these best practices, helping you to stay compliant while protecting confidential employee information.

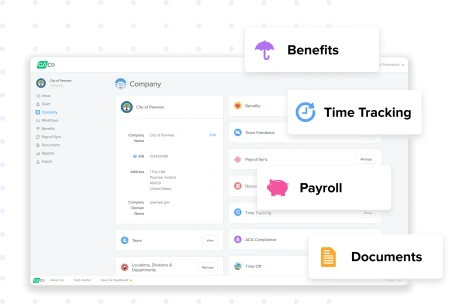

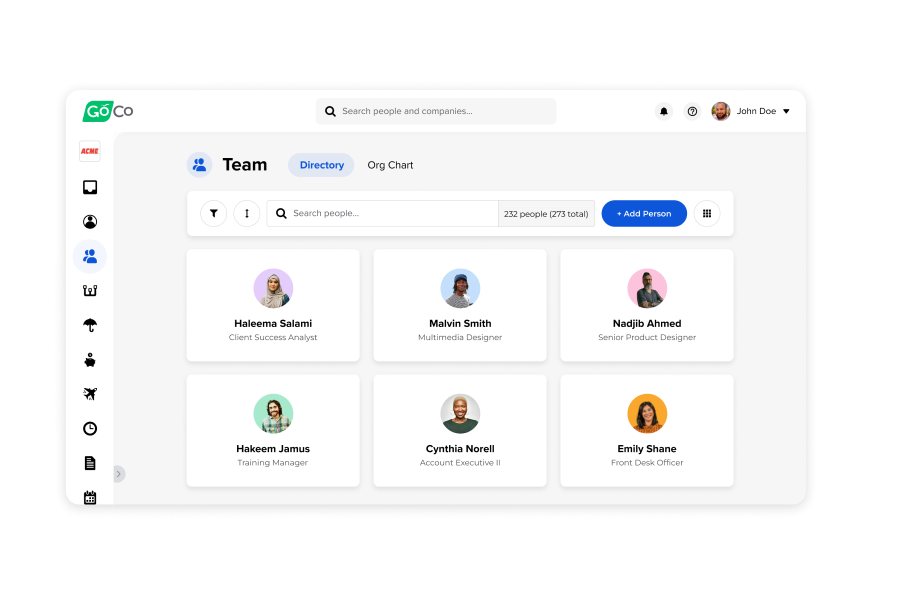

How GoCo Can Help Manage Employee Documents

HR laws and regulations are there to ensure you avoid mistakes and that you provide equal opportunity, suitable working environments, and appropriate compensation packages. All-in-one HR platforms like GoCo streamline the process by keeping up with compliance and digitally storing and organizing all essential documents for your team.

Automating your HR processes makes a huge impact on cost savings that extend far beyond documents. Check out our ROI calculator to see just how much time and money your organization can save by investing in HR technology.

Ready to explore our platform for yourself? Take a tour today to learn more about how we can help you streamline your documents and much more.

Updated 4/30/2024

Subscribe to Beyond The Desk to get insights, important dates, and a healthy dose of HR fun straight to your inbox.

Subscribe hereRecommended Posts

HR's Guide to IRS Forms (Part 1)

Blog Articles

HR's Guide to Payroll Compliance [+ Checklist]

Blog Articles

Search...

Product

GoCo

Resources

Articles

eBooks

Webinars

Customer Stories

![HR's Guide to Payroll Compliance [+ Checklist]](/img/containers/assets/goco/featured_images/posts/Guide-to-Payroll-Compliance.png/ee0dd9cd82d830db4fc85f32e1f5c7ca.png)

![4 Offer Letter Templates to Boost Hiring Success [Free Download]](/img/containers/assets/goco/featured_images/posts/CreatingAPerfectOfferLetterIn2022_BlogFeatImg.png/eed93d011f63ee771501e57f1170dcfd.png)